How Much Is Manhattan Worth?

A pair of researchers show how the island's land values have evolved since 1950

By Matt Grossman March 14, 2018 12:00 pm

reprints

When jazz bandleader Charles Mingus’ slinky tune “51st Street Blues” appeared in 1957, the land value of the Manhattan that inspired him had more or less held steady since just after World War II. In fact, it had declined a hair, in real terms, since 1950.

Back then, the island’s asset prices basically just tracked inflation over the long term—as real estate prices around the world typically did, pretty much since anyone started keeping records.

But like a languid tune that suddenly switches into double time, all that was about to change.

By 1973, when Bobby Womack paid musical tribute to Manhattan’s grid with his song “Across 110th Street,” land values had climbed, in real terms, about 55 percent over the 16 intervening years.

And by the time the Beastie Boys brought things back Downtown with their 2007 song “14th Street Break,” the price of a plot of Manhattan ground had climbed more sharply than any skyscraper. Even adjusting for inflation, land values in that year just before the financial crisis were up a whopping 3,500 percent from their 1950 levels.

Music, indeed, to the ears of anyone who’d had the foresight to buy and hold all those decades earlier.

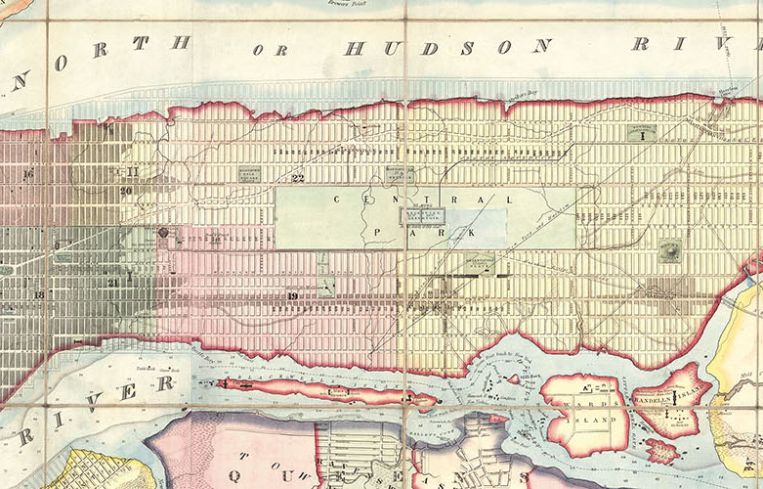

In the week-in, week-out frenzy of condominium buildings bought and office towers sold, it’s easy to lose sight of how much value the bedrock of Manhattan’s real estate industry contributes. That’d be the literal bedrock under the streets—the Manhattan schist itself. Far more than glass-curtained skyscrapers or amenity-laden apartments, it’s Manhattan’s fixed—hence scarce—supply of actual land, all 22.8 square miles of it, that has been the city’s evergreen engine of appreciation since the middle of the 20th century.

That, at least, is the conclusion of a painstaking new study by Jason Barr, an economics professor at Rutgers University–Newark, whose chance discovery of an exhaustive trove of property records in a library led him to pore over every example of a sale of vacant land on Manhattan since 1950. In all, he and his co-author, professor Fred Smith of North Carolina’s Davidson College, amassed data for nearly 3,600 transactions spanning almost 70 years, allowing them to create a year-by-year, inflation-adjusted index of Manhattan land prices.

Even taking all buildings and structures out of the picture and withholding 40 percent of the island’s acreage for streets, parks and piers, the new index values the island as high as $1.9 trillion today. That’s roughly 10 percent of U.S. gross domestic product—or more than twice as much as the net worth of the world’s 10 richest people combined.

The broad strokes of the land-value index—constructed from the raw data—line up well with any longtime New Yorker’s intuition for the city’s good years and bad. Relatively flat between 1950 and 1970, the index falls sharply during the U.S. recession that began in 1973, reaching a historic low in 1977. That year, land was less than half as pricey, in real terms, as it was at the middle of the century.

But then, a pair of meteoric rises from 1983 to 1988 and from 1993 until 2007 ensued to bring the property markets to unimaginably dizzying heights. So sharp was the rise that any meaningful chart of the index must be plotted logarithmically, giving equal scale to the difference between 10 and 100 and the difference between 100 and 1,000.

Plotted normally, the rise in land values starting in about 1990 is so sharp that it would look like a straight line up.

Even so, the relatively flat period from the 1950s to the 1970s, and the precipitous drop at the end of that decade, translate into only modest long-term yield on property in the city.

