Presented By: Nuveen Real Estate

Millennial Moves—Smart Investing in Millennial Housing

By Nuveen Real Estate March 18, 2019 12:07 pm

reprints

In November 2018, Nuveen Real Estate issued a report titled “U.S.: Investing in the MiMis (Millennials & Middle-Income Households).” The report contains an analysis of housing trends among this cohort with an eye toward identifying investment opportunities that are positioned to outperform in tomorrow’s world.

Nuveen divides Millennials into two distinct groups: older Millennials (OMs), who are roughly 30-36 years old and are likely to have families and purchase homes in the next few years, and younger Millennials (YMs), roughly 19-29 years old and often still building careers and renting. Many Millennials in both categories are middle-income households (defined in the report as earning between 80% and 120% of area median income or typically between $45,000 and $75,000 per annum). This demographic often rents by necessity, further enforcing consistent demand.

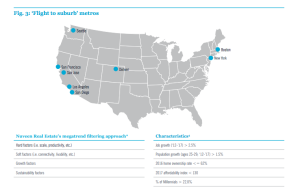

The company has identified eight major cities it believes are “at greatest risk of losing higher income OM renters to suburban homeownership”: New York, Boston, Denver, Seattle, San Francisco, San Jose, Los Angeles, and San Diego.

Nuveen Real Estate has determined that OMs leaving these “flight to suburb” cities “will create an investment opportunity in the over-built luxury and Class A apartment markets, particularly in large, expensive major metros across the U.S.”

The report’s analysis determined that “these eight cities experienced a large influx of Millennials in the last decade due to their strong post-recessionary job growth,” and that those Millennials are now largely renters. With home ownership rates for the 35-39 age group at 56.8 percent, Nuveen is assuming a 60 percent ownership rate for the group moving forward, which translates to “roughly 1.3 million at risk to flee to suburban locations and purchase a single-family home.” The company also believes that the other 40 percent—close to one million Millennials—are likely to seek out more affordable cities.

When combined with the recent “unprecedented levels of new supply” of luxury and Class A apartments in these cities, this dislocation represents a cyclical opportunity for investors.

“Demand for Class A and luxury apartments should wane and prices for these types of apartments are likely to fall,” the report states. “In our view, these central cities remain attractive locations for multi-family investment due to their high cost of living and strong, well-diversified job markets.”

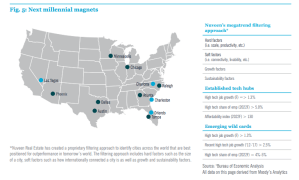

By contrast, YMs are in a very different stage of life and therefore seeking out different opportunities. They are “likely to be attracted to areas with strong job prospects, particularly in tech.” As only 15 percent of first-time home buyers are under the age of 30, Nuveen assumes that YMs “will generate demand for rented apartments for at least another seven to ten years.”

Nuveen Real Estate has identified a group of cities—dubbed the “next millennial magnets” that are affordable but also serve as tech hubs providing strong career prospects. These include Charleston, S.C.; Raleigh, N.C.; Charlotte, N.C.; Orlando, Fla.; Austin, Texas; and Las Vegas.

As Millennials tend to earn the U.S. median household income or less, Nuveen refers to them as the “rentership generation.”

Reasons Millennials rent, in addition to income level, include “declining home affordability, record student loan debt burdens, stricter lending requirements, and delayed decisions to marry and start families.” Given that declining affordability, “many middle-income Millennials, even those who move to the suburbs, will not be able to afford a home, generating demand for apartments.”

The firm believes that the majority of Millennials will be cost-conscious and avoid recently-built higher-end units, which will “creat[e] increased demand for value-oriented Class A and well-located Class B apartment communities.” The report also states that the next “millennial magnets” will be less urban, and that multi-family demand will likely be “concentrated in attractive, highly-amenitized suburban locations.”

In conclusion, Nuveen Real Estate believes “targeting MiMis will provide investors with significant favorable investment opportunities in tomorrow’s world.”

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Nuveen Real Estate is a real estate investment management holding company owned by Teachers Insurance and Annuity Association of America (TIAA). Nuveen Real Estate securities products distributed in North America are advised by UK regulated subsidiaries or Nuveen Alternatives Advisors, LLC, a registered investment advisor and wholly owned subsidiary of TIAA, and distributed by Nuveen Securities, LLC, member FINRA.

Please note real estate has specific risks, including fluctuations in property value, higher expenses or lower income than expected and environmental problems and liability.