The 25 Most Powerful Real Estate Figures in Los Angeles

By The Editors November 5, 2018 1:30 pm

reprints

Selecting a mere 25—or, 26, if you count our honorable mention, Elon Musk—individuals who represent the power players in commercial real estate in a city as vast and diverse as Los Angeles is a daunting task. A fool’s errand, perhaps, but also an enlightening, provocative one. Our inaugural survey of the men and women behind some of the biggest deals, the grandest designs and most intriguing commercial developments in 2018 is a study of contrasts.

From brokers at CBRE specializing in the overheated creative office sector who brought in mega-tenants to the burgeoning Arts District in downtown Los Angeles to the developer behind Primestor who focuses on bringing retail and commercial properties to underserved communities in Los Angeles like Watts, many are directly tied to commercial real estate. There are the uniquely Los Angeles picks, like Victor Coleman of Hudson Pacific Properties, whose company has had Hollywood properties in its crosshairs—and portfolio—for years. Or, the billionaire developer of shopping malls reminiscent of Disneyland that have become L.A. landmarks, Rick Caruso.

Others have graced Commercial Observer’s past power lists for their work in the New York market, like Charles Cohen of Cohen Brothers Realty and Donald Bren of the Irvine Company.

There’s a place for policymakers. Mayor Eric Garcetti, for instance, who oversees a city with an ongoing homeless and affordable housing crisis and is coming up with solutions that have been met with mixed reactions.

And there’s even a small bit of room for outliers like Lynsi Snyder, the president of In-N-Out Burger. What does a burger chain, albeit a SoCal institution, have to do with commercial real estate? You’ll just have to read on to find out.—Alison Stateman

Subscribe here to CO’s Los Angeles Weekly Newsletter for more coverage like this.

Robin Potts FINANCE

Co-Head of Real Estate and Director of Acquisitions, Canyon Partners Real Estate

Finding worthy investment opportunities throughout a business cycle is always a moving target—which is why Robin Potts, the co-head of real estate investments and the director of acquisitions at Canyon Partners Real Estate, prides herself on the firm’s flexibility.

“I would say that five or six years ago, there was a different opportunity set available in terms of buying or capitalizing distressed situations. Those opportunities have really been worked through at this point,” Potts said.

But that shift has been no problem for Canyon, Potts avers. The Century City, Calif.-based debt and equity investor has simply fallen back on its expertise handling tricky transitional, repositioning and construction deals. It’s a smorgasbord of capabilities that has been sufficient for the firm to put out $4.5 billion in capital over the ten years since the financial crisis.

“We really like to focus on segments of the market that are less crowded,” Potts explained. “We capitalize on understanding complexity and having the expertise to execute on assets going through transition.”

The firm’s recent investments in a pair of Southern California development projects exemplify its knack for playing all positions. In Simi Valley, Calif.—about 30 miles northwest of L.A.—Canyon pitched in with $10.6 million in preferred equity for a seniors-housing project in a market Potts described as severely supply constrained.

“Southern California is one of the most undersupplied markets in the country for seniors housing,” Potts said.

Meanwhile, a $49 million senior loan to fund construction of a new hotel on the University of Southern California’s health sciences campus has showcased Canyon’s ability to pick its spots on the debt side as well.

And a transcontinental trio of financing deals—including properties in Northern and Southern California and in Washington, D.C.—make up the first closings for a recently launched Canyon equity platform that Potts promised will only gain momentum. The three investments announced to date sum to $58.3 million, although Potts, an East Coast native, wouldn’t say whether other equity stakes were in the works elsewhere.—Matt Grossman

Rick Caruso

Founder and CEO, Caruso

Rick Caruso, the driving force behind Los Angeles landmark The Grove, the 575,000-square-foot shopping center adjacent to the historic Farmers Market established in the Fairfax District in 2002, has helped redefine the American mall. With its Neo-Deco facades, chiming trolley and dancing fountains, the shopping center often has been likened to the Disneyland of retail. Caruso’s town-square-style retail emporiums with central manicured green space are outdoor lifestyle centers in homage to a golden age—which may or may not have ever existed.

As the head of Caruso Affiliated, one of the nation’s largest privately held real estate companies, founded in 1987, his vision has paid off handsomely.

The Grove and his nine other shopping centers in the area, including Palisades Village in Pacific Palisades, which opened last month, have made the 59-year-old real estate developer rich. According to a recent profile on him in Forbes, Caruso is worth an estimated $4 billion.

Earlier in his career, Caruso served as the youngest commissioner in L.A.’s history when Mayor Tom Bradley appointed him to the board of the L.A. Department of Water and Power in 1985 at the age of 26. In a subsequent post as the president of the board of the Los Angeles Police Commission, he led an effort to rework the Los Angeles Police Department’s disciplinary procedures and recruited William Bratton as police chief.

An alumnus of the University of Southern California, Caruso was appointed head of the board of trustees in May to lead an investigation into sexual misconduct by a gynecologist at the university’s student health center and the school’s handling of nearly three decades of claims to help restore public confidence in the administration among students, faculty and staff.—A.S.

Thomas Whitesell FINANCE

Group Head of Real Estate, CapitalSource

As L.A. real estate powerhouse lenders go, CapitalSource is up there with the very best. At its helm is Thomas Whitesell.

Whitesell has originated more than $25 billion in construction loans over the duration of his career, so it’s perhaps unsurprising that CapitalSource has carved out an exceptionally strong market foothold in construction lending (as well as bridge lending), closing deals from coast to coast.

This year alone the lender has originated $1.5 billion in construction loans and $900 million in bridge loans across 60 transactions, despite increased market competition.

“People are working a little harder to get transactions completed,” Whitesell said. “We’re busier than ever on both the construction and bridge lending side because of our relationships; repeat business is what’s driving that increase.”

