Washington DC’s 25 Most Powerful Real Estate Players

By The Editors September 17, 2019 6:36 pm

reprints

Power in Washington, D.C., as everybody knows, is traditionally understood as a Capitol Hill affair.

But, as real estate has emerged as one of the more important forces in the business of the city, the definition must be stretched.

Late last year, the richest man in the world — Jeff Bezos — decided that he would make Arlington’s Crystal City the home of Amazon’s second headquarters. (He also chose Long Island City, Queens, but in the end didn’t care for New York’s special brand of hospitality.)

With millions of square feet of real estate on the line as well as many thousands of jobs, it’s the kind of move that (to borrow an overused word) is transformative. It marked the D.C. area’s establishment as a formidable real estate market.

But, of course, it had been for years already.

From The Wharf to National Landing to Tysons Corner, the city and its suburbs have seen remarkable growth and a population that swelled with it.

Who are the developers who have altered the landscape of this city? Who are the financiers who fueled the revolution? Who are the brokers who have spread the evangel? And what of the politicians and agency heads whose decisions have had such an impact in the D.C. area, and beyond?

This list of 25 names (in the alphabetical order of their companies) is really only a fraction of the ones that are critical in forging the city, but they are our best estimate of the most important ones for real estate professionals to know in 2019. We asked who was doing the biggest deals; who were the most important owners; who was able to transform a neighborhood with a single restaurant?

These are our findings.—Max Gross

Amy Bowser

Executive Managing Director, JLL

On a path to law school, Amy Bowser took a detour. At 25, she accepted what she thought would be a short-term administrative position at Spaulding & Slye — a commercial real estate firm that was conveniently in walking distance from her apartment.

Twenty years later, Bowser is an executive managing director at JLL, which acquired Spaulding & Slye. Since 2007, she’s negotiated more than 8 million square feet of leases and has closed more than 540 transactions totaling over $4.5 billion. She currently leads one of the firm’s highest-impact teams in the D.C. region.

“The brokerage side of commercial real estate, the entrepreneurial nature of it and the ability to some degree create your own destiny was very appealing to me,” Bowser said, explaining why she decided to pursue brokerage as a career.

Bowser and her colleague, Brian Dawson, are responsible for all the office leasing at Madison Marquette and Hoffman & Associates’ The Wharf. In December 2018, she represented the landlords in law firm Williams & Connolly’s 292,000-square-foot lease as the anchor tenant for the project’s second phase. The deal was JLL’s largest transaction for the calendar year. Bowser also completed transactions with Business Roundtable, Michael Best & Friedrich and others in Phase 1, which was 90 percent committed as of August 2019. Phase 2 is slated to deliver an additional 591,000 square feet in 2022 and is already over 60 percent committed.

Bowser calls The Wharf’s absorption rate “astonishing,” adding that the project’s ability to garner several high-profile firms “really speaks to the strength of it” as a waterfront property with “outstanding architecture and real, true community feeling.”

Looking back, she said, “it’s been incredibly rewarding to be in a position to grow my career in a period of time in which the Washington, D.C., marketplace has experienced some of the most dramatic growth and changes as a city — we’ve always been a gateway city but the real fundamentals of Washington, D.C., as a desirable office market, residential environment, and dynamic retail scene have changed profoundly in the last 20 years. It’s an exciting time to be a part of the fabric of D.C. and lead a team in an industry that has a heavy hand in changing the face of the city.”—C.S.S.

Muriel Bowser

Mayor of the District of Columbia

The District of Columbia has always been a tough city to govern, but four years into her mayoralty, Muriel Bowser seems to be presiding over one of the city’s most prosperous periods in decades.

But that prosperity has come at a price: the loss of D.C.’s black majority, and the displacement of many lower income black residents.

The second-term mayor has tried to raise money for affordable housing in a number of ways — by demanding an increase in the city’s Housing Production Trust Fund, securing additional money for senior housing, and passing new taxes on commercial property sales over $2 million.

She’s also trying to direct investment toward areas of the city that need it. Bowser recently issued a mayoral order requiring D.C. city agencies looking to lease office space to give priority consideration to properties in Wards 7 and 8, east of the Anacostia River in southeast D.C.

“The daily presence of District employees can have a significant positive impact on an area, driving demand for products and services such as grocery stores, restaurants, pharmacies, health care providers, professional services, and other local businesses, as well as increasing foot traffic that can help influence future retailers’ location decisions,” the order notes.

And the city is looking to redevelop the Reeves Center, a large government office building at 14th and U Streets Northwest, as well as the Metropolitan Police Department’s Third District building at 1620 V Street NW, which could force some city agencies to relocate. The D.C. government leases 3.2 million square feet of office space throughout the city, according to WAMU.

Bowser has been no slouch on constructing affordable housing development either. The District has built and preserved 9,651 affordable housing units since she took office in 2015, according to the city’s open data website, and has 136 projects under construction.—R.B.R.

José Andrés

President, ThinkFoodGroup

Celebrity chef José Andrés helped popularize the tapas-dining style in America and earned two coveted Michelin stars at his Penn Quarter eatery Minibar, but his cooking took a back seat to his humanitarian work last year.

The James Beard Foundation named Andrés its humanitarian of the year for his disaster relief work, Tufts University awarded him an honorary doctorate, and Time magazine named him one of the 100 most influential people of 2018.

But even as Andrés’ profile grows internationally, he still remains an essential chef in D.C.’s dining scene, not just because of Minibar.

Andrés started in D.C. in 1993 with Jaleo — one of the first critically acclaimed tapas restaurants in the country — and currently operates six eateries in the city. These include the Michelin Bib Gourmand-winning Oyamel, China Chilcano, and Zaytinya, along with the more casual Beefsteak. Several are clustered around the Penn Quarter neighborhood, which helped draw new residents to the once-derelict area.

His non-culinary accolades came based on the work he has done with his nonprofit, World Central Kitchen (WCK), which the Spanish-born chef started in 2010 to provide earthquake disaster relief to Haiti.

After Hurricane Maria decimated Puerto Rico in 2017 and killed nearly 3,000 people, WCK helped to serve more than 3.5 million meals to residents. It established 25 kitchens with 19,000 volunteers around the island and recently committed $4 million to support farmers and local food businesses increase the island’s food security, NBC News reported. Andrés also used his popular social media presence to draw attention to the island’s struggles after the storm.

WCK has done similar work for victims of Hurricane Harvey in Houston, the 2017 California wildfire and most recently, of the Bahamas after Hurricane Dorian.

