Breaking Down the New Rent Laws and What They Mean for the Real Estate Industry

By Rebecca Baird-Remba June 25, 2019 11:08 am

reprints

Nearly a century ago, in 1920, the New York State legislature passed the first emergency tenant protection laws, which sought to protect tenants from New York City landlords who could raise rents every month in the midst of a widespread housing shortage after World War I.

The laws did not impose rent regulation as New Yorkers would recognize it today. However, if a landlord wanted to evict a tenant for not paying his or her rent, the emergency tenant laws forced the owner to furnish a list of expenses that could prove the rent increase was reasonable, according to Robert M. Fogelson’s The Great Rent Wars. Housing court judges rarely sided with landlords.

The book recounts a Bronx landlord who complained in 1920 to a housing court judge, “Profit! Ugh, believe me, judge, I don’t know what a profit is. It’s a crime, judge, the way I am losing money, [which] I spend like running water.”

The Real Estate Board of New York, already a powerful and established lobbying group that represented city landlords and developers at the time, argued that the legislation did nothing to encourage residential construction or address the city’s housing shortage. The organization lobbied unsuccessfully against the bills before they passed, called them “ill-advised” and filed legal challenges arguing they were unconstitutional. Conservative upstate legislators opposed the bills. Even the governor at the time, Al Smith, was uncertain about the proposals, although he ultimately signed them into law.

The political dynamics in Albany today definitely have a sense of déjà vu about them.

On June 14, the newly Democrat-controlled legislature passed a slew of rent reforms that dramatically limit landlords’ ability to raise rents on the basis of building and apartment renovations. The law amended the state’s current emergency tenant protection laws, which were first passed in 1974 and have been extended and amended several times since then. The 74-page legislation, which Gov. Andrew Cuomo signed into law right after it passed, strengthened tenant protections for residents of the nearly one million rent-stabilized apartments in New York City. And it made the rent regulation laws permanent, after 40 years of state rent laws expiring every four to eight years and then being temporarily extended. All told, the city has 966,000 stabilized apartments, which make up slightly less than half of the 2.2 million rental units in the five boroughs.

The law, “The Housing Stability and Tenant Protection Act of 2019,” also eliminated vacancy bonuses, which allowed landlords to raise rents by 20 percent when a tenant moved out. And it effectively banned preferential rents—a measure that let landlords charge less than an apartment’s legal rent but meant they could increase rents to the legal maximum when a tenant renewed their lease.

One of the most earth-shaking provisions eliminated the high-rent decontrol threshold, meaning that landlords can no longer deregulate apartments when they reach a monthly rent of $2,770. All of this, combined with capping the amount of renovation costs that landlords can pass onto tenants, has left landlords feeling like they won’t have enough revenue to maintain their buildings and keep updating apartments as tenants move out.

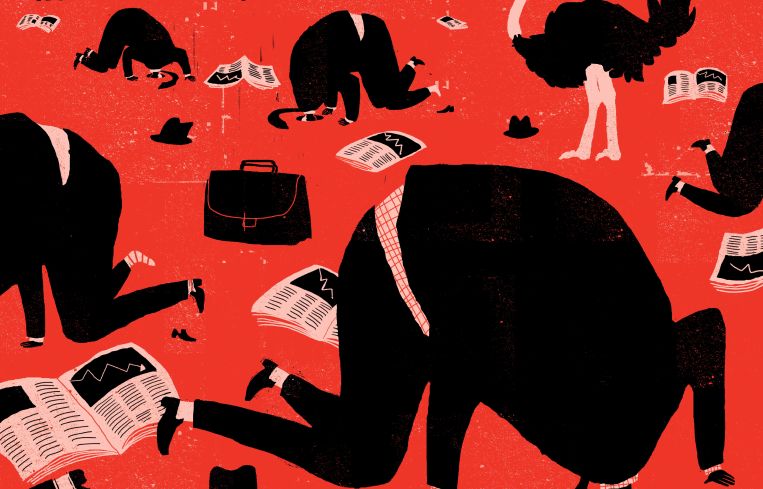

The Real Estate Board of New York, along with groups that represent smaller landlords, like the Rent Stabilization Association (RSA) and the Community Housing Improvement Program (CHIP), fought hard to prevent the legislature from passing the rent reforms. Since the legislation went into effect two weeks ago, owners, investment sales brokers, real estate lawyers and developers have made doom and gloom predictions about the new laws’ effect on New York City’s rental market.

“By eliminating vacancy bonuses, and all but eliminating major capital improvements and individual apartment improvements, the governor and legislature are consigning hundreds of thousands of tenants to buildings that will fall into disrepair,” REBNY President John Banks wrote in an op-ed in Real Estate Weekly last week.