Recent transactions include a $64 million five-year loan to Fields Holdings for the construction of a 230-unit private dormitory for students at the University of Washington in Seattle; a $41 million ground-up construction loan for L.A.-based developer Watt Companies’ Tuscan Highlands 304-unit apartment complex (part of its Southern Highlands master-planned community located 10 miles south of the Las Vegas Strip); and a $117 million construction loan for the ground-up construction of The Residences at Wilshire Curson—an L.A. luxury high-rise multifamily property being developed by Jerry Snyder’s J.H. Snyder Company and OGO Associates of Wilshire.

The Residences at Wilshire Curson transaction—for which CapitalSource provided a five-year, non-recourse loan—marked the lender’s first transaction with Snyder, described by Whitesell as an L.A icon. “He’s phenomenal, so sharp,” he said. “J.H. Snyder is a class-A operator and I’ve wanted to do business with them for many years.”

A smaller but equally interesting loan CapitalSource recently made was a $13.7 million construction financing for Ring Doorbell’s new headquarters in Hawthorne, Calif. (where two existing warehouses will soon be connected). The home security tech startup was recently bought by Amazon for a reported $1 billion price tag, right before the loan closed.

For Whitesell, teamwork is the name of the game; he pegs his group’s overall success on each individual’s contribution.

CapitalSource’s footprint continues to expand, with transaction volume increasing year over year. The sky is seemingly the limit, but the firm is focused on smart and steady growth. “We don’t want to be the biggest,” he said, “just the best.”—Cathy Cunningham

Chris Penrose and John Zanetos

First Vice President and Executive Vice President, CBRE

Chris Penrose recalls a less than glorious industry start. He was hired by John Zanetos after graduating from USC in 2008 during the height of the recession, living on Hot Pockets and soup.

“It was horrible,” Penrose said. “I would cold call people, and I would literally get CEOs on the phone that said, ‘Just so you know, I had to fire 200 people today, you’re the last person I want to talk to.’ It was depressing.”

The 33-year-old has come a long way.

Zanetos, 40, an executive vice president and Penrose, a first vice president, are the team behind some of the biggest creative office deals in recent years. The duo, acting on behalf of Shorenstein, scored Warner Music Group’s 13-year, 257,000-square-foot lease and headquarters move from Burbank to the Ford Factory in the then emerging Arts District neighborhood and City National Bank’s nearly 242,000 square-foot lease at Two Cal Plaza in the central business district downtown, among the two biggest deals in 2016.

The Warner deal, for which they worked with Todd Doney, CBRE vice chairman, Rob Waller, an executive vice president and Phil Ruhl, an associate on the duo’s team, was the Art District’s first sizable office tenant and a game-changer, attracting other notable entertainment and media companies to the area in its wake.

The ability to draw tenants from more established markets including Playa Vista and Hollywood was what Penrose said set them apart and how they nabbed the Ford Factory listing.

“John was really the leasing broker pioneer in the Arts District. He thought it would be a good idea to build our resume with smaller deals,” he said. These included an 80,000 square-foot lease for Splendid and Ella Moss at The Row DTLA and 20,000 square-foot leases for Mark Forman.

More recently, the duo landed one of the largest headquarters move this year, when Honey signed a 10-year lease for 130,000 square feet in the former Coca-Cola plant in the Arts District in August.—A.S.

Darla Longo and Barbara Emmons Perrier

Vice Chairman, Managing Director and Vice Chairman

CBRE Industrial, Capital Markets

For Darla Longo, 61, and Barbara Emmons Perrier, 51, who lead CBRE’s Industrial and Capital Markets group, industrial was where it was at long before the dominance of e-commerce drove rents for warehouse and logistics properties sky-high.

Longo, a vice chairman and managing director of capital markets, industrial and logistics, is the first woman in the company’s history to be elected to its board of directors. She and Emmons Perrier lead the western division of National Partners, a group of the firm’s top institutional real estate professionals, which accounted for 60 transactions, totaling 34 million square feet with a value of $2.8 billion last year.

The two sisters and long-time CBRE business partners—“we have 70 years between us at CBRE,” Emmons Perrier said—were encouraged by their father, who was in the steel manufacturing business, to go into the sector.

“He said industrial real estate is a great business for women,” Emmons Perrier said, after having wished he had gone into it himself. “I don’t think he realized there were no women in this business.”

Women were definitely scarce in the specialty area when Longo first joined CBRE after graduating from the University of California, Los Angeles, and Emmons Perrier followed suit a decade later.

The all-women team, which currently includes Rebecca Perlmutter Finkel and Valerie Achtemeier, stood out.

“It’s just very unusual because most of our competitors walk in with four men and so certainly it’s definitely a different dynamic,” Emmons Perrier said. “You just had to kind of work a little bit harder, be smarter because you had people who weren’t sure what to think because you were not typical.”—A.S.

Eric Garcetti

Mayor, City of Los Angeles

Eric Garcetti, the city’s youngest mayor in a century (he’s 47 years old) and the first Jewish one, is representative of the city’s diversity.

Being mayor of a sprawling metropolis like Los Angeles is no easy feat. Since being elected to the office in 2013 and re-elected in 2017, Garcetti has been confronted with no shortage of challenges. These include an ongoing homeless crisis, an immigration crackdown since President Trump took office and getting Los Angeles up to speed on mass transit projects in advance of the city hosting the Summer Olympics of 2028, for which he led the winning bid.

To combat the homeless crisis, Garcetti declared an emergency shelter crisis in April and signed into law dual ordinances passed by the City Council, the Permanent Supportive Housing Ordinance and Interim Motel Conversion Ordinance. He also passed a linkage fee last December to be assessed on all new commercial development starting in 2019 in order to help fund affordable housing in Los Angeles, which, unsurprisingly, wasn’t popular among business groups including commercial developers.

In May—in a less controversial measure—he appointed former architecture critic Christopher Hawthorne to serve as the city’s first chief design officer to “improve the quality of civic architecture and urban design across Los Angeles,” he said in an official statement.

Most recently, he has been campaigning for several Democratic candidates, voicing his support for the repeal of Costa-Hawkins, which, if passed on Nov. 6, would expand the local government’s ability to expand rent control in Los Angeles.