But Andrés’ humanitarian work didn’t distract his company, ThinkFoodGroup, from making moves in the restaurant world.

In March, he opened a 35,000-square-foot food hall, dubbed Mercado Little Spain, with Ferran and Albert Adrià in Manhattan’s sprawling Hudson Yards megadevelopment. And in July, he purchased the intellectual property of his restaurant brand within SLS Hotel, The Bazaar by José Andrés, with plans to expand it beyond the four locations it currently has, as the Washington Business Journal reported.

To cap things off, the Bethesda, Md.,-based chef was nominated for a 2019 prestigious Nobel Peace Prize in November 2018, Time magazine reported.—N.R.

Ken Broussard

Senior Vice President and Mid-Atlantic Market Manager, SunTrust

Senators, cabinet secretaries and presidents come and go, but some of the most important members of Washington, D.C.’s real estate community have managed to show more staying power. Take Ken Broussard, the mid-Atlantic market manager for SunTrust Bank’s commercial real estate lending: He’s been a fixture on the city’s finance circuit since he arrived from Texas 30 years ago.

After stints at Wells Fargo, Bank of America and KeyBank, Broussard landed at his current home at the Atlanta-based powerhouse four years ago. SunTrust has long been a powerful institutional lender in the capital district and its environs, but Broussard’s influence is sure to wax ever greater as his company approaches its merger with BB&T, expected to close by the end of the year.

A lot has evolved in three decades.

“The submarkets that have really become something were just rundown parts of the city,” Broussard said, listing the 14th Street and 8th Street corridors, as well as the East End neighborhood, as prime examples. It also doesn’t hurt that Amazon is moving into a Virginia suburb that had never seen much private-sector activity in the past, he added. “The change we’ve seen has just been tremendous.”

Broussard’s group has reaped the benefits, in part by taking an especially active role in financing multifamily assets in the region — after all, those new private-sector workers will need somewhere to live. One recent deal saw SunTrust write a $139 million term loan for JBG Smith on its 377-unit Central Place rental building in Rosslyn, Va., just across the Potomac from Washington, D.C., SunTrust provided the whole loan and then brought in another bank in syndication, a pattern Broussard says is typical for his group’s lending.

In all, it adds to an approximately $2 billion book of business that turns over quickly: In any given year, Broussard said, his group might churn through around $900 million in originations. Just under half of that goes to financing office buildings, he said, with multifamily accounting for about a third and industrial or data-center deals making up the rest.

The city is “building a lot of apartments, continuing to lease them up, and seeing good job growth and absorption,” Broussard said. “It’s a very dynamic market that’s growing away from reliance on the government sector.”—M.G.

David Lipson, Thomas Fulcher, Julie Rayfield, Art Greenberg

Vice Chairman and Director; Vice Chairman and Co-Regional Manager; Vice Chairman; Vice Chairman, Savills

A whopping 66 lease transactions and two acquisition deals have led to a very busy 12 months for Savills’ David Lipson, Tom Fulcher, Julie Rayfield and Art Greenberg. In fact, the crew came out ahead this past year as the firm’s highest grossing team in the Washington, D.C. region.

With more than 30 years each at Savills, vice chairmen Lipson and Fulcher are co-regional managers of the firm’s three offices in the D.C. area. From this perch, they’ve overseen some of the biggest leases in the city. In December, Lipson led a team that represented law firm Williams & Connolly in its 15-year lease for 292,000 square feet in the second phase of The Wharf. Lipson, along with Fulcher, also spearheaded law firm WilmerHale’s lease for 288,000 square feet at 2100 Pennsylvania Avenue NW.

Rayfield, a vice chairman at Savills, has been a leader in negotiating numerous deals, locally and nationally, for the General Services Administration and the Veterans Administration. On the sales front, Greenberg, also a vice chairman at the firm, led a team in December 2018 that arranged the sale of Marriott’s global headquarters in Bethesda, Md., for $105.4 million on behalf of Marbeth Partnership. Upon Marriott’s relocation in 2022, the buyer, Erickson Senior Living, plans to convert the site to a mixed-use retirement community.

Lipson said in a recent interview that the team goes “beyond the transaction, serving as business partners throughout the real estate cycle” and they’re “continuously looking for ways to optimize their clients’ spaces by staying in front of changing occupancy standards and market conditions.” —C.S.S.

Julia Springer, Victor Tolkan, John Kusturiss

Co-Founders and Managing Partners; Senior Vice President Development, Penzance

Founded in 1996 by husband-and-wife duo Julia Springer and Victor Tolkan, Penzance has grown into one of the better-known real estate owners and operators in the D.C. area.

In the early years, the Penzance portfolio was primarily focused on commercial office (including the Watergate), but in recent years, the company has expanded into multifamily and development as well. Starting in 2013, the company began adding multifamily assets, and now owns close to 2,000 residential units.

In addition to its holdings, Penzance has recently embarked on several mixed-use development projects under the direction of John Kusturiss, the company’s vice president of development.

One of their largest projects to date is The Highlands, a mixed-use development in downtown Rosslyn, Va., that broke ground in 2018.

“The Highlands is definitely like my fourth child,” Kusturiss told Commercial Observer last year. It includes three residential buildings, including the company’s first condo development, along with retail space, a fire station, and a neighborhood park. The project, which is a public-private partnership that took seven years to plan, is scheduled to be completed in 2021.

The company also has a proposed 4.3-acre mixed-use development near the future Metro station in Herndon along the Silver Line. The 1-million-square-foot project, Landing at Innovation, received a green light from the town in April and is scheduled to open in 2020.

In 2018, Penzance closed its first private equity fund, targeting value-add residential and commercial properties, with commitments totaling $225 million. The company has since acquired a Capitol Hill office building at 50 F Street NW for $85 million and has plans to acquire between $800 million and $1 billion in assets over the next several years.—C.G.

Jeffrey Sussman

President, Property Group Partners

Building an entire neighborhood on top of an active highway is not for the faint of heart. Property Group Partners is focusing much of its Washington, D.C. resources on Capitol Crossing—a five building, 2.2 million-square-foot mixed-use development that’s being constructed on a platform above the I-395 freeway. The addition of the three new city blocks will serve as a de facto pedestrian crossing, linking D.C.’s Capitol Hill and East End neighborhoods.

“It’s an enormous focus. We’re dancing as fast as we can,” said Jeffrey Sussman, CEO of Property Group Partners.