Jay Martin, the executive director of CHIP, called the new policies “devastating for the small landlords we represent. What’s going to happen is building owners are going to become extremely frustrated as repairs pile up and they don’t have the liquid capital. They’re going to go to banks, who are going to say, ‘You don’t have a way to raise capital based on rents.’ When you can’t deregulate units, you don’t know what the rent guidelines board increases are going to be year to year; banks aren’t going to lend to them carte blanche. They’re going to do temporary repairs or they’re going to sell.”

Sherwin Belkin, a landlord lawyer and founding partner of Belkin Burden Wenig & Goldman, argued that the legislation will ultimately lower the amount of real estate taxes the city will collect from stabilized buildings. The bill “doesn’t recognize the realities of running and managing and owning property in New York State,” he said. “I think it will ultimately be destructive to owners, tenants, contractors and the tax base of this city.”

To help understand how the new rules will impact the industry, here’s a look at the major changes and what they mean for real estate.

Caps major capital improvements and individual apartment improvements

Previously, landlords could renovate apartments—spending tens or even hundreds of thousands of dollars—and pass a fraction of that expense onto tenants in the form of permanent rent increases. The state would essentially rubber stamp the upgrades, known as individual apartment improvements (IAIs), without looking into whether owners were fraudulently overcharging tenants for items like new appliances, floors or toilets. Under the new policy, landlords can only pass on $15,000 worth of renovations over 15 years. That works out to a monthly rent increase of $89. The state housing agency will also review and audit IAIs more closely than they have in the past.

“The IAI program has been gutted to a point that’s essentially useless,” said Martin. “For small building owners, the financials are at a point where they are essentially useless. Owners will do what they can to keep buildings safe for tenants, but they will do it with their hands tied behind their backs. In many cases owners do go into their pockets and their bottom lines to keep units competitive. Stabilized owners are now being basically put in a position that they can’t compete with market rate units and the amenities they are able to offer.”

Many members of the real estate industry argue that the $15,000 IAI limit is simply too low. Much of New York City’s residential building stock is 80 to 100 years old, and owners argue that the new caps won’t provide the revenue they need to maintain their buildings.

“You can barely do anything for $15,000,” said David Schwartz, a principal at development firm Slate Property Group. “It will cost you $7,000 or $8,000 just to file permits [with the Department of Buildings], between buildings department fees, architect fees, asbestos [abatement] and expediters. And then you get $89 [a month].”

However, Democratic legislators and advocates argue that IAIs were often abused by landlords, who would do construction work while an apartment was vacant and then report inaccurate costs to the state Department of Housing and Community Renewal, which enforces the rent laws. Rent increases triggered by the renovations were only scrutinized when tenants filed challenges with the agency or housing court.

“The purpose of this provision was to take the law back to its original purpose, which is to do improvements, not maintenance,” explained Ellen Davidson, a tenant attorney at the Legal Aid Society. “You’re not supposed to get an improvement to do a repair. DHCR’s own rules say you’re not supposed to get a rent increase for a repair. But since it happens during vacancy, it’s hard to know what work was actually done. Repairs were never meant to be charged against people’s rents. The fact that tenants are afraid that that will happen is because landlords were breaking the law.”

Tom Waters, an affordable housing policy expert at the progressive nonprofit Community Service Society of New York, agreed. “To me, $15,000 sounds like a lot for an apartment to turn over,” he said, noting that he’d spent that much renovating his own house in the Bronx. He also noted that the low-income tenants have gone from paying 40 percent of their income in rent in 2002 to 52 percent in 2017, largely driven by rent increases from IAIs.

State Senator Brian Kavanaugh, who chairs the senate housing committee, defended the cap as the only way to prevent abuses of the IAI system. “There was no limit on the amount someone can spend and pass that cost onto the tenant. IAIs have become a huge tool of gentrification. Under the old law they get [back] 30 percent of the amount they spend every single year. So we limited the rate at which landlords recoup their costs.” He added that the $15,000 limit was “intended to be an amount that would allow landlords to make modest improvements. A number of people said that was a reasonable amount of money to spend on an apartment, especially when it was vacant.”

For major capital improvements (MCIs), owners can now only pass on two percent of the construction cost to tenants, down from six percent under the old law. MCIs are building-wide upgrades like boilers, plumbing, heating and cooling systems, electrical systems, roofs and windows. Both MCIs and IAIs will drop off of tenants’ rents after 30 years, rather than being built in as permanent rent increases as they were under the old system.

The industry consensus is that landlords will have fewer incentives to invest in their buildings, because the new rent laws will keep their returns so low.