On a national level, he has taken very public roles, which some say are in line with his ambitions to run on the Democratic ticket for the presidency in 2020.—A.S.

Charles S. Cohen

President and CEO, Cohen Brothers Realty Corporation

For Charles S. Cohen, West Hollywood is where it’s at. His signature West Coast property, the Pacific Design Center, has, like many of the properties his company owns, become a landmark in the area. The 1.6 million square-foot complex’s César Pelli-designed original Blue, and subsequent Green and Red buildings rise into view from the major thoroughfares feeding into the design center at the corner of Melrose Avenue and San Vicente Boulevard.

The mixed-use property is one among the trophy assets that Cohen’s company, Cohen Brothers Realty, has been involved in developing, redeveloping and operating among the more than 12 million square feet of commercial properties it owns nationwide.

Cohen has an affinity for trade and design centers, describing them as “museums of the living” and buildings that are uniquely American to Commercial Observer during a recent meeting at the Red Building. In addition to the PDC, Cohen’s holdings in the sector include the renowned Decoration & Design (D&D) Building in Manhattan and the Design Center of the Americas (DCOTA) in South Florida, the largest design center in the U.S.

Under his tutelage, the Pacific Design Center, which he purchased in 1999, has gone under extensive renovations to redesign around 500,000 square feet of underutilized showrooms into the very in-demand creative office project. As a result, the 14-acre campus became home to entertainment and arts communities in addition to design showrooms, such as AllSaints, DBA Media and the Abrams Artists Agency. Recent leases include indie-entertainment company A24 and Imagine Impact, the creative incubator from Imagine Entertainment and WeWork’s expansion in which they added 93,500 square feet to the footprint they already occupy in the Red Building Cohen built from the ground up and Green Building next door to total more than 163,000 square feet.

The film aficionado and budding movie mogul (Cohen picked up an Oscar last year for The Salesman, a French-Persian film distributed by his Cohen Media Group with Amazon Studios), didn’t skimp on amenities, adding a state-of-the-art screening room to the Red Building, dog park with artisan coffee served from out of a hipster Airstream trailer and dining option from Wolfgang Puck among them, all nods to the community the property serves.

“I always believed that, for real estate to be successful, it’s got to connect to the various communities in which it exists,” he said. “Here it was the design community, the entertainment industry, the charitable organization industry. We wanted this, which is a building a lot of people are intimidated by the sheer scale and architecture, to feel welcome and to remove barriers wherever we could.”—A.S.

James Malone

Senior Managing Director for the Greater Los Angeles Region, Colliers International

Colliers International manages more than 16.4 million square feet of office space within Greater Los Angeles, and in 2017, the company closed more than 44.8 million square feet in leasing and sale transactions in the area, totaling nearly $3.7 billion, according to its website.

James Malone, a senior managing director for the Greater Los Angeles region, has proven himself one of the powerhouses behind the company’s top producers in the area.

“What sets Colliers apart is our entrepreneurial vision,” said Malone, who manages between 60 and 70 brokers. “We allow our brokers to go out and run their businesses for their clients like they would as entrepreneurs. We give them all the tools and support they need to do their work,” he said.

When people think of Los Angeles, they think Hollywood, but Malone said Colliers is keenly focused on L.A.’s industrial economy—the Port of Long Beach and shipping traffic—both of which he said are important facets and opportunities for Colliers brokers.

Malone is African-American, and admitted there are not a lot of minorities working in commercial real estate. “That’s not lost on me.” But, he added, “I also think we live in a diverse community in L.A. and I believe it’s important that we [Colliers] reflect that diversity and it’s important that we have brokers and real estate professionals who reflect that.”

Malone said that Colliers is keen on building up the company’s platform in the L.A. market.

“We’re looking to double our revenue from 2015 to 2020, and we’re about one-third of the way to that goal,” he said. “We have a big region with 180 brokers. We’re one of the largest in Colliers platform and continuing to recruit great talent.”—Rebekah Segar

Andrew McDonald

President of West Region, Cushman and Wakefield West

On the heels of an already strong 2018, Cushman & Wakefield’s August IPO gave West Region head Andrew McDonald a wealth of additional resources to make a stronger push into new markets.

“Twenty eighteen has been a pretty incredible year,” McDonald said, “Going public gives us the ability to expand into [new areas]. For me in the west, that means Texas and L.A., with the Pacific Northwest and Northern California third and fourth.”

In the greater Los Angeles area alone, C&W West has 50.5 million square feet under management, and estimates 2,400 transactions in 2018 to date with a value of $22 billion. By contrast, transaction value for all of 2017 was around $8 billion.

In the L.A. area, the company’s grand achievement this year was the opening of At Mateo, a complex with 130,000-square-feet of retail and restaurants that saw Spotify take nearly 110,000-square feet of office space, making the spot its regional headquarters.

“At Mateo is the first ground-up development in the L.A. Arts District—the area was all renovation work prior to that—and that has been one of the most important projects in L.A. country in the last few years,” he said. “What it does is solidify the Arts District as a place that institutional capital has now built from the ground up, and delivered significant success as it relates to lease up.”

McDonald is looking forward to many exciting projects in 2019, including working with Ivanhoe Cambridge on the Colony Commerce Center, a $450 million industrial project which will eventually feature 3 million-square-feet of leasable space over 11 buildings.

While 2018 was Cushman & Wakefield West’s best year to date, McDonald sees even bigger things ahead for 2019.

“One of our priorities is to grow our multifamily practices in Texas and Southern California,” he said. “Continued growth within our property management business in both of those markets is also extremely important for us.”—Larry Getlen

Mark Fluent FINANCE

Head of Western U.S. Real Estate, Deutsche Bank

True to his name, Mark Fluent speaks the parlance of real estate finance deals with great proficiency.