Begun in 2016, Capitol Crossing’s 12-story office building, 200 Massachusetts Avenue, is now complete, with The American Petroleum Institute occupying about 78,000 square feet across two floors. PGP announced in May 2019 that WeWork had signed a lease for 111,000 square feet at the 400,000-square-foot property. A connecting office building at 250 Massachusetts Avenue is expected to be completed by the end of 2019, said Sussman, adding that the firm is currently working to get zoning approval for a possible hotel, and a residential building is also slated for construction.

Sussman, who closed his first D.C. deal for PGP in 1974, acknowledges that there’s a lot more competition since the days in which only local developers planted their flags in the capital city. With an influx of major American and foreign firms in the D.C. market, he said PGP tries to “stick to our knitting” which is, for the most part, “what we consider to be first-class trophy office buildings.”

At Capitol Crossing, he also hopes to soon announce some well-known retailers and “perhaps get lucky and get one of the major law firms” to open a headquarters in the new neighborhood.—C.S.S.

Eric Ekeroth

Mid-Atlantic Regional Director, Northwestern Mutual

Northwestern Mutual’s Mid-Atlantic regional director Eric Ekeroth had an interesting start to his real estate career.

Ekeroth, 58, started in I.T. at Bank of America before returning to his alma mater, the University of Maryland, to get an MBA in real estate, later rejoining BoA’s real estate group.

The industry veteran has now logged 20 years with Northwestern Mutual after making stops at Union Labor Life Insurance Company and General Motors Acceptance Corp.

His team of just six covers not only D.C., but Indiana, Ohio, Michigan, the Carolinas, Virginia and New Jersey.

In D.C. and Baltimore, Ekeroth said his team — led by Peter Jahn and Matt Ascher — “has been extraordinarily busy … [adding] to our exposure judiciously,” given the insurer’s large real estate investment exposure in the region. Annually, his group’s lending volume is between $350 million and $550 million, and he expects it to be down slightly this year.

“We’ve seen fewer acquisition finance opportunities from traditional core buyers,” said Ekeroth, “and when those opportunities arise, the competition surrounding those deals has been intense. Also, our construction-to-[permanent] mortgage product has faced more competition from traditional bank loans.”

Ekeroth characterized the D.C. market as “competitive and healthy.” He said his team has focused on apartment buildings over the last two years, “especially construction-to-permanent opportunities with well-heeled, long-term owners.”

In June, Northwestern Mutual picked up a luxury high-rise at 22 M Street NE in Washington D.C.’s NoMa neighborhood for just under $142 million from Skanska.

“Over the past 12 months we have been a net seller of apartment properties in the D.C. [metro area], so [that] was an excellent opportunity to rotate into a high-quality downtown apartment property,” Ekeroth said.

The team also provided a $91 million, 10-year, fixed-rate loan to USAA for the firm’s $151.2 million acquisition of One Liberty Center in Arlington, Va., according to information from CoStar Group.—M.B.

James Cassidy and Jud Ryan

Executive Managing Directors, Newmark Knight Frank

As co-heads of Newmark Knight Frank’s investment sales business in the Mid-Atlantic region, James Cassidy and Jud Ryan, executive managing directors in the firm’s Washington, D.C., office, have enjoyed 15 years of a successful partnership.

“Over the last two years, we have a 100 percent closed rate on our transactions and there’s no other team in the market that can point to that level,” Cassidy said. “What makes us a good team are the people around us; our valuable teammates who strive for perfection every day; there are no egos here. For us, it’s a completely collaborative atmosphere and the communication is seamless.”

The duo came to the company together in 2016, with a combined 34 years of experience in commercial real estate.

“The competitive landscape in D.C. has shifted a lot in the last few years, and we see the big three all resembling each other, and we feel clients are looking for something new and different,” Cassidy said. “What we saw at Newmark was the opportunity to build something at a firm that’s nimble and well-capitalized. We created a business model here that’s both creative and collaborative, and that’s really resonated with our clients.”

In 2019, the pair represented Beacon Capital Partners on the sale of the 349,303-square-foot Presidential Tower at 2511 Jefferson Davis Highway in Arlington, Va., to Starwood Capital in an approximate $100 million deal.

“This was in National Landing, just a few blocks from HQ2, which set the market as it was the first office asset to transact post Amazon’s HQ2 announcement,” Ryan said.

Another notable deal in 2019 was a data center project out near Dulles Airport where Newmark raised the equity for the newly developed project fully leased to a well-known user in the marketplace.

“It brought institutional capital into that space that had not been there for years,” Cassidy said. “This product, where land pricing and construction costs have gone, you can’t really build it anymore.”

The pair are currently marketing the famous (and a little infamous) Watergate Office Building, a 214,508-square-foot, 11-story office building at 2600 Virginia Avenue NW, on behalf of owner Rockwood Capital.—K.L.

Amer Hammour

Chairman, Madison Marquette and Managing Director, Capital Guidance

Madison Marquette is not only building D.C.’s biggest real estate development, The Wharf, but the firm is also working on major projects in Baltimore, New Jersey and Orlando. It’s even managing the operations of Staten Island’s newly opened Empire Outlets shopping mall. And Amer Hammour has been running the firm for nearly three decades, since founding Madison Marquette with only five employees in 1992. (Capital Guidance, started by his father in the 1960s in Washington, D.C., is Madison’s parent company.)

Hammour was the CEO of the company — which has invested in $6 billion worth of property — until July, when he brought in Vincent Cosantini as CEO. Madison officially merged with The Roseview Group, Cosantini’s real estate firm, in July.

However, Capital and Madison’s investments in the D.C. area were relatively small until it broke ground on The Wharf in 2014. The first phase of the 3.3-million-square-foot project was finished in 2017, with 650 rental apartments, 220 condominiums, a 6,000-seat music hall, 210,000 square feet of retail, a marina, 500,000 square feet of office space, three hotels, and a 1,500-car garage. Last year, Madison and its development partner, Hoffman & Associates, started work on the second phase of the Wharf, which includes 547,000 square feet of offices, 255 rentals, 96 condominiums, 95,000 square feet of retail, 131 hotel rooms and a 1.5-acre park.

“Cities aren’t built with one use in mind,” Hammour explained. “So we created a complete mixed-use plan. We have an office building next to a residential building next to retail. And we tried to take advantage of the water; the spine of the project is one long 60-foot-wide promenade.”