“I think you’re going to see landlords doing the bare minimum to rent an apartment,” said Belkin, the landlord lawyer. “Scrape the floors, spackle the holes in the walls and paint the walls and you’re good to go. They’ll keep the old boiler as long as possible and patch the roof before they replace it. There’s no return on investment.” He added that if less than 35 percent of the building is occupied by rent-stabilized tenants, the landlord can’t claim any MCI increase.

Repeals high-rent and high-income deregulation

The most common way for landlords to remove units from rent regulation was to find ways to jack up the rent on a unit until it met the deregulation threshold, which has risen quickly in recent years to $2,774. The new law not only eliminated this option, but it also axed a less commonly used rule that let landlords deregulate an apartment if they could prove its occupant earned more than $200,000 a year.

Most landlords won’t be able to deregulate apartments for the foreseeable future, which affects the value of rent-stabilized buildings. Investment sales brokers think that owners of regulated buildings will have to sell for lower prices than they did a year or two ago. And the changes will dampen an already sluggish property sales market in New York City.

“The law has definitely shaken up the multifamily community of owners and operators,” said Michael Tortorici, an investment sales broker at Ariel Property Advisors. “In the near term we’re expecting to see a slowdown in transactions as the market digests this legislation and as owners and investors revise their plans for their existing portfolios.” He added that the cheaper residential properties may attract a different kind of buyer to New York City than the ones that dominate the market today.

“Future owners of multifamily in New York may not be the traditional players that have been here in the past few years,” he noted. “It may be new capital coming to the city responding to the changes in pricing and returns.”

Makes condo and co-op conversions tougher

Another aspect of the new law that irks landlords is that it increases the number of tenants who must agree to a tenant or co-op conversion in a rent-stabilized building. Under the old law, it was 15 percent of tenants; now it’s 51 percent. Also, the old law allowed outside investors to purchase the 15 percent of converted apartments if tenants decline to purchase them. This month’s legislation requires 51 percent of tenants to not only support the conversion but also to agree to purchase their units before the state attorney general will sign off on a condo conversion plan.

Moving the threshold up will “effectively kill condo and co-op conversions,” said Mark Edelstein, a real estate attorney at Morrison Foerster.

State Senator Brian Kavanaugh, who chairs the senate housing committee, said that was not the intention. “We think that [the new rent law] might maintain this program as something that allows homeownership opportunities but doesn’t simply allow landlords to sell apartments to outside investors.”

Establishes preferential rent as the base rent for a new lease

Preferential rent is when a tenant pays any amount lower than an apartment’s legal rent registered with the state. While the rent reform bill didn’t eliminate preferential rents entirely, it did create a rule that extends preferential rents for the duration of a tenancy. Under the old system, a tenant could sign a lease at a preferential rent, then see the rent jump to the legal rent upon renewal. Now, renters who pay preferential rents don’t have to worry that owners will summarily jack up their rents by hundreds or thousands of dollars when they renew their leases; they will only be subject to normal increases from the Rent Guidelines Board.

But when a tenant moves out of the apartment, the landlord can raise the rent to the maximum legal rent.

Affordable New York confusion

A drafting error in the original version of the rent regulation bill accidentally placed market-rate units under permanent rent regulation in new buildings receiving the Affordable New York tax exemption (formerly known as 421a). After spotting the mistake, the Real Estate Board of New York alerted its members, and developers were in an uproar. The Durst Organization threatened to cancel its massive Halletts Point residential project on the Astoria waterfront, which would include several hundred affordable units, if the language was not corrected.

Last Thursday, the state senate voted through a cleanup bill that clarified Affordable New York units can still be removed from stabilization when they reach the current deregulation threshold of $2,744. So builders are breathing a sigh of relief for now.

Creates stronger tenant protections and limits upfront fees for renters

The law bans the use of tenant blacklists, which include tenants who have been sued in housing court for not paying the rent, repeatedly paying it late or creating a nuisance. It also limits security deposits to one month’s rent and requires landlords to return a deposit two weeks after a tenant moves out. Charges for late rent payments are capped at $50. And it mandates that landlords give tenants at least a month’s notice if they plan to raise the rent more than five percent (even on free-market units) or if they plan to not renew a lease.

The legislation also creates the crime of unlawful eviction, where a landlord uses force to evict a tenant or illegally locks them out, and makes it a misdemeanor punishable by a civil penalty of up to $10,000 per violation.

A host of new protections for tenants fighting eviction in housing court include additional time to get a lawyer, fix lease violations or pay back rent. Judges will also be allowed to push back an eviction for up to a year if a tenant can’t find a suitable apartment in the same neighborhood at a similar rent.