Mall Developers Bet on the Basics—and a Trampoline or Two

Will new—and old—approaches help last century’s retail model thrive today?

By Alison Stateman January 10, 2018 9:00 am

reprints

The death of the American mall has been a topic discussed ad nauseam. Whether through overdevelopment, the rise of Amazon or the financial woes of traditional anchor tenants like Macy’s and Sears, brick-and-mortar retail—and the mall meccas that house them—have had their obituaries posted for the last year, or more.

Yet, in seeming defiance of the mournful headlines, private investors, with the funds and ability to reinvent struggling properties, are buying into the regional mall model that has defined the U.S. retail landscape since its creation in the mid-1950s by Victor Gruen.

Way back when, Gruen, the Austrian-born architect created the nation’s first grand shopping center, the 800,000-square-foot Southdale Center in Edina, Minn., in 1956 and still operates as the oldest, fully enclosed shopping mall in the United States. He was inspired by the town center of Vienna where he was born. He envisioned a communal gathering spot with a lively mix of commerce, art and entertainment. A socialist who hated cars, Gruen designed the development with long promenades and parking lots built far away to encourage walking. Gruen also envisioned a property with medical centers, schools and residences, not just an array of retail.

He wasn’t alone. Matthew Bucksbaum and his brothers, Maurice and Martin, the founders of what would become General Growth Properties, bought a struggling shopping center in Cedar Rapids, Iowa, around the same time and went on to expand to many small cities throughout the Midwest.

The model was widely embraced, and the rest is history. Today, there are an estimated 1,200 malls nationwide, primarily in suburban areas, inspired by Gruen’s conception—one he grew to despise. They didn’t bring about the vibrant urban centers Gruen envisioned; they led more to the rise of American car culture, suburban sprawl and the decline of walkable downtowns.

Is it any wonder then that the American mall—a concept dreamed up and later cursed by its own creator—would continue to stir debate and contradictory ideas about how to run, refashion or completely reinvent them?

Too Much of a Good Thing

“You know, the big question is, How many malls does the country need?”

This is the question asked by Thomas Dobrowski, the executive managing director at Newmark Knight Frank in New York, who handles regional mall investment sales nationally.

“Does it need 500? Does it need 800? There’s no question that the U.S. is over-retailed, and it’s really the regional malls that have been overbuilt. There are just too many, especially with people shopping more and more online and with people looking for more experiential experiences.”

Pete Bethea, an executive managing director at NKF, concurred.

“Some of these centers that are in secondary and tertiary markets were just overbuilt with retail. So, instead of there being three viable centers, there might be one,” said Bethea, who is based in NKF’s San Diego office and focuses mainly on open-air suburban mall property sales. “What happens with those other two centers [depends on what] the market lends itself to, right? What is the next evolution of use of that space or that land?”

As mall real estate investment trusts (REITs) have been shedding their B- or C-level malls or noncore assets over the last five years, private equity investors have stepped up to purchase them.

“Contrary to all the news out there, there have been a lot of transactions happening in the enclosed mall space,” Dobrowski said. “Some of the malls we’re selling are almost exclusively to private equity or high-net-worth buyers who don’t have the same scrutiny that an institutional or typical mall REIT would have when it comes to repositioning or redeveloping these malls by bringing in alternative uses.”

Dobrowski said that a lot of the malls he sells are purchased to continue as malls with about one-third bought to be redeveloped.

He pointed to the Moreno Valley Mall in San Bernardino County outside of Los Angeles, which was previously owned by GGP before the company filed for bankruptcy in 2009 in one of the largest commercial real estate collapses in U.S. history, as a prime example of a mall turnaround.

NKF sold the property on behalf of CW Capital, which had bought it back from GGP, for $63 million in November 2017 to International Growth Properties, a small private equity firm in Beverly Hills.