He said Madison tries to use this same planning mentality for its other projects, which include a recently completed office, residential and retail tower at One Light Street in Baltimore as well as the dramatic redevelopment of the boardwalk in Asbury Park, N.J.

Madison has also been venturing into new sectors of the market. It just got into the senior housing game with the $170 million purchase of six senior housing facilities in Michigan, California, and Washington in July.—Rebecca Baird-Remba

Kevin Cullinan

Executive Director, Originations, Mack Real Estate Credit Strategies

It’s not only those who reside in the nation’s capital that are busy making waves in D.C.’s financing market. New York-based Mack Real Estate Credit Strategies has provided roughly $2 billion in debt over the past 15 months, including sizeable loans on some of the D.C. area’s most-buzzed-about projects.

The lender created its credit business in 2014 and started investing in D.C. in 2015, primarily because it liked the diversity of its job growth story, Cullinan said.

“The market has shown a distinct ability to attract people from multiple different professions; it continues to evolve and be dynamic,” he said. “We’ve seen high-earning job growth and that trend will continue, as recently evidenced by Amazon’s commitment to moving HQ2 into Northern Virginia.”

Mack — happily — started investing dollars in the area before Amazon’s big announcement, including a $380 million construction loan for Penzance’s The Highlands project — a 1.2-million-square-foot mixed-use development in Rosslyn, Va. — in September 2018. “We think very highly of the Penzance team,” Cullinan said of the deal. “They worked for seven years to put this project together and it’ll be a market leader when it’s delivered.”

Then there’s the $160 million loan it provided in August 2018 for the conversion of the former U.S. Coast Guard headquarters in D.C. into River Point, a major mixed-use waterfront project at 2100 Second Street SW. When complete, the project — being undertaken by Akridge, Western Development Corporation and Orr Partners — will include 481 rental apartments and 59,000 square feet of retail space.

“At Mack, we like the story of investing in neighborhoods that will continue to grow and gentrify over time and if you look at the Southwest waterfront we think it’s ripe for new development given the central location. This is a natural progression for D.C,” he said.

Another project Cullinan is especially excited about is the repositioning of the Marriott Key Bridge Hotel on the Potomac River in Arlington, Va. Mack provided $157 million in acquisition financing for the asset last July to a joint venture of Woodbridge Capital Partners and Oaktree Capital Management. “The business plan is in part to redevelop the hotel and tap into excess development rights to create a really exciting project,” Cullinan said.—Cathy Cunningham

Mark Lerner

Principal, Lerner Enterprises

This year marks Lerner Enterprises’ 67th year in operation. Mark Lerner, principal of the Rockville, Md.-based private real estate developer that was founded by his father, Ted, said the firm’s goal is to develop and manage only first-class properties in the Washington area.

Lerner, who also serves as managing principal owner and vice chairman of Major League Baseball’s Washington Nationals, said his main responsibility is to look for ways for the companies to be imaginative, visionary and growth-oriented.

“As a company and family, we’re proud of our ownership of the Washington Nationals, as well as our real estate development projects, including Tysons II and Washington Square, among many others,” he said. “It also gives us the opportunity to give back in many ways to our community through the Washington Nationals Dream Foundation and the Lerner Family Foundation.”

Lerner Enterprises’ development of Nationals Park helped lead to the development boom the area is experiencing in Capitol Riverfront.

This year, Lerner Enterprises started construction on 1000 South Capitol Street SE, a 250-unit luxury residential tower, aiming to complete the project in 2022. It also recently began construction on the Lerner Black Hill Apartments, a 649-unit luxury apartment home community in Germantown, Md.

The year also saw the 476,000-square-foot, 17-story tower at 1775 Tysons Boulevard in Tysons, Va., becoming fully leased, and Lerner noted the company is so encouraged by the success of this building that it is already well underway designing their next office building at 1725 Tysons Boulevard.

“My father set the standards for how we run our businesses, and I, along with my family, have worked to continue that standard,” Lerner said. We are fortunate to have talented colleagues who design and build first-class buildings that attract great tenants. At the same time, we have passionate fans and a committed team of folks who make Nationals Park one of the best ballparks in the country.”—K.L.

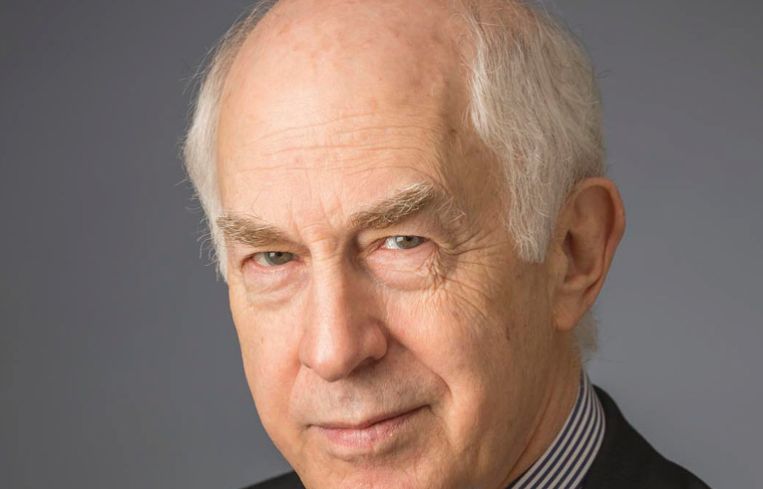

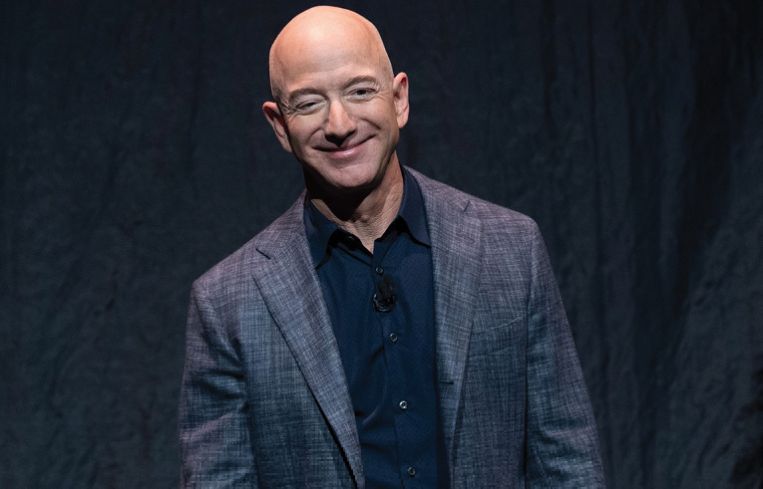

Jeff Bezos

CEO, Amazon

Seattle might be home base for the online retail giant Amazon, but Washington, D.C., has become a second home for the company and its CEO, Jeff Bezos.