“The long-run value of Manhattan from 1950 to the present has a relatively moderate return on investment,” Barr said. All together, the researchers estimate returns over their 65-year time horizon at about 5.5 percent annually, a figure Barr compared to typical returns on some stocks or corporate bonds. “Only in the last 20 years has the value of land itself been super high—much higher than other kinds of investments.”

In studying only vacant land sales, the economists aimed to strip away the varying values that buyers place on fixtures, design elements and other accessories that differ widely from use to use and building to building.

“[The sale of a] $100 million condo doesn’t tell you all that much, because these apartments are filled with luxury goods: the highest-end kitchens with marble counters,” Barr said. “So how much of that $100 million is going to the building itself? You want to remove all those other things and just understand, What is the value of the location?”

That way of thinking accords with how appraisers who work on real estate sales see the main drivers of value.

“When you look at price appreciation, it’s the land that’s appreciating—not the property,” said Jonathan Miller, an appraiser whose firm Miller Samuel has been providing New York City valuations since 1986. “Land is what the real estate actually is. The building on top of it is just the improvement that goes with it.”

Of course, limiting the study to sales of vacant land ensured that some neighborhoods were overrepresented in the researchers’ data. A map of the sites they studied shows that since 1950, hundreds and hundreds of empty lots have changed hands in places like Harlem, Hell’s Kitchen and the Lower East Side. On the other hand, only a few dozen vacant land sales occurred on the west side of Manhattan between West 59th and West 96th Streets during that period, and just a smattering more took place on the Upper East Side.

To make sure the index wasn’t biased by those neighborhoods that were overweighted in particular years, Barr and Smith controlled for location by referring to which sanitation district each lot lies in. (Sanitation districts are an administrative division about the size of a large neighborhood.) Their model also controls for each lot’s distance to Broadway, finding that proximity to the artery yields sales with significantly higher prices per square foot.

That premium that accrues to land in prime locations derives directly from the perpetual upper bound to Manhattan’s geography. In a real estate market with dimensions as firmly fixed as Manhattan’s, scarcity is a determining force in the market. With the notable exception of Battery Park City—the planned community that juts into the Hudson River on landfill created in the early 1970s from the ground excavated for the World Trade Center—the island cannot simply grow to accommodate rising demand.

Barr, who has previously extensively studied the economics of skyscrapers, said that’s the force that has shifted so much development onto the vertical axis.

“There’s a substitute for land: building up,” Barr said. “Because you’re not seeing the supply of geography match the demand for geography.”

The paper, published in the journal Regional Science and Urban Economics, is silent on questions of how accelerating values over the last 35 years have affected Manhattan’s development. But other experts aver that real estate trends have been central in shaping the island as it exists today.

Richard Ocejo, a professor of sociology at John Jay College of Criminal Justice who has studied the changing face of the Lower East Side, said he believes that the same scarcity that drives skyscraper construction and asset-price growth has always played a determining role in the stories of those who make their lives as city residents.

“That’s the big reality of Manhattan: the finite space,” Ocejo said. “It’s an island—it’s not very good at growing out. And in any kind of urban environment…people compete over and try to co-exist in a limited amount of space.”

His interviews with longtime denizens of the East Village revealed that, for residents, a sense of ownership isn’t a simple matter of land values and property rights.

During the 1970s, when the neighborhood was an area of blight and poverty, residents “rehabbed spaced and lots,” participating in a larger movement to create community gardens, Ocejo said. “Or they’d set up some kind of block association. It became a place of great meaning to them, and [one they] felt like they owned. You don’t own the bricks, but there’s something within the soul, within the bricks that is yours.”

But when land prices rose in the 1990s as the city sold off vacant lots to developers and the neighborhood gentrified, neighborhood renters were forced to confront the gulf between their sense of investment in the area and their lack of legal ownership.

“When they saw things start to change, newcomers, new businesses, a new reputation, a new character, they felt like they were losing it, that it was being taken from them,” the sociologist said. “In some cases, it was that they plowed over your building.”

Of course, that kind of eye-watering change has always been a constant in real estate. As values in the city tanked in the 1970s, waves of youngish baby boomers—able to afford far choicer Manhattan real estate than they could have during a bull market—flooded in, boosting prices and even rewriting residential ownership structures.

“The [prices] really surge from the 70s to the 80s,” said Miller, the longtime appraiser. “It was the conversion frenzy, where landlords were able to cash out by converting apartments to co-ops. There were far more units that came into market in the 80s.”

Glad to see a brisk trade, building owners offered steep discounts to whomever happened to be living in the building at the time.

