Private Equity Dominated CRE Investment in LA Last Year: CBRE

By Rey Mashayekhi May 7, 2018 11:12 am

reprints

Led by a flood of private equity dollars, Los Angeles leaped ahead of Manhattan to become the number-one destination in the U.S. for institutional capital investment in real estate in 2017, according to a recent report from CBRE.

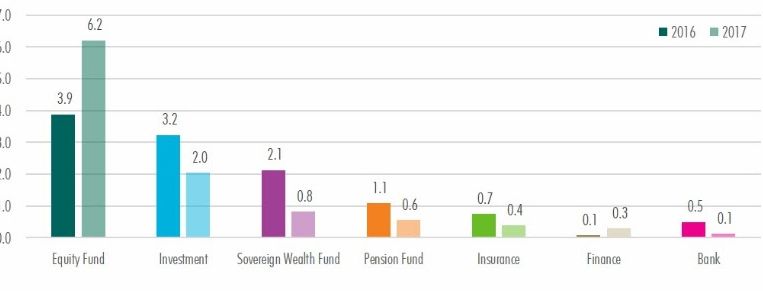

Private equity drove real estate investment in Los Angeles County last year, pouring $6.2 billion into the area’s commercial real estate market—up nearly 60 percent from $3.9 billion in 2016, according to data from Real Capital Analytics cited by CBRE.

Equity funds dominated market share in L.A. in 2017, accounting for roughly two-thirds (66.4 percent) of all commercial real estate acquisitions compared with only 27.6 percent in the previous year, CBRE said. In turn, capital outlays from investment managers, sovereign wealth funds, pension funds, insurance companies and banks all declined year-on-year in 2017.

With private equity investors typically willing to take on riskier investments in the hope of maximizing their returns, equity funds ramped up their exposure to “value-add acquisitions” in the L.A. real estate market while most other types of investors exercised “late-cycle caution,” the brokerage added.

Though foreign capital continued to have “a significant presence” in the L.A. market in 2017—comprising for 20 percent of all institutional investment—total foreign investment fell by roughly 50 percent from the previous year after seven consecutive years of growth, CBRE said. Sovereign wealth fund investment, in particular, dropped to around $800 million from approximately $2.1 billion in 2016.

The brokerage refused to attribute that decline to “government capital controls restricting outflows from China,” noting that China “represents a relatively small segment of foreign institutional capital in Los Angeles” and that foreign investors were exercising the same caution seen from most types of non-private equity investors.

Qatar assumed the highest share of foreign investment dollar volume in L.A. last year with more than $500 million spent, according to Real Capital Analytics data, followed by Singapore, South Korea, Canada and the Netherlands. China came in eighth, with more than $100 million.