In November 2018, Amazon announced it would split its highly anticipated second headquarters — cities around the country had clamored to be the tech behemoth’s home — between New York City and the Crystal City area of Arlington, Va.

Though Amazon’s New York City plans eventually fell through due to fierce local opposition, the company has been steadily making progress in Northern Virginia.

It has already signed a deal to lease 500,000 square feet of office space from Maryland-based developer JBG Smith and entered into an agreement to buy up to 4.1 million square feet of land owned by JBG for its HQ2 buildings, as Commercial Observer previously reported.

Virginia officials quickly approved a $550 million incentive package for the company in January, which could climb up to $750 million if Amazon adds 12,850 more jobs than it already plans to at HQ2, the Wall Street Journal reported.

All told, Amazon’s Crystal City offices are expected to create 25,000 jobs and Amazon plans to invest $2.5 billion into the area and develop 4 million square feet of space.

But Bezos’ influence in D.C. doesn’t just begin and end in Crystal City; the richest person in the world has been cozying up with the city’s elite in recent years.

Bezos reportedly spends more time in his $23 million Washington mansion than in any of his other residences outside of Seattle, dining with dignitaries and joining influential social club the Alfalfa Club, the Washingtonian reported. In 2013, he bought The Washington Post for $250 million and has spent plenty of his company’s cash lobbying government officials on the Hill.

Last year, Amazon lobbied more than any other tech company and spent a record $14.4 million, NBC News reported. So far in 2019, Amazon has spent more than $8.1 million for issues like taxes, trade, immigration and defense.—Nick Rizzi

Matt Kelly

CEO, JBG Smith

With more than 18 million square feet of operating assets and a development pipeline of 18.7 million square feet within the metro D.C. region, JBG Smith was clearly on the radar when Amazon began its nationwide HQ2 search.

Under the direction of CEO Matt Kelly, the Chevy Chase-based, publicly traded REIT has established a strong reputation for its transformational “placemaking” skills, focusing on mixed-use neighborhoods in transit-oriented areas with walkability, abundant green spaces and lifestyle-oriented amenities.

“We enjoy the position of being one of the biggest and most active players in the market,” Kelly said. “Our strategy has us focusing on these urban infill high-growth neighborhoods, many talked about as the up-and-coming areas. We’ve played a major role in remaking the landscape of the city.”

It wasn’t a surprise when Amazon chose Kelly and his team for HQ2. JBG Smith is now entitling and designing Amazon’s new headquarters at National Landing, which will be over 4 million square feet.

“We’re now in the planning and design phase and will start construction towards the end of this year,” Kelly said. “The area has been starved for new investment for over a decade. Over the next 12 to 18 months, as we deliver the first phase, the neighborhood will change probably more than any other area in D.C. This will be the place everyone will want to visit.”

As part of the deal, Amazon agreed to lease 537,000 square feet in three existing JBG Smith buildings and purchase two other JBG Smith-owned development sites. Amazon also asked Kelly and his team to serve as its developer, property manager and retail leasing agent.

In addition, the company has handled approximately 1.4 million square feet of leasing activity within National Landing since the Amazon announcement last November.

Other notable projects include the master plan for Virginia Tech’s $1 billion innovation campus in the Potomac Yard district in Alexandria, Va.; the development of Central District Retail, which will contain 109,000 square feet of shops at National Landing, anchored by an Alamo Drafthouse Cinema; and Central Place Tower in Rosslyn, Va., a 552,540-square-foot commercial building with a unique observation deck, which is already 93 percent leased.

JBG Smith is also active in the vibrant new district surrounding Nationals Park. The firm recently completed 1221 Van Street, a 291-unit multifamily building, and will open West Half, a 465-unit multifamily building, in 2020. JBG Smith is curating a mix of entertainment, food and beverage, and amenity options at the retail base of the two projects.

Since earning his MBA from Harvard, Kelly has served as an analyst at both Thomas H. Lee Partners in Boston and Goldman Sachs, & Co in New York; co-founded ODAC Inc., a media software company; and worked at JBG for the past 15 years.

“As the captain of the ship, the way I approach my job is no different than the way I’ve always done it, which is to find the best people and find the best team,” Kelly said. “If you work hard, treat people well and lead by example, the rest will take care of itself. That’s the formula for success.”—K.L.

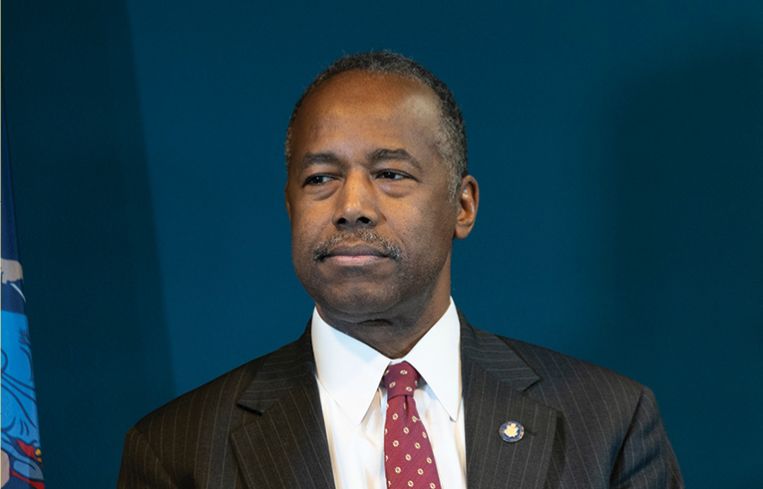

Ben Carson

United States Secretary of Housing and Urban Development

As the secretary of the U.S. Department of Housing and Urban Development (HUD), Ben Carson has an outsized influence on the real estate industry.

In the last month alone, HUD allocated $75 million to help end youth homelessness, launched an investigation into San Francisco’s affordable housing policies, expanded a program to preserve affordable housing for seniors, introduced new rules that roll back the Obama-era Disparate Impact rule, and released a housing finance reform package together with the Treasury Department.

