FHFA Halts Mortgage Payments for Landlords With Government Loans

By Chava Gourarie March 23, 2020 3:57 pm

reprints

The Federal Housing Finance Agency will suspend mortgage payments for landlords affected by the coronavirus, expanding its support of renters in addition to homeowners, the agency announced.

The program applies only to multifamily owners with Fannie Mae (FNMA) and Freddie Mac (FMCC) loans, and on the condition that they do not evict tenants affected by the coronavirus fallout.

This program expands the agency’s protection to include renters as well. Last week, the Federal Housing Authority suspended evictions and foreclosures for homeowners with FHA loans for a period of 60 days, which was in line with the FHFA’s guidelines on the matter.

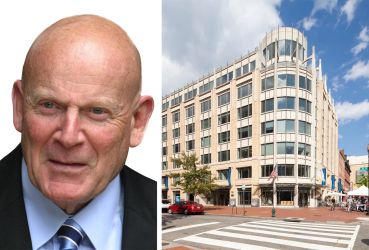

“Renters should not have to worry about being evicted from their home, and property owners should not have to worry about losing their building, due to the coronavirus,” FHFA director Mark Calabria said in a prepared statement.

Cities and states across the nation have also instituted moratoriums on evictions and foreclosures. In New York, housing courts suspended evictions along with all non-essential court procedures, and Governor Andrew Cuomo instituted a 90-day pause on evictions and foreclosures for commercial and residential properties. But without rent relief, those moves may not be enough for people who can’t afford rent because of the economic standstill.

Government-backed multifamily mortgages have ballooned since the recession nationwide, peaking in 2017 with a dollar volume of $107.9 billion, compared with the pre-recession peak of $8.2 billion in 2003, according to data from Trepp. New guidelines have capped the total of apartment mortgages that Fannie and Freddie can back to a combined $100 billion in 2020.