From his vantage point overseeing Deutsche Bank’s commercial real estate lending at its San Francisco, Los Angeles and Dallas offices, Fluent has played a key role in fueling the bank’s lending success on the West Coast. During his eight-year tenure at the German lender—he joined in 2010, following prior stints at Lehman Brothers and Related Capital—Deutsche has been the top annual CMBS originator nationwide seven times: a testament, Fluent believes, to the bank’s forward-looking philosophy.

“We’ve tried to really connect with our borrowers, understand their businesses and forge long-term partnerships,” Fluent said. “Instead of being transactional, we’ve really tried to be client focused.”

That approach has served the L.A. native well this year, as his team projects to close out more than $6 billion in financings before the calendar turns on 2018. As Fluent has throughout the business-cycle expansion, his biggest deals have focused on booming property markets in new-media-heavy markets in Northern and Southern California. One of his largest, for example, was a $550 million loan against Gateway Apartments, a set of luxury towers in a tony San Francisco neighborhood near the Bay.

Regional economies driven by the technology sector are a strong play for lenders like Deutsche, Fluent said, because the economic growth they represent will persist far more strongly than any near-term business-cycle turbulence.

“I keep saying, I feel like we’re living in Florence in A.D. 1600,” Fluent said. “We’re in the middle of a technology shift in the economy, and we can’t fully see it because we’re living in it. We want to be one of those companies that’s changing fast and taking advantage of the way the world’s changing. A slight shift in interest rates isn’t going to...offset the growth.”—M.G.

Frank Gehry

Founder, Gehry Partners

On the cusp of his 90th year, Frank Gehry, the Pritzker Prize-winning architect whose designs have become synonymous with his long-adopted hometown, shows no signs of slowing down. When he spoke to Commercial Observer for a profile earlier this year, the very thought of retiring made him wince. “No. Don’t say that. I’m only 88 for god’s sake,” he said with characteristic crackle.

The man, now 89, behind the iconic Walt Disney Concert Hall in Los Angeles and, before that, the Guggenheim Museum in Balboa, Spain—a project that launched his reputation into the stratosphere—is currently at work on several high-profile developments in L.A.

Most notable, Gehry is the design force behind The Grand, a massive $1-billion mixed-use development spearheaded by Related California, across from the Disney Concert Hall and set for completion in 2021.

“My hope is that this project will be a good neighbor to the buildings and institutions that have created the backbone of Grand Avenue over the years. There is a lot of work to be done. This is a beginning, and we are excited to be a part of it,” Gehry told CO in a subsequent story on the Bunker Hill project.

His firm, Gehry Partners, is also among three selected for a two-year contract to update the 22-year-old master plan for the Los Angeles River.—A.S.

Victor Coleman

CEO, President and Chairman, Hudson Pacific Properties

In a city long defined by its Hollywood heritage, Hudson Pacific Properties (HPP) has made its mark in Los Angeles by acquiring marquee studio properties and nabbing the biggest among a new generation of content creators as tenants. The company, started in 2006 as Hudson Capital before going public in 2010, is led by its founder Victor Coleman.

The $8 billion real estate investment trust, which focuses on acquiring, repositioning, developing and operating top-of-class office and state-of-the-art media and entertainment properties in select West Coast markets, owns and operates 3.9 million square feet of Class A and creative office properties and 1.2 million square feet of stage and production offices, among its more than 17-million-square-foot portfolio in top submarkets from Seattle to Los Angeles. In L.A., holdings include a trio of historic studio lots, Sunset Bronson, Sunset Gower and Sunset Las Palmas, Coleman purchased in 2007, 2008 and 2017, respectively, which are now collectively known as Sunset Studios.

Content-streaming giant Netflix leased the company’s entire 327,913-square-foot office tower called EPIC, a 13-story building set to be completed in 2020.

“Los Angeles is one of the highest barrier, highest growth potential markets in the U.S., and as such there is considerable competition to acquire assets,” Coleman told Commercial Observer.

Hudson has also partnered with some major players. Last March, the company joined forces with Macerich to transform the struggling Westside Pavilion mall into a campus with 500,000 square feet of creative office space in a project estimated to cost between $425 million and $475 million. In October, Hudson partnered with Allianz Real Estate to acquire the historic Ferry Building in San Francisco from Equity Office, for $291 million.

“The acquisition of the Ferry Building fits perfectly with our strategy of identifying creative ways to improve the performance of exceptional real estate within global centers of tech innovation,” Coleman said in a statement at the time, and alluded to new amenities and events at the property as well as future investment projects with Allianz.—A.S.

Lynsi Snyder

President, In-N-Out Burger

While not a real estate company, per se, In-N-Out Burger’s hold on L.A. taste buds translates to an impressive real estate presence.

The connection between real estate and restaurants is a lot less tenuous than many might think. As B.J. Novak’s Harry Sonneborn memorably told Michael Keaton’s Ray Kroc in The Founder about that other legendary Southern California-born fast food purveyor: “You’re not in the burger business. You’re in the real estate business.”

In Kroc’s case this meant milking as much rent as possible out of franchisees, but In-N-Out has resisted the McDonald’s model of franchising itself. In-N-Out’s 333 outlets are all company-owned, and their consistent limited menu format produces equally consistent results. According to Forbes, a typical In-N-Out store brings in $4.5 million in gross annual sales, compared to just $2.6 million for a typical McDonald’s. While In-N-Out doesn’t disclose financials, the magazine estimates the company’s profit margin at around 20 percent, which eclipses both Shake Shack and Chipotle. Restaurant Business Magazine estimated the company’s 2016 sales at just over $807 million, a 7.3 percent increase from the prior year.

The company was founded in 1948 by Snyder’s grandparents, and Snyder, 36 the company’s owner, has ensured that In-N-Out’s brand has changed as little as possible in her care. If the company’s sales are any indication, Snyder’s strategy is as well executed as the company’s signature burgers.—L.G.

Charlie Rose FINANCE

Senior Director, Structured Investments, Invesco Real Estate

A year ago, when Charlie Rose joined Invesco Real Estate, the firm was in the process of launching its senior loan origination platform after many years dedicated to equity investment and mezzanine lending.

