Amidst Flourishing CMBS Results, Single-Tenant Properties Could Raise Concerns

By Matt Grossman November 9, 2017 3:42 pm

reprints

Smart investors have long seen diversification as a central tenet of revenue management. But in the niche realm of commercial mortgage-backed securities, that virtue seems to be growing just a bit less universal.

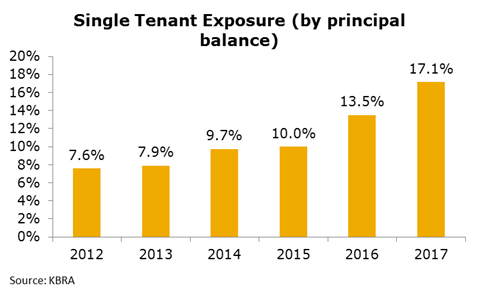

A new report released by Kroll Bond Rating Agency this week notes that over the last five years, an increasing number of loans securitized into CMBS deals are backed by properties that host just a single tenant. In 2012, less than a tenth of CMBS debt was backed by loans on single-tenant properties. But that number has climbed steadily in the years since, rising to over 17 percent for the first nine months of 2017.

That lack of revenue diversity translates to higher risk, because the property’s entire income stream is concentrated in the performance of just a single company. Even so, the authors of the KBRA report aren’t unduly concerned, noting that a significant portion of those single tenants are especially creditworthy renters.

“Seventy percent of single-tenant exposure is in office,” Larry Kay, a senior director at KBRA, told Commercial Observer. “That has been driven by technology companies such as Apple, Amazon and Google. One good thing that we’ve noticed is that even though we have single-tenant exposure, over 50 percent of the single tenants are high-quality, creditworthy tenants.”

Even so, Keith Kockenmeister, a KBRA managing director, reiterated that single tenancy can put significant pressure on landlords around the end of lease terms. He noted that a significant chunk of the single-tenant properties backing CMBS deals have leases that expire prior to the transactions’ maturity: “about a third, or 31 percent,” he said. “That could be an issue.”

On the whole, he noted, the trend hasn’t deterred investors in the least. In October, according to KBRA, prices on AAA-rated CMBS tranches fell to an average of 85 basis points on a swaps basis, down eight percent from September. Kay said he believes that the securities buyers’ appetite for CMBS paper may also be influenced by the risk retention rules that went into effect.

“Investors may be attracted to CMBS paper as interests now appear to be more aligned between investors and the issuer base as to long-term performance,” Kay said.

Risk retention rules require the banks that package CMBS transactions to keep a portion of the tranches on their balance sheets, incentivizing them to build less risky financial products.

That, in turn, could encourage investors to buy tranches with a smaller risk premium.

“From [investors’] perspective, they’re probably happy,” about the regulatory regime, Kay said.

That sentiment appears to be contributing to a healthy market. Through October, $71.2 billion in private-label CMBS has come to market this year, already topping the full-year total of $69.2 billion for 2016.

“Rates are still relatively low. Real estate fundamentals are strong. All those together have created a good environment for CMBS,” Kockenmeister said, noting that one area of concern for the firm was the performance of suburban office properties.

“In our travels, we’ve seen [concerns] in markets like Chicago, where a move from the suburbs into Chicago could be a function of millennials’ wanting to be in cities,” Kockenmeister said. “That’s a trend that’s not only impacting Chicago but nationwide.”