NYC Sales Posting Highest Volume in Six Quarters

With nearly $8.9 billion in sales volume last quarter, Manhattan posted the highest quarterly total since the second quarter of 2016

By Richard Persichetti May 10, 2018 5:37 pm

reprints

The New York City investment sales market demonstrated some signs of life in the first quarter by posting the highest dollar volume in six quarters with more than $12.4 billion was traded. This equates to a 38.5 percent increase compared to the quarterly average of $9 billion throughout 2017. Although the increase in volume is a positive, the number of properties traded during the first quarter was the lowest total since the first quarter of 2013 with 832 properties sold. The number of properties sold is down 9.1 percent from a quarterly average of 915 sales in 2017 but still down substantially—39.9 percent—from the quarterly average at the height of the market in 2014.

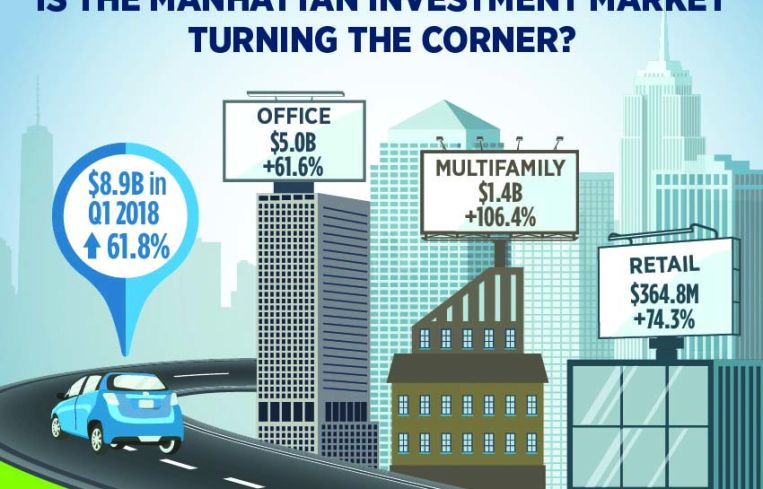

The Manhattan investment sales market pushed first quarter New York City totals upward as 71.6 percent of the dollar volume was invested in this borough. With nearly $8.9 billion in sales volume during the first quarter, Manhattan posted the highest quarterly total since the second quarter of 2016 and 61.8 percent above the 2017 quarterly average of $5.5 billion. Similar to the citywide trend of a limited number of properties sold, only 147 traded in the first quarter in Manhattan. This marked the lowest quarterly total since the first quarter of 2011 but was not far off from the 2017 quarterly average of 154 properties sold.

The office sector accounted for 56 percent of Manhattan’s dollar volume with $5 billion traded and was up 61.6 percent from the 2017 quarterly average. This was bolstered by Google’s purchase of Chelsea Market for nearly $2.4 billion, which accounted for 48.2 percent of the office investment dollar volume. But it was not just the office sector that recorded upticks in dollar volume, as multifamily investment sales more than doubled the 2017 quarterly average of $656.4 million with more than $1.4 billion traded. Even retail investments had a strong first quarter, 23 transactions completed, marking the highest total since the first quarter of 2015 and nearly double the quarterly average of 12 sales over the past two years. Total dollar volume for retail was up 74.3 percent compared to the quarterly average in 2017 with $364.8 million traded.

With a robust pipeline of transactions either closed or expected to close in the second quarter of 2018, anticipate activity to maintain this throughout the year.