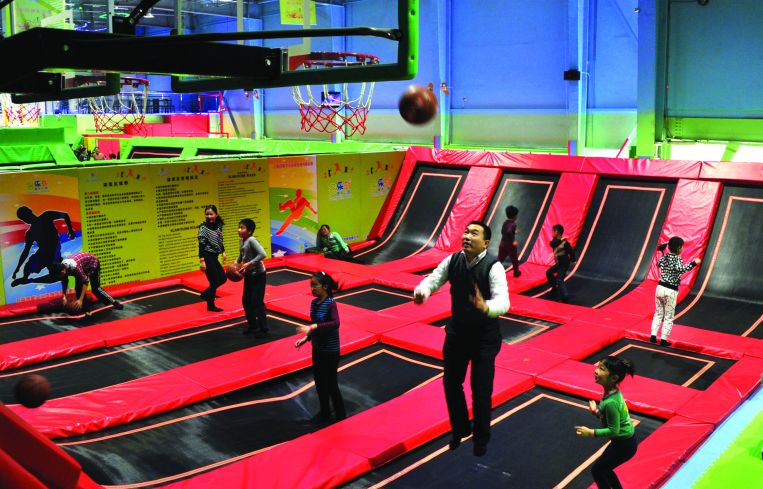

CW Capital brought in a gym, Crunch Fitness—in a move most mall operators previously shunned, according to The Wall Street Journal—Round1 Bowling and Amusement, Action Time Bungee Jumping (a trampoline park) in addition to movie theaters and anchor tenants like Macy’s already on the premises.

“They really transitioned this mall from a kind of cookie-cutter enclosed mall with your traditional anchor tenants into a shining star of a lot of the malls that we sold this year,” Dobrowski said.

He and Bethea expect the trend to continue given market conditions.

“Pricing now is at a level where it makes sense to purchase a property and then go reinvest and reposition it,” Bethea said. “We’re in the early innings of that starting to happen. There are double-digit cap rates. Certainly, in the world of suburbia, we are starting to approach the 8 or 9 [percent cap rate] in submarkets.”

Dobrowski said the trend will likely accelerate in the next 12 to 24 months, depending on the state of major retailers.

“Last year was a big year in terms of stores closing and bankruptcies, and 2018 will probably be another big year,” he said. “But to redevelop a mall takes a long time. It’s a two- to five-year process, so we’re really just in the early phase of malls being purchased to eventually be redeveloped.” (For more from Dobrowski, see the Sit-Down on page 32.)

Adapt or Perish

IGP’s strategy of incorporating something like a trampoline park is exactly what the mall redevelopers are looking for to attract consumers to their properties, from families to millennials. Some are going even further. The long-stalled American Dream Mall in Northern New Jersey is back in business with construction resumed and developer Triple Five Group targeting a fall 2018 opening. The 6-million-square-foot property at the Meadowlands sports complex will feature the country’s first indoor ski slope, an aquarium, an indoor water park with a 1.5-acre pool capable of generating seven-foot waves and the largest indoor theme park in the Western Hemisphere with four roller coasters.

Triple Five, the Canadian company that already owns the two largest malls in the Western Hemisphere, the Mall of America in Minnesota and the West Edmonton Mall in Canada, is obviously betting big on the megaproject despite the pessimism surrounding traditional brick-and-mortar enterprises of which the shopping mall is emblematic. According to The New York Times, the developer has spent $700 million thus far on the project.

Ami Ziff, the director of national retail at Time Equities, is in the process of adding amenities to reinvigorate a few of its regional mall properties, including the Newgate Mall in Ogden, Utah, for $69.5 million in August 2016 from GGP, as CO previously reported and two malls in Tennessee purchased from Chattanooga, Tenn.-based CBL & Associates Properties for $53.5 million last May.

In addition to adding a Fly High Trampoline Park, which will occupy 41,000 square feet at the Newgate Mall, Time Equities is looking to add amenities that can meet the human’s need to socialize and appeal to social media and Instagram-addicted consumers.

There are plans for flash mobs as a special event, as well as immersive experiences, including a bubble and ball exhibit like the one the company has at its residential condominium at 50 West Street in Manhattan.

At Newgate, Time Equities will be renovating the food court area with the addition of a fireplace and common-area seating meant to evoke a ski lodge with seasonal and community programming—think caroling and hot chocolate around the fire during the winter holidays, s’mores and ghost stories come Halloween.

“There is such a difference in the kind of work that goes into owning a mall versus a strip center,” Ziff said. “You might have a lot of the same tenants, but the fact that you have this common space, there’s a significant burden on the landlord as well as the tenants to produce experiences. There needs to be a whole marketing agenda and program that we roll out at different malls based on different needs, timing and markets.”