Over the last 12 months, the financier has jumped onto the scene and established itself as a formidable player in the transitional debt space, logging just over $1.4 billion in originations as of November. In 2019, Rose, 37, said he and his team have a goal to reach $3 billion in volume.

“The goal has been to take our long track record as a successful equity investors and mezz lender and apply that to our growing bridge lending business,” Rose told Commercial Observer. “The focus has been to establish a reputation as a flexible, creative and responsible lender in the transitional space. It’s been all about ramping up the lending business.”

Mission accomplished. In July, Rose’s team closed two $250 million debt facilities for investment firm KKR. One is geared to facilitate the acquisition of newly built multi family product in lease-up, and the other is targeted for the acquisition of newly built industrial assets, along with the aggregation of an industrial portfolio. In October, Invesco closed on a $250 million five-year, floating-rate bridge loan to refinance 80-90 Maiden Lane in New York’s Financial District.

“We are right on track with our total volume in terms of aggregate lending activity,” Rose said.

“But one thing that has surprised us over the last year is the continued compression of spreads. A year ago, we were originating whole loans in the mid Libor+ 300s, and now we’re originating in the low Libor+ 200s. Throughout the year, we thought we had hit a new floor on spreads, only to see that blow out.”—Mack Burke

Donald Bren

Chairman and Owner, Irvine Company

Since acquiring Irvine Company in 1977, as per Fortune magazine, Donald Bren has been the sole owner of the Orange County-based development firm. With a personal net worth of $16.4 billion, he ranks No. 30 on the Forbes 400 list, and he owns a 97.3 percent stake in New York City’s 58-story MetLife building, worth nearly $3 billion—making Bren the country’s richest real estate developer.

But his real prize is southern California—Bloomberg has reported that the octogenarian owns one-fifth of the 3 million-person county. (You know Irvine, California? There’s a reason that Bren’s company and the town name are the same. They started building it in the 1960s.)

Bren’s company owns 46.5 million square feet of office properties, 160 apartment communities, more than 40 retail centers, five marinas and three golf courses, as well as three hotel resorts, according to a company spokesman who spoke to Business Insider. (Bren and Irvine Company declined Commercial Observer’s request for an interview.)

In addition to being wealthy, Bren’s philanthropic endeavors are quite impressive. His lifetime giving exceeds $1 billion, according to Forbes.

“For me, philanthropy has always been about simply creating new community partnerships, partnerships that will be valued forever,” Bren said when he was awarded the first Donald Bren Legacy of Giving Award, by the backers of Orange County’s National Philanthropy Day in 2010.

According to the Irvine website, the firm and the Donald Bren Foundation have contributed more than $200 million toward public schools and four-year universities for programs, events, recognitions and scholarships that advance research and enrich primary education.

Bren has directed Irvine to set aside more than 57,000 acres of the original 93,000-acre Irvine Ranch, in the heart of Orange County, less than an hour south of L.A. and about 90 minutes north of San Diego. The Ranch stretches nine miles along the Pacific coast, 22 miles inland and accounts for more than one-fifth of Orange County’s total 798 square miles. As permanently protected open space, it will be creating an urban preserve the size of 67 New York City Central Parks, within 30 minutes of 3 million people.

“In terms of great visionaries who have influenced Southern California,” Rick Caruso, a former member of the Irvine Company board, said in 2010, per Business Insider, “I’d put him up there with Walt Disney.”—R.S.

Jaime Lee

CEO, Jamison Realty

Speaking to the CEO of a company traditionally known for commercial properties with over 90 under management, it’s surprising to hear Jaime Lee, 33, talk solely about multifamily.

The company entered the multifamily market in 2013 and has 2,000 residential units, but these were the result of adaptive use conversions of commercial space and new construction from the company’s extensive portfolio. This year saw the company’s first multifamily projects emerge from the ground up.

“This felt like a test year for us to prove our model — that our shift into multifamily had been the right decision and investment,” said Lee. “We’re ready to open well on time and to lease them up as quickly as possible.”

The projects Lee refers to are in Koreatown, which she said is an area in dire need of new housing product.

“Ninety-six percent of Koreatown residents rent, and the average vacancy here is about three to four percent, but the product is old, most built in the 1920s or 1970s, with no amenities, parking, Wi-Fi, or communal spaces. So we thought we could convert from our existing office portfolio any office floor plates that make sense to convert into multifamil.”

Jamison was started by Lee’s father, Dr. David Lee, who has stayed largely behind the scenes, (three of Lee’s siblings have also roles at the company), but the company has quietly become one of the biggest landlords in L.A., with a portfolio of some 18 million square feet, and a valuation of $3 billion, as per their website.

Jamison’s new multifamily projects in the area include 30Sixty, a 348,000-square-foot mixed-use development with 226 apartment homes over 17,500 square-feet of ground floor retail; 3345 Wilshire, an adaptive reuse of a 12-story office building that will feature 202 apartment units; the market rate 72-unit Maya apartment complex, the company’s first ground-up complex; and Luna on Wilshire, which will include 209 apartments with 3,100 square-feet of street level retail.

Based on the success of these projects, which Lee says were leased up in two to four months, the company has 20 multifamily projects in the pipeline, almost all in Koreatown.

“We already have about 6,000 units in the pipeline,” she said. “We’ve been really floored with this model. With 2018 being the test year for these projects, [finding out if] we can build them, open them on time and lease them up, [this has now] been proven. That gives us a sense of confidence moving forward. We’re just going to keep doing what we’re doing.”—L.G.

Peter Belisle

Market Director, Southwest Region, JLL

Peter Belisle, 51, knew he wanted to get into commercial development since he was a kid. A Cape Cod native who has called California home since age four, Belisle said having a father in the design and construction industry was “certainly a primer.” He set his sights on creating a strong foundation in the industry by focusing first on civil and structural engineering at the University of California, Los Angeles, where he earned a bachelor’s in civil engineering before going on to earn an MBA in real estate and finance from UCLA’s Anderson School of Business.