Carson, a retired neurosurgeon and former Republican presidential candidate, grew up in Detroit and graduated from Yale University and the University of Michigan Medical School. He was the Director of Pediatric Neurosurgery at Johns Hopkins Hospital in Baltimore until his retirement in 2013. After a failed presidential run in 2016, he was appointed to his post as HUD Secretary in 2017 by President Donald Trump.

HUD currently funds 3,300 public-housing authorities with 1.2 million units, as well as the Section 8 housing program, which serves 2 million families, according to ProPublica. It has also subsidized millions of home mortgages through the Federal Housing Administration, and finances local development initiatives through the Community Development Block Grant program.

Carson’s reign at HUD hasn’t been smooth. He, along with the rest of the Trump administration, has repeatedly attempted to drastically cut the HUD budget, which would eliminate or curtail some of the abovementioned programs, though Congress has thus far countered those efforts. Carson has defended the proposed cuts, suggesting that less money will lead to more self-sufficiency.

He’s also made quite a few professional gaffes. In July, he was booted out of a church in Baltimore while attempting to temper the offense caused by President Trump’s remarks about the “rat-infested” city. At a conference in Brooklyn about opportunity zones, he dismissed criticism that the program disproportionately benefits the wealthy by saying, “Rich people are going to get richer anyway.” And in May, during a testimony before the House Financial Services Committee, Carson misheard the term ‘REO’, the real estate metric, for ‘Oreo’, the cookie. Rep. Katie Porter was not amused, and was forced to explain meaning of the term to the Secretary.—C.G.

Monty Hoffman

Founder and CEO, Hoffman & Associates

Hoffman & Associates, under the leadership of Founder and CEO Monty Hoffman, has developed a variety of projects over the past 25 years in a mission to enhance the way people socialize, work, and live in the D.C. region.

The firm, which until a few weeks ago was called PN Hoffman, is one of the developers on the $2.5 billion mixed-use development The Wharf. The project’s driving vision is to establish a true waterfront community and reestablish Washington, D.C., as a waterfront city.

“For us, it’s not about shiny new buildings; it’s about creating spaces with creative uses that connect people in ways that raise the human spirit,” Hoffman told Commercial Observer. “It’s about syncing commercial interests to serve a community. In doing so, it’s profitable investment that serves a higher purpose. Using this lens, every development opportunity is different, containing its own unique potential.”

The firm, alongside partner Madison Marquette, kicked off the year with construction of Phase 2 of The Wharf with a pre-lease to anchor tenant, law firm Williams & Connolly, Hoffman said.

“Williams & Connolly will join a list of the region’s top office tenants in Phase 1 and other prospects we are currently finalizing in Phase 2,” he said. “The Wharf, with its walkable streets, cafes, entertainment, hotels, residences and retail, is the new preferred paradigm over office parks and traditional CBD.”

In his role, Hoffman focuses on creative outcomes and solving systemic problems.

“Our team is tremendously talented, and I work to ensure they have the right resources,” he said. “Because of this, I find that my role is to provide them with the space needed for creativity. We never want to be typical because we are better than that, so it’s part of my job to come up with ideas, resources or even a contrarian path that leads to something unexpected and great.”

This past June, Hoffman Associates signed a major community redevelopment project with The City of Falls Church, partnering with EYA and Regency on the $500 million project.

Additionally, the company has also recently expanded its platform to North Carolina, acquiring seven acres in the city of Raleigh, and is currently in the pre-development stage of a mixed-use community called Seaboard Station.

“While we’ve been very selective, our pipeline of new projects exceeds 4 million square feet of new mixed-use development,” Hoffman said. “Large mixed-use developments take a long time to gestate and our timing for completing Phase 2 on The Wharf as well as other ongoing projects compliments our new business pipeline.”—K.L.

Antonio Marquez

Chief CRE Lending Officer, EagleBank

Washington, D.C., hasn’t always been synonymous with consensus building. But when the best and brightest of the D.C. finance world were asked for the marquee names of the business, time and again the city’s lenders mentioned Tony Marquez.

Marquez, 60, is chief lending officer at EagleBank, a name lesser known outside the Beltway but one of the most ubiquitous, dedicated CRE lenders within it.

It’s a big job, given the bank’s commitment to putting real estate first. As of the end of 2018, 85 percent of the bank’s $6.99 billion loan book was secured by D.C.-area real estate — all commercial except for a relative sliver of single-family business.

After breaking into finance with Chase Manhattan Bank in New York City, Marquez first came to D.C. with Riggs National Bank and then became the head of CRE lending for Chevy Chase Bank, a job he held for eight years until 2015. He next moved shop to HSBC, where he created the bank’s first Washington, D.C., real estate lending arm before taking up his current role at EagleBank in 2011.

Business during the economic recovery has been booming. Five years ago, Eagle had $1.7 billion of income-producing commercial loans on its balance sheet. But by the end of last year, that figure had grown more than 91 percent to $3.3 billion. Add to that a construction-lending book worth $1.04 billion — which has itself grown by 31 percent since 2014 — and it’s clear the bank’s sway in D.C. is on the rise.

EagleBank’s $95 million construction loan is fueling the construction of a prime new office building D.C.’s central business district, a Lenkin Company project at 1050 17th Street NW. Other recent deals have refinanced office and lodging projects in the city’s Virginia and Maryland suburbs. And just last month, Element Critical called the bank’s number for a $67 million data-center refi in Northern Virginia.—Max Gross

Norman Jemal

Principal, Douglas Development

With dozens of high-profile properties, Norman Jemal’s Douglas Development (founded by his father Douglas Jemal some 34 years ago) is one of the true powerhouses of Washington D.C. real estate.

In partnership with Brookfield Properties, Douglas Development completed its biggest project of the past year and one of the largest office projects in D.C., at 655 New York Avenue. The developers took a historic property in Mount Vernon Triangle and transformed it into a cutting-edge structure that serves as the corporate headquarters to The Advisory Board, a health care and education consulting company. Spanning almost an entire block, 19 historic structures were preserved to create the 11-story property with retail, trophy office spaces and tenant amenities including a two-floor fitness center, a rooftop conference room, and game rooms.

Continuing its revitalization of Northeast’s Ivy City neighborhood, the developer signed another brewery and an axe-throwing company at 1401 Okie Street NW, where the neighborhood’s first upscale restaurant, Gravitas, opened its doors. The neighborhood is also awaiting the opening of D.C.-based Compass Coffee’s roastery and cafe as well as a small format Target store.

