Stat of the Week: 8.4 Percent

By Richard Persichetti February 20, 2017 8:57 pm

reprints

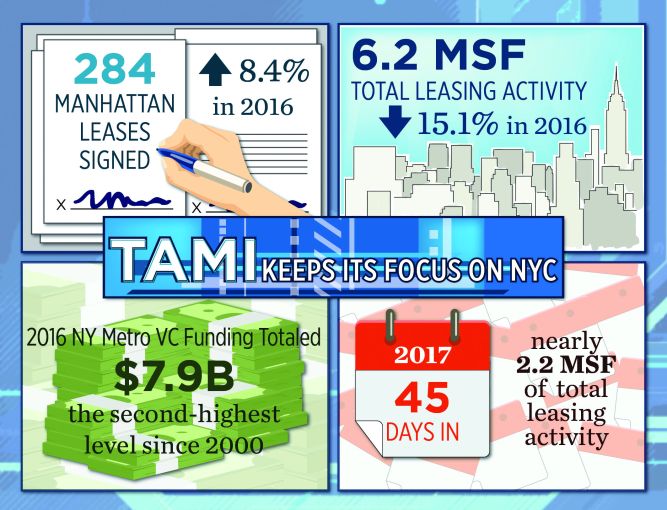

Once again, the TAMI (technology, advertising, media and information services) sector was the dominant industry group for total leasing demand in Manhattan during 2016. Although it reclaimed the top spot after falling behind the financial sector in 2015, TAMI total leasing activity actually had a 15.1 percent year-over-year decline with only 6.2 million square feet leased. Despite the drop in leasing volume, the 284 TAMI leases signed resulted in an increase of 8.4 percent in 2016. With more leases signed for less square feet, the average lease size dropped to 21,708 square feet in 2016, 21.7 percent down from 2015. This can mostly be attributed to leases less than 20,000 square feet accounting for 75 percent of all TAMI leases signed.

Midtown had the largest decline in total TAMI activity with only 3.3 million square feet leased in 2016, a 27.3 percent year-over-year decrease, despite 140 leases signed—15 above 2015’s total. Midtown South total leasing volume was down from 2015 as well but only by a mere 5,893 square feet with 1.8 million square feet leased. Similar to Midtown, there were more TAMI leases in 2016, as 102 were signed compared with only 91 in 2015. Downtown went against the 2016 trend with more square footage leased but with fewer TAMI tenants. With almost 1.1 million square feet leased, activity was up 16 percent but with four less leases signed, at 42.

Do not worry, though, as this is not the end of TAMI. This industry sector is here to stay in New York City, and there are some positive signs that point to 2017 being a strong year. Despite VC funding being down 9.6 percent year over year in 2016 with $7.9 billion, it was the second-highest funded year since 2000. In addition, the four-largest U.S. markets had a decline in VC funding, but the New York metro area had the smallest decline of the major markets—compared to Silicon Valley’s funding which dropped 27 percent. Also, after posting a six-quarter low for VC funding in the New York metro area during the second quarter of 2016, funding increased in the last two quarters with just under $2 billion funded in the fourth quarter alone. If that is not enough to convince you, TAMI total leasing is off to an incredible start in 2017, with almost 2.2 million square feet of leases signed or renewed through the first 45 days of the year—more than one-third of 2016’s production.