He began his 20-plus year career in construction management doing historic preservation projects in San Francisco, including the Bohemian Club and World Trade Club.

“It was really interesting because of the bridge between what could be preserved from history while meeting current safety and construction codes. That sort of work was really fascinating,” he said.

Belisle had the opportunity to transition to development at the Walt Disney Company, where he came onboard as the director of development and program management in 1997 on the cusp of a $1 billion massive development plan. He was responsible for more than $230 million of international development.

As the development process was winding down at Disney, Belisle said his desire to “continue to work on large, complex projects” is what led him to JLL in 2000.

As market director for the Southwest region, Belisle oversees operations at 11 offices, and 588 associates in Southern California, Arizona, Nevada and Hawaii. These include six offices and 343 associates spread across Los Angeles. Business lines under his direction are equally varied, including tenant representation, agency leasing, project and development services, capital markets, public institutions and a property and facilities management portfolio of 65 million square feet.

During his tenure, transaction volume for JLL in Los Angeles has risen from $6.3 billion in 2016 to $6.9 billion last year and it has acquired six companies, including Orange County, Calif.-based healthcare-focused firm CLEO Construction Management in 2014, L.A.-based Wilson Retail Group and Orange County-based Martin Potts & Associates, both in 2015.—A.S.

Jeffrey Mezger

President, CEO, Chairman of the Board, KB Home

While KB Home shows strong numbers for 2018, it’s also preparing to take a bold move into the future.

As of the end of second quarter 2018, KB showed a 10 percent year-over-year increase in total revenue and a greater than 70 percent increase in earnings-per-share.

KB is one of the largest homebuilders in the U.S., and was the first homebuilder listed on the NYSE. Focusing on new homebuyers, the company has built over 600,000 homes in 36 markets throughout eight states. KB was formed in 1957 as Kaufman & Broad, after co-founders Donald Kaufman and Eli Broad. Broad, who stepped down as CEO in 1974, went on to run SunAmerica for several decades, and is now one of the richest men in America.

In September, KB announced a deal with Google making it the first homebuilding company to build homes integrated with Google’s technology, including two speakers connected to Google Home, Google Wifi and a Nest smart video doorbell. If homebuyers prefer, they can add appliances that connect to the home’s central control system.

The company also impressed this year on the environmental front, earning 20 regional Energy Star Certified Homes Market Leader Awards from the EPA, more than any other homebuilder. The company has now built over 115,000 Energy Star homes since 2000.

New KB developments in 2018 included Sawgrass Bay, a community of one- and two-story homes with nine distinct floor plans, with prices beginning in the mid-200,000s, in Clermont, Fla.; Edgemont, a gated community of single-family homes in Compton, Calif.; and Northeast Crossing, a community of one- and two-story homes starting at around $180,000 in San Antonio, Texas.—L.G.

Ed Coppola and Thomas O’Hern

President and Senior Executive Vice President, Chief Financial Officer and Treasurer, Macerich

Macerich continued its march on mall retail domination in 2018, building on its 52 million square feet of real estate with some exciting new developments.

At press time, the company announced a major initiative in experiential retail with the development of the Crayola Experience in Arizona’s Chandler Fashion Center, a 20,000-square-foot family attraction that features hands-on activities for kids.

Experiential and immersive experiences have been an increasing company focus. Leases signed in 2018 include the interactive Cayton Children’s Museum by ShareWell in Santa Monica Place, Calif.; Life Time, an upscale, “diamond-level” athletic lifestyle resort, including a rooftop pool and bistros at Broadway Plaza, Calif., and Biltmore Fashion Park, Ariz.; and an on-demand scooter and bike concept called Lime, also in Santa Monica Place.

On a larger scale, the company announced in September it will be working with Simon Property Group in a 50/50 venture to develop the 566,000-square-foot Los Angeles Premium Outlets megamall, which is expected to open in fall 2021. In August, they also announced a partnership with coworking company Industrious that will place coworking outlets in Macerich malls, the first such collaboration, according to Macerich, between a mall operator and a coworking space for a multiproperty rollout.

The company’s business is currently so strong that, according to Barron’s, Wells Fargo named Macerich as the company best positioned to prosper from Sears’ recent bankruptcy due to its “negligible exposure and industry-leading productivity of [its] portfolio.”

Coppola is Macerich’s co-founder and oversees the company’s strategic direction. According to the company, Coppola directs “financial resources, key lender and investor relationships…[and] oversees acquisitions and dispositions [and] department store relations.” O’Hern’s responsibilities include “accounting, financial and tax reporting, investor relations, raising capital through debt and equity markets and information technology systems.”—L.G.

Jeff Friedman FINANCE

Co-Founder and Principal, Mesa West Capital

Mesa West Capital co-Founder and Principal Jeff Friedman knows how to survive the cut-throat and competitive landscape of commercial real estate finance. He need only look to his previous experience navigating crowded fields of senior debt originators after launching his shop with co-Founder Mark Zytko in 2004. Since then, Mesa West has held its own, surviving through the financial crisis and thriving by playing the long game. “It’s definitely gotten more crowded, more competitive,” Friedman said. “We originate loans on value-add and transitional real estate as bridge lenders. Because it’s gotten easier to raise capital, that means there’s more out there. We survived [through the crisis] and returned all investor capital; the key is not to chase yield. It’s about working the relationships and picking out spots and leaning on the things we like and saying no to everything else.” It’s been close to six months since Mesa West was sold to Morgan Stanley, a move Friedman said was geared to position his firm to compete long term with the likes of more active lenders such as Blackstone and Brookfield. “When we started there was a great benefit to being independent or unique,” Friedman said. “We were competing with behemoths like GE Capital and then other boutiques like ourselves. Now, a lot of the big real estate private equity firms have gotten in and we’re now competing with [shops like] Blackstone, Brookfield, TPG Capital and KKR. Where they have additional business lines, they can bring more to the table. Our view was we went from it being beneficial to be independent to being a powerful presence, having the strength of Morgan Stanley standing behind us in terms of relationships and different competencies in other markets.” The firm will log $2 billion in originations this year, including roughly $800 million on multifamily product in the New York and San Francisco metro areas. Friedman said he expects his shop to dole out around $3 billion in 2019.—M.B.