In Mount Vernon Triangle, Marriott opened its 200-room millennial-centric Moxy hotel at a 14-story Douglas Development property at 1101 K Street NW. Guests check in at a brightly colored bar in the lobby, which doubles as a social space with games and seating for remote workers. Curated Instagram moments inside and outside guestrooms abound. For the project, Douglas Development also partnered with Atlas Restaurant Group for two dining destinations at the property.—C.S.S.

Ned Goodwin

Director, Cushman & Wakefield

As a political science undergrad at George Washington University, Ned Goodwin took an internship at a commercial real estate brokerage and never looked back.

“I think it’s all about the people you work with, within your company and team. That’s what drew me in — fun, smart people,” said Goodwin, a director in Cushman & Wakefield’s D.C. office. “And day to day, you’re dealing with very sophisticated individuals who are leading very prominent organizations — it’s always interesting and challenging to be around those types of people.”

At just 30 years old, the firm has lauded Goodwin for providing unparalleled real estate transaction management, development advisory, strategic planning and real estate solutions to a roster of clients including Fortune 500 companies, law firms, nonprofits, government contractors and tech start-ups in the region and across the country.

“Working with any of these big groups is about rolling up your sleeves and sometimes working around the clock to get [deals] done,” he said. “Every day is another problem to solve.”

One of Goodwin’s largest clients is Fannie Mae, which has been on a years-long mission to consolidate its footprint in the D.C. region. In early 2018, the financial services firm signed an 850,000-square-foot lease at Boston Properties’ Reston Gateway development. The company is slated to move into the space as its new Northern Virginia hub in 2022. Later in 2018, Fannie Mae sold three office buildings in Northern Virginia totaling 750,000 square feet for a combined $140 million.

Goodwin earned the CREBA Leasing Transaction of the Year award for his work on the lease, as well as CREBA’s Top 35-and-Under Regional Leasing Agent Award for 2018. The young broker has also been praised by the likes of CoStar, NAIOP, Washington Business Journal and the Dallas Business Journal.—C.S.S

James M. Underhill

CEO, Cresa

As the largest tenant advocate in the Greater Washington, D.C., area, Cresa’s differentiator is that it is 100 percent focused on supporting the needs of occupiers. It’s up to CEO Jim Underhill to ensure the “occupier-only” advisory firm continues its focus on client advocacy and grows the partnerships the firm has built internally with clients and externally in the community.

“I’ve been very fortunate to have had some successes along the way in my professional life, but what makes me most proud is when my family hears about me being a good leader — not just being good at executing a vision, but me being a person who genuinely cares about the people around him and the reputation we all leave behind,” Underhill said. “People may forget specific results, but they always remember how they were treated along the way.”

Cresa achieved record-high revenue in 2018 and is currently projected to exceed that figure in 2019.

The firm’s work over the past 14 months includes representing REGENXBIO, a biotech company focusing on gene therapy, in its long-term lease agreement for its new 132,000-square-foot headquarters in Rockville, Md. Earlier this year, Cresa partnered with health information network Surescripts to help with its relocation to a 45,000-square-foot site in Crystal City, Va. Additional projects include restructuring the lease agreements for the National Association of Manufacturers’ 40,000-square-foot site near Metro Center in D.C., and Fibertek’s 50,000-square-foot location in Herndon, Va. Other clients include Media Matters and the National Democratic Institute, both locally, and engineering company KBR on a global scale.

Beyond overseeing the growth of the company, Underhill views his most important job duty as “creating a culture of service that attracts talent who want to be part of the company’s future,” he said.

“The only time I really didn’t enjoy myself professionally was when I found myself in a big company where I just didn’t think I was having an impact,” he said. “That’s why I’m so excited about the potential of Cresa and what we can do here.”—K.L.

Kurt Stout, Charles Dilks and Keith Lavey

Founding Partners, Colliers Government Solutions

As leaders of Government Solutions, a national practice group at Colliers, the trio of Kurt Stout, Charles Dilks and Keith Lavey are primarily focused on representing owners and investors leasing space to the federal government. They also provide sales and property management services. It’s a specialty niche, but one they believe is important.

“If you’re dealing with Uncle Sam, we’re good people to know,” Stout said. “The federal government is the quintessential high-credit tenant, but its leasing process is confusing, governed by dozens of laws, executive orders and regulations. Bringing the government into your building can feel much more like a federal procurement than a traditional leasing process.”

The three founders of the Government Solutions practice group are transactions-focused, though are part of a much larger platform that provides all types of government-related real estate services.

“Our ‘day jobs’ are spent leasing space to federal agencies across the U.S. on behalf of property owners and investors, though Kurt spends time leading the overall platform as well,” Lavey said. “Important decisions are made as a team, generally with our colleagues.”

The team has executed 20 million square feet of federal leases across the United States but what excites them most is the comprehensive platform they’re currently building of services to investors of government-leased assets.

“This year, for example, we acquired a property management company that now puts Colliers as the clear leader in the government property management space, with more than 300 government-leased buildings managed by our platform,” Dilks said. “Also, this year we’ve recruited investment sales teams from CBRE and Marcus & Millichap, which now give us a track record of 150 government-leased property sales. We want to lead this sector in every category and in 2019 we’ve made fantastic progress towards that goal.”

Stout, Dilks and Lavey have worked together for 20 years and their approach to brokerage has always been grounded in the concept of teaming — not just with one another but with a variety of individuals and business units throughout our company.

“We met as researchers early in our careers, we entered the brokerage business together and, ultimately, built our government practice together,” Lavey said. “Teaming has enabled us to support our clients in ways that we’d not be able to accomplish as individual practitioners.”—K.L.

Robert Moser, Jr.

President and CEO, Clark Construction

Robert “Robby” Moser, Jr., took over the reigns of storied Clark Construction in 2016, after the passing of its longtime chairman and namesake A. James Clark.

Headquartered in Bethesda, Md., Clark Construction is one of the foremost construction companies in the metro D.C. area, having built many of the city’s landmarks and engineered portions of its infrastructure over its 100-year history. That includes two dozen Metro stations, more than a dozen Smithsonian projects, L’Enfant Plaza, FedEx Field, and the Verizon Center, to name a few.

The $5 billion national company is also responsible for projects like the Salesforce Tower and the recently delivered 18,000-seat Chase Center, the home court of the Golden State Warriors, both in San Francisco.

The company’s recent and current projects in D.C. include the revitalization of the National Air and Space Museum, the construction of the new International Spy Museum (which reopened in 2018), and the design of the Dwight D. Eisenhower Memorial to the south of the National Mall, expected to open in 2020.