Alternative Uses

In addition to off-the-hook amenities, mall developers have turned to creating truly mixed-use properties, including creative office space, residential, grocery and, at some, alternative uses like medical facilities, thereby creating in effect the one-stop community center Gruen once envisioned.

“The same Baby Boom population that fueled regional malls and other retail property types in the 1950s, ’60s and ’70s continues to do so,” said Mark Hunter, the managing director of retail asset services for the Americas at CBRE based in Chicago. “We’re now seeing Baby Boomers [are] now requiring additional medical services and [how they’re being integrated]. A perfect example of that is the 100 Oaks Mall in Nashville, Tenn.”

In 2007 100 Oaks Plaza, which bought the property the previous year for $49.2 million, redeveloped one of its department stores into a medical center for The Vanderbilt University Medical Center, which leases over half of the 850,000-square-foot building. “I think you’re going to continue to see this trend where there’s a mix of medical, office, entertainment and residential as different markets adapt to the changing environment,” Hunter said.

Data centers could also fill in space left by struggling retailers, given the rise in cloud storage needs, pointing to how Rackspace, a web-hosting company based in San Antonio, moved its corporate headquarters into the local now-shuttered Windsor Park Mall in 2012.

Then there is a model that turns the whole American mall discussion on its head. Billed as a “solution to the retail conundrum,” Case Equity Partners introduced a patent-pending concept called the Shopping Fulfillment Center last month. The SFC, a hybrid of brick and click, combines a vast fulfillment center in the back of a retail center component. In the proposed model, retailers would share logistics costs and require much less in terms of traditional square footage. It would allow customers to peruse or test out their products, but instead of, say, having to stock several varieties of a high-touch item like a sweater, one would suffice with a vast array of options housed in a communal warehouse in back. (For more on the concept, see Chopp’s column on page 35.)

Omnichannel and Co-Existence

Arthur Coppolla, the chairman and CEO of Macerich, one of the country’s leading owners of high-end mall REITs, is bullish about the future of brick-and-mortar retail.

“If you read the social media and the news media, you would come to the conclusion that Amazon and e-commerce are killing all legacy retailers, but I see digital as being the best of friends with brick-and-mortar retail,” Coppolla said during a keynote talk at “Rethink: Emerging Macro Trends in Real Estate” in Los Angeles this past December. (Coppolla declined to be interviewed for this article.)

Coppolla said the common misperception among investors is that Amazon is synonymous with e-commerce “and that there’s nothing else, which is not true.”

Digitally made, vertically integrated brands—brands that have a niche and identified a broad market to disrupt and are not Amazon—are where it’s at in terms of the next great brands.

“Digitally native is a very chic place to be born,” he said. “Digital brands are growing at a far greater rate than e-commerce itself. If you look at the next [few] years between now and 2020, the digitally native brands are going to be generating as much business as Amazon direct.”

If you want a glimpse into the future of traditional retail, he said, just look to its past.

“The future of retail is its past,” Coppolla said. “If you look at legacy retailers, department stores were everything. They distinguished themselves in how they curated brands for their customers. But they cut sales people on their floors and lost touch with their customers. We have to be curators of brands like how department stores used to be.”

Successful malls need to take over where legacy retailers faltered and curate brands. E-commerce, he said, is the driver of brand creation today, and as such, he is actively seeking digitally native brands to his properties and the feeling among these brands is mutual.

“These digitally native brands, they all believe that brick and mortar is where they want to go because, when they open their store, that’s when they feel that they have arrived. It’s the last mile for them in terms of having a relationship with their customer,” Coppolla said.

Not only can e-commerce and brick and mortar co-exist, but according to Hunter at CBRE, the perception that online selling eclipsed traditional retail is much overblown.

“When you really delve into where most retail sales are happening today, as of last year, 9 percent of all retail sales were online, meaning 91 percent of all other retail sales were done in a physical space,” he said. “Our research shows that peaking in the next, call it, eight to 10 years in the high teens. Still, the bulk of retail sales will be done in physical space.”

The more important point, he said, is that, to thrive, retailers must be adept at omnichannel distribution.

“Whether you’re on your smartphone, or you’re in the store, it’s going to be a much more seamless transaction. You’re going to continue to see that happen, and the retailers that can adapt to the omnichannel distribution, they’re going to be very successful,” he said. “Those behind the times, that don’t adapt to that, will struggle more.”