Eric Hasserjian

President and CEO, NAI Capital Management

Eric Hasserjian, a veteran of CBRE and NKF, joined NAI, the largest independently-owned full-service commercial real estate firm headquartered in Southern California, in January of this year, with an eye toward massively growing the company’s business.

“A big focus for me was business development — getting new property management assignments for the company,” Hasserjian said

“I was with CBRE here in L.A. previously and had a portfolio of over 30 million square feet. A lot of institutional clients I did business with, I’m calling on now, not only about property management, but agency leasing and capital markets as well.”

So far, Hasserjian has been meeting his own expectations, as NAI’s property management business has increased by 70 percent this year. NAI’s total transaction volume in Southern California for 2018 stands at $2.9 billion.

Hasserjian is not just overseeing the company’s vision but bringing in business himself. In a deal with Greenbridge Investment Partners that he was personally involved with, NAI was named the exclusive leasing agent to market Six25 South Pasadena, a 92,547-square-foot, Class A office building in South Pasadena, California.

Other significant property management deals include management of Wilshire Common, a five-building, 87,562-square-foot office campus Santa Monica, and the same plus leasing for a 10-building, 200,000-square-foot R&D industrial portfolio in Chatsworth, CA.

In winning business and growing the firm, Hasserjian sees an advantage in a flexibility that some larger firms can’t match.

“NAI is really entrepreneurial,” he said. “We have a lot of flexibility in pricing with clients and structuring contracts. Also, I spent a majority of my career on the ownership side, so I can relate to owners because I sat in their chair.”

Looking ahead, in addition to building the company’s investment sales opportunities, Hasserjian hopes to double NAI’s approximately 2.5-million-square-foot portfolio by the end of next year.—L.G.

Kevin Shannon

Co-Head of US Capital Markets, Newmark Knight Frank

For Kevin Shannon, now in his third year at NKF, 2018 was a year of both continued success and progressive growth.

The past 12 months saw Shannon’s team close 86 west coast transactions valued in excess of $5 billion. In addition, his team currently has over $4.9 billion in property listed or under contract.

One significant priority for Shannon has been growing his team. Starting with 15 people when he joined the firm in 2015, he is now up to 31, having opened new offices this year in San Diego and Phoenix. This has all led to greatly expanded sales and market share.

“In 2018, we started to focus on markets like Phoenix and San Diego and ramped up our efforts in Seattle and Portland, working with recent capital markets hires including Nick Kucha, CJ Osbrink and Brunson Howard,” Shannon said in an email to Commercial Observer. “Our market share and momentum has increased dramatically in 2018 in all of these markets, and we continue to do very well in Los Angeles and Orange County.”

Deals Shannon completed this year include Cerberus’ purchase of the 476,491-square-foot, 21-story Class-A office building Wedbush Center at 1000 Wilshire, in downtown Los Angeles, for $196 million; International Real Estate Corp’s purchase of the 337,904-square-foot, three-building Connexion Burbank office campus for $123.5 million; and The Kelemen Company’s purchase of the 303,000-square-foot, 10-story Atrium building for $106.7 million. NKF represented the sellers on these deals.

Shannon has also focused on aggressive growth in terms of personnel, including hiring Bill Bauman’s retail team from Savills Studley, which Shannon said was “one of 11 capital markets teams that have now joined us in the Western US in the last 2.5 years.”

Shannon sees this as just the beginning of NKF’s growth in the region.

“In just two years, Newmark Knight Frank has become one of the top two investment sales firms on the West Coast for both office and retail investment product,” Shannon said.

“I’m looking forward to continued growth with the addition of more top capital markets and leasing teams nationally. Newmark Knight Frank’s game plan is only in the third or fourth inning. We are just getting started.”—L.G.

Arturo Sneider

CEO and Co-Founder, Primestor Development

As the CEO and co-founder of Primestor Development since launching Primestor Properties in 1992 and Primestore Development in 1999, Arturo Sneider focuses on creating commercial projects for underserved communities in Los Angeles. Most notably he’s the developer behind the reimagination of Jordan Downs, as a “mixed-income” community located in the Watts neighborhood of Los Angeles. Sneider told Commercial Observer his company is proudest of the creation of job stability that his company is providing with Jordan Downs in the community.

“We create a lot of jobs because we’re focused on local hiring—from construction jobs all the way to requiring our tenants to hire locally,” he said. “Developing a retail project in the community takes the form of an economic catalyst and that’s what we stand for above all.”

In 2008, Housing Authority of Los Angeles in conjunction with residents and community stakeholders launched the redevelopment of the property at 9800 Grape Street to the tune of $5 billion. Primestor Development was charged with the development of the more than 120,000 square feet of new retail space. On the housing side, newly built affordable units are made available to existing Jordan Downs residents first under the same terms and conditions as their previous ones but new market-rate units are also being brought on-line since JD has about 700 units and will (when completed) have about 1,500 to 1,600.

“Our strategy is to create a plan for entrepreneurs and small businesses owners from the community,” he said. “We actively look for local small businesses and work on locating their businesses (which are usually smaller footprint units from 1,000 to 2,500 square feet, max) next door or in close proximity to strong foot traffic generating businesses which in turn help each other drive both, stronger sales and a more authentic shopping experience for consumers.”

Smart & Final Extra (a full-service grocer version of the old Smart & Final) has signed on as an anchor tenant at the project, slated to be completed in the third quarter of 2019 at 32,000 square feet.—R.S.

William Witte

Chairman and CEO, Related California

Related California spent the year continuing its aggressive development of housing, retail, office and more, furthering its progress on several large mixed-use developments.