In the areas surrounding D.C., Clark is currently working on the 264,000-square-foot Schar Cancer Institute in Fairfax, Va., and the 240,000-square-foot Howard County Circuit Courthouse in Columbia, Md. The company also recently celebrated the completion of its fourth office in Baltimore.

Clark is also one of the many companies involved in the extension of the Metro’s Silver Line to the Washington-Dulles International Airport, a multi-phase public-private project that has been delayed several times and is now scheduled to open in late 2020.

Moser, who has a civil engineering degree from the Virginia Polytechnic Institute and State University, began his career as a field engineer at Clark Construction in 1997. He worked his way up through the ranks to become CEO in 2013. After the passing of Clark, Clark Construction executives bought out the majority share of their parent company, Clark Enterprises Inc., to become an independent company. —Chava Gourarie

Tim Leon

Executive Vice President, Citizens Bank

Citizens Bank Executive Vice President Tim Leon oversees a large chunk of the bank’s footprint, managing lending teams from New Jersey to Florida to Texas.

The bank is headquartered in Boston, but Washington, D.C., is where its bread is buttered, according to Leon, 59. The D.C. group is in line to have “another $1 billion year,” he said, adding that the group typically doles out around $1 billion to $1.5 billion in new debt investments in the area annually.

Leon’s D.C. team avoids competing with smaller local and regional banks by targeting three food groups: REITs, private equity funds, and large, well-capitalized regional and national institutional players that are “investing in trophy-grade real estate.” The bulk of the bank’s work — about 70 percent of its portfolio in D.C. — lies in the office and multifamily sectors, but, “we’re involved in all deal types from construction, perm, bridge, value-add, build-to-suit and sale-leasebacks.”

In March, the bank acted as the syndication agent with Capital One on $132 million in construction financing to MRP Realty for Bryant Street, a three-phase mixed-use development on the site of a former shopping center in northeast D.C. that will include 1,650 residential units and 250,000 square feet of retail once it’s completed. Capital One held $72 million while Citizens retained the remainder, according to a report from GlobeSt.

“For [Citizens Bank], [D.C.] is one of our most important markets,” said Leon, a 12-year veteran of the bank. “Up until the near term, it was our largest area for real estate exposure in the U.S. … It’s still No. 1 or [No. 2], slightly behind Boston. We’re a very important market for the bank in terms of loans outstanding and activity for our business.”

Coupled with Amazon’s insertion into the market in nearby Virginia, the area’s positive population and job growth create “a compelling story and a very vibrant marketplace,” despite signs of downward pressure on the broader economy, Leon said.

“Washington continues to be an exciting marketplace. D.C. has the presence of the federal government, which serves as a strong anchor to the economy, here, the job market and overall economic activity,” he said. “It’s not recession-proof, but it behaves better in the face of downward trends.”—Mack Burke

William S. Roohan

Vice Chairman, CBRE

William Roohan is a powerhouse in CBRE’s D.C. office, having participated in more than 999 apartment transactions and 38 investment transactions exceeding $38.6 billion.

In the past year, the vice chairman co-led the firm’s D.C. multifamily investment property team in negotiating the acquisition of 116 properties encompassing more than 31,866 units. Most notably, the team represented Lone Star Funds in selling a portfolio of four properties in Virginia, Pennsylvania, New York and Massachusetts totaling $2.6 billion.

His key to success? “Hard work and showing up early.” How early? “I turn the lights on,” said Roohan, who was listed as one of CBRE’s “Top Five” in the nation for multifamily sales throughout the last 23 years. He was also among the firm’s “Top 10” from 1984 to 2007 and 2009 to 2018 in the Washington-Baltimore region.

Roohan also surrounds himself with high-quality people: “Our goal is always to hire people smarter than us who have the drive and intellect — then figure out if they have the sixth sense to figure out what a deal is.”

Stacked with a dozen brokers who thrive on collaboration, Roohan says his multifamily sales team consistently outpaces other firms. “The way I look at it, 12 brokers working separately will do 12 brokers’ worth of work but 12 brokers working as a team will do 16 brokers’ worth of work.”

With 35 years of experience, Roohan says the only thing that’s constant in the business is change. “The trick is to figure out the change before the people do and react accordingly, so change is part of the game plan.”—Christina Sturdivant-Sani

Josh Peyton

Managing Director, Avison Young

As managing director of Avison Young’s D.C. region, Josh Peyton oversees the firm’s full-service real estate platform in the District, Maryland and Northern Virginia, handling everything from planning and portfolio management to lease negotiations and space planning.

“We are principally owned and make the decisions collectively as a group; most of the other firms are owned by Wall Street, so having this model correlates into a ‘we’re all in it together’ mentality and that has been incredibly successful for us so far,” Peyton said.

In 2009, Avison Young didn’t exist in the U.S.; now it’s a billion-dollar company with offices in every major city. Today, in D.C., there’s three offices in the region, 35 million square feet of listings and 12 million square feet of property management.

Peyton started in the business almost two decades ago, coming up as a tenant broker with Transwestern. Success didn’t come easy, and he shared that he failed miserably but dug himself out of a hole until he was recruited to join Grubb & Ellis, where he stayed for six years.

When Avison Young was expanded from Canada into the U.S., Keith Lipton was named managing director in D.C., and recruited Peyton for his team.

“I was the first broker at the firm and did the first-ever tenant deal in the entire U.S. for the company,” Peyton said. “In 2015, I took over as managing director for the D.C. region when Keith was promoted to chief operating officer of the entire U.S.”

Since joining the company in 2010, Peyton has successfully negotiated office transactions for a diverse client base, including Fortune 500 companies, law firms, associations and nonprofits.

As a more of a “coach” rather than a player in the game, Peyton doesn’t participate in any transactions, but he’s responsible for recruiting the talent that made Avison Young stand out in 2019. For example, bringing aboard Glenn Meltzer and his team from the Ezra Company put the company on the map of the tenant side of the business for the first time.

“In the D.C. region, Avison Young is landlord-strong, but bringing them on board, as well as John Silkatis as chief innovation officer, has certainly elevated our brand significantly this year,” Peyton said.

On the agency side, representing Alexander Court, Rockrose Development’s 815,000-square-foot trophy office development at 2001 K Street, was notable this year. Avison Young will actually be moving its D.C. offices there in September.

The firm’s Virginia office is currently working on a new Tysons project, which Peyton hints will be a big deal in the months ahead.—Keith Loria