“As you move later into the 1980s and get to the 1990s, sponsors were raising the insider prices relative to the market value [for co-ops],” Miller said. “But in 1984, your insider [discount] might have been 30 to 50 cents on the dollar. By the end of the decade, it might have been 10 percent.”

New York City’s buoyant success since those years has spawned its share of problems of course—overcrowding, for example, and a seemingly intractable shortage of affordable housing. But even Ocejo, whose has extensively interviewed gentrification’s losers, is loathe to sugarcoat what life in the city was like during the financially stagnant 1970s.

“I think it is romanticized a lot,” Ocejo said. “There’s always a context involved in how any culture gets done, and the context in this case was severe devastation, poverty and blight. There were a lot of people who were struggling and suffering down the street from where those folks were having parties” on the Lower East Side.

But that’s not to say that today’s Manhattan—with its cleaner, safer streets and thriving property market valued at record-high levels—hasn’t lost its intangible spark along the way.

“You can’t be creative in Manhattan like that anymore. It’s too expensive—you have to go someplace else,” Ocejo said. “Certain kinds of art and creativity need certain conditions to thrive.”

And even as property values shape the city’s culture and politics, politics has a key role in shaping property values as well.

New York City’s 1916 zoning rule—the first law of its kind in the United States—sought to ensure that air and light would filter down to street level with provisions that shaped the design of early century skyscrapers built with setbacks like a wedding cake. Even so, the law imposed few restrictions on residential density.

“It was so capacious,” said Nicholas Bloom, a professor of social science at the New York Institute of Technology. If all five of the city’s boroughs had fully developed under that plan’s guidelines, the Big Apple could have accommodated a population as large as 50 million. “But in the early 1960s, they revised the code significantly, [saying] ‘We’re not going to build Manhattan density over all the boroughs.’ That’s a political decision.”

The lower-density zoning that supplanted the earlier model, Barr said, has been a crucial ingredient in fueling blistering property value growth.

“Incredibly high returns to land remain a strong possibility because the policies are designed to slow down neighborhood transformation,” the economist explained.

That means that an island appreciating far faster than inflation shows no signs of letting up.

“There are new sources of demand for Manhattan land,” Barr said, citing international investors and the families of city college students whose moneyed parents buy condos for them to live in. “If the supply is not matching demand, the price is just going higher and higher.”

Perhaps a little like Sly and the Family Stone’s 1969, “I Want to Take You Higher.”

FiDi

Though it’s been New York City’s financial hub for centuries, the Financial District has served more recently as a proving ground for a few bold experiments that have transformed valuations for residential lots in Manhattan. On the supply side, there’s Battery Park City: built on landfill excavated for construction of the World Trade Center, it’s the exception that proves the rule that Manhattan island cannot simply expand to accommodate more development. More recently, in the years since 9/11, the neighborhood has been a sandbox for developers who have experimented with integrating lavish amenities like screening rooms and swimming pools into condominium buildings.Central Park

What’s the value of the land underlying an 850-acre park in the heart of New York City’s indispensable borough? A back-of-the-envelope valuation of Manhattan, by professor Jason Barr at Rutgers University—Newark didn’t posit a guess, but it did assume that 40 percent of the island was given over to public uses like streets and parks. Extrapolating from average price per acre, his $1.9 trillion valuation of Manhattan would price the 160-year-old park at north of $187 billion—and that’s not even accounting for its prime location in the very heart of the island. Still, appraisers point out that though its value remains in public hands, the park confers immense private benefit to the owners who control the land close to its borders.The Lower East Side

Perhaps no Manhattan neighborhood has transformed as quickly—or as divisively—as the Lower East Side. As Manhattan’s 1980s and 90s resurgence banished the blight that had tarnished the area for decades, land prices rose dramatically as landlords swarmed to bring in tonier lessees, both for apartments and for retail spaces that now host a cornucopia of restaurants and bars. But the rising tide east of the Bowery hasn’t lifted all boats. The neighborhood “is probably 80 percent rental,” said Richard Ocejo, a sociologist who has studied the area. “Those people are not going to directly benefit financially from gentrification.”The Upper East Side

Valuating the Upper East Side presented a challenge to the researchers studying land values, because so few vacant lots have changed hands in the well-established residential enclave over the last 70 years. Since last year, however, the neighborhood’s Yorkville section—north of East 79th Street and east of Third Avenue—has been a case study in how public policy dovetails with lot values. The long-awaited Second Avenue subway, which opened on New Year’s Day 2017, has transformed commutes for area residents, and developers have responded by planning a clutch of high-end residential high-rises as close as they can get to the line’s three new stations.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)