In 2018, the company secured full entitlements for City Place Santa Clara in Santa Clara, Calif. Located right next to Levi’s Stadium, home to the San Francisco 49ers, the new 239-acre, $6.5 billion development, will eclipse 9 million square feet. According to the company, City Place Santa Clara will “boast multiple districts, each with its own unique personality and lifestyle affiliation with a mix of residential units, restaurants, entertainment venues, hotels, retail and much needed space for the growth of Silicon Valley companies.”

Specifically, the development will include 5.7 million square feet of office space, 1.5 million square feet of retail including food and beverage options, 1,680 residential rental units and 700 hotel rooms. The first phase is expected to be completed by around 2022 with additional phases coming online over the following decade.

Also this year, in San Francisco, beginning construction on the 1.2-million-square-foot, 39-story 1500 Mission, a mixed-income, mixed-use development that will include a 550-unit luxury apartment tower with 20 percent affordable units, 50,000 square feet of retail, and a separate 460,000-square-foot office tower. In Los Angeles, the company completed and opened Argyle House, an 18-story, 114-unit, LEED-Silver luxury residential tower commanding the highest rents in Hollywood. Studios at the Argyle start at $3,195 a month, though a studio with terrace will run you $3,995. A corner three-bedroom with a terrace in the building rents for $25,000 per month.

Related California currently has more than 1,500 affordable and 3,500 market-rate units in pre-development. These include The Grand in Downtown Los Angeles, a public and private partnership designed by Frank Gehry that will integrate residential, retail, commercial and cultural elements including an already-completed 12-acre public park, residential tower and The Broad contemporary art museum. The company also has three large mixed-income developments totaling 1,300 residential units currently under construction in San Francisco.

“The key to California’s immediate future is providing housing for all income levels,” Witte said via a company publicist. “This and developing projects that transform neighborhoods and communities are what motivates me and our team.”—L.G.

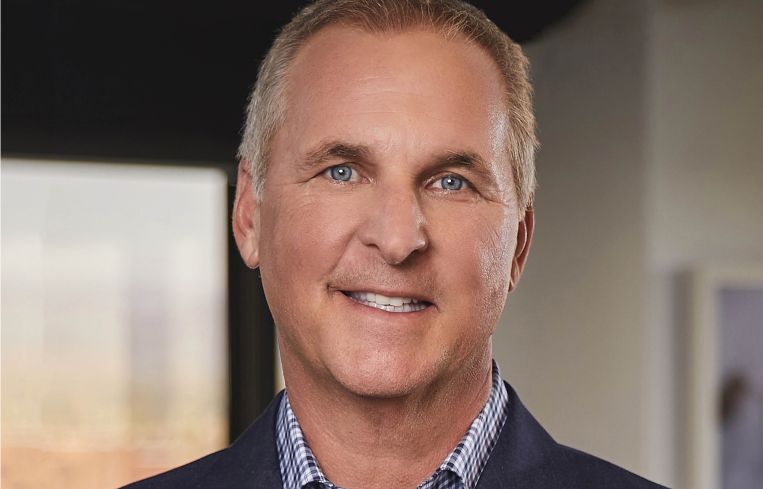

Mike Kuntz

Executive Vice President, Turner Construction Company

Mike Kuntz is the senior leader for the Southwest, Northern California and Northwest regions of construction powerhouse Turner Construction Company.

The New York-based company, with a staff of nearly 6,000, completes on average $12 billion of construction on 1,500 projects each year; Kuntz is the senior leader for work in California, Washington, Oregon, Arizona and Nevada. Among the projects underway in this region are the new headquarters for California Department of Natural Resources in Sacramento; the new L.A. Stadium in Inglewood; the Midfield Satellite Concourse at Los Angeles World Airports; and the expansion of the Las Vegas Convention Center.

“We’re experiencing the benefit of what is now and continues to be an incredibly robust market across multiple sectors,” Kuntz said.

“Two years ago we finished Wilshire Grand in Downtown Los Angeles,” he added. “Within a five-mile area, we have almost $5 billion worth of work on projects under construction—between the new L.A. Rams/Chargers stadium and the Midfield Concourse project at Los Angeles World Airport—it’s pretty vibrant. What keeps me up at night is trying to figure out how to build more billion-dollar projects all at one time.”

Kuntz said he’s most excited about the Manchester Gateway Project in San Diego, across from the Midway ship. The 13.5-acre project, costing $1.5 billion, will include a mixed-use space with a 250-key hotel and another 1,000-key hotel, and a rebuild of the U.S. Navy offices. Phase 1, the office is slated for completion in 18 months.—R.S.

HONORABLE MENTION

Elon Musk

Co-founder and CEO, Tesla Motors and SpaceX; Founder and CEO, Boring Company

Technology billionaire Elon Musk is known for electric vehicles, rockets, being a guest voice on The Simpsons and publicly smoking pot with Joe Rogan.

But the biggest news (and what catapults him into honorary mention territory) is that in Hawthorne, Calif., Boring will unveil the long-anticipated 2.7-mile-long ultra-high-speed test tunnel—primarily for pedestrians and cyclists—on Dec. 10, per a Tweet from Musk. Something which should have a, let’s say, minor effect on real estate.

“The initial test tunnel…is being used for the research and development of the Boring Company’s tunneling and public transportation systems,” according to the company’s website, which says the tunnel runs from SpaceX’s parking lot east of Crenshaw Boulevard and south of 120th Street, turns west under 120th Street and remains underground at 120th Street for up to two miles.

He is also working on a 10-mile tunnel in Maryland, and a high-speed train from Chicago’s O’Hare International Airport to downtown.

Of course, all is not running smoothly for Musk.

By the middle of this month, he will have to relinquish the chairmanship of Tesla, as part of a September agreement with the Securities and Exchange Commission.

In addition to stepping down as chairman for three years, Musk and Tesla each are required to pay $20 million. Still the company posted a record profit for the third quarter, per WSJ.—L.E.S.