Starbucks and Simon Reach Agreement in Teavana Store Closure Dispute

By Lauren Elkies Schram January 18, 2018 11:45 pm

reprints

Coffee giant Starbucks Coffee and mall owner Simon Property Group have reached an agreement over the shuttering of 77 failing Teavana stores in Simon malls nationwide.

“We’ve reached an agreement with Simon to settle our dispute,” a Starbucks spokeswoman said in an email to Commercial Observer. “We are thankful to our customers who have enjoyed Teavana tea at these specialty retail locations and will continue to emphasize Teavana tea in new and different ways at Starbucks.”

While the spokeswoman didn’t respond to further inquiries about the agreement, a source said it includes Starbucks moving forward with closing the 77 stores.

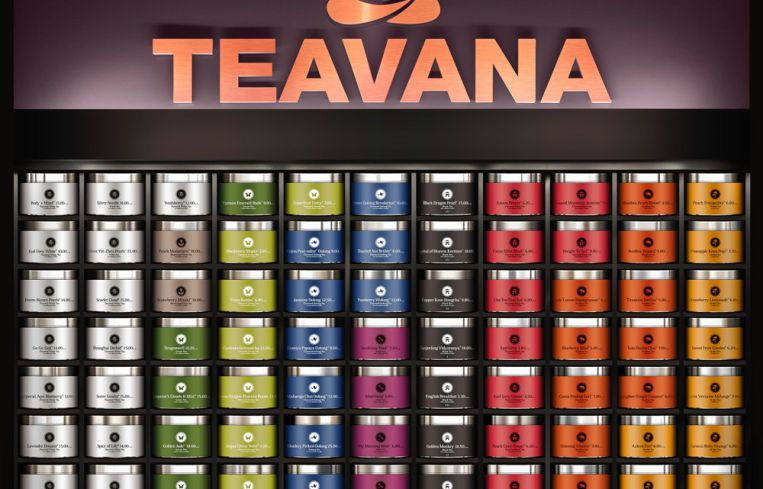

Seattle-headquartered Starbucks, which acquired Teavana on Jan. 1, 2013, for $620 million, decided in the beginning of 2016 to abandon its Teavana tea bar concept, including the three New York City locations, by the end of that April, as CO reported at the time.

Last June, Starbucks announced that it would be closing the entire 379-unit Teavana operation, as CO previously reported, after reporting lagging sales at the tea stores. (The final two New York City Teavana stores—at 1291 Lexington Avenue between East 86th and East 87th Streets and 2261 Broadway at West 81st Street—are slated to close this weekend, the source said.)

In August 2017, Indianapolis-based Simon sued to stop the coffee retailer from shuttering the 77 stores at its properties in 26 states, claiming it would have a negative domino effect with other mall tenants. This past November, an Indiana judge sided with Simon, and temporarily barred Starbucks from closing the locations, saying that Starbucks would be better equipped to handle the $15 million financial hit than the mall owner.

On Dec. 19, 2017, in an unusual move, the Indiana Supreme Court accepted Starbucks’ appeal in the case, bypassing the state’s Court of Appeals. Since then, the two sides have come to an agreement.

At a time when malls and retailers have been getting their sea legs, this case has been under the microscope for how it could impact co-tenancy rights in future leases.

“The litigation is going to have a ripple effect,” attorney Joshua Stein, who isn’t involved in the case, said in an email. “Property owners are now going to feel emboldened to ask for this sort of injunctive relief. Traditionally no one thought it was realistically available, but maybe now it is. So landlords are going to come up with some creative new language to put in their leases to try to persuade future courts to issue similar injunctions again in future disputes. And major tenants are going to try to come up with other language going the other way. That’s an example of why leases only get longer and more complicated, never shorter.”