CMBS Shops Figure Out How to Structure Deals With New Capital Requirements

By Danielle Balbi July 14, 2016 2:16 pm

reprints

When the credit risk retention rule of the Dodd-Frank Wall Street Reform and Consumer Protection Act was finalized at the end of 2014, commercial mortgage backed securities players knew they had a little while to prepare, and regulators were still ironing out some kinks. Now, the Dec. 24 implementation date is six months out, and CMBS shops are coming up with different ways to retain the required 5 percent of credit risk in their deals.

The idea behind the rule is for market players to “eat their own cooking,” or rather take responsibility for a pool of loans by ensuring that the underlying collateral is presented accurately.

At first, the industry assumed that either the sponsor (the party that originates 20 percent or more of the conduit) or B-piece buyers would hold on to the bottom 5 percent as those lower tranches or “B pieces,” are the riskiest part of a deal to buy into.

CMBS players have also presented two alternatives: taking a 5 percent vertical slice of a deal or taking a 5 percent L-shaped portion. To date, no CMBS deals have been closed using the latter model, but it has been reported that Wells Fargo and Bank of America Merrill Lynch are testing out the vertical structure this summer.

Given that the rule has yet to be implemented, issuers and regulators alike are unsure of what will work best, but one thing is certain: The cost of closing is going up. In November of last year, the U.S. Securities and Exchange Commission’s revisions to Regulation AB came into play, which requires the chief executive officer of the depositor to sign a certification for each CMBS offering—the regulation makes the signer personally liable for any false information. Together, these regulations are estimated to add anywhere from 10 to 50 basis points of cost to an average loan or roughly 0.5 percent to 3.5 percent of the mortgage’s coupon, according to a report from the CRE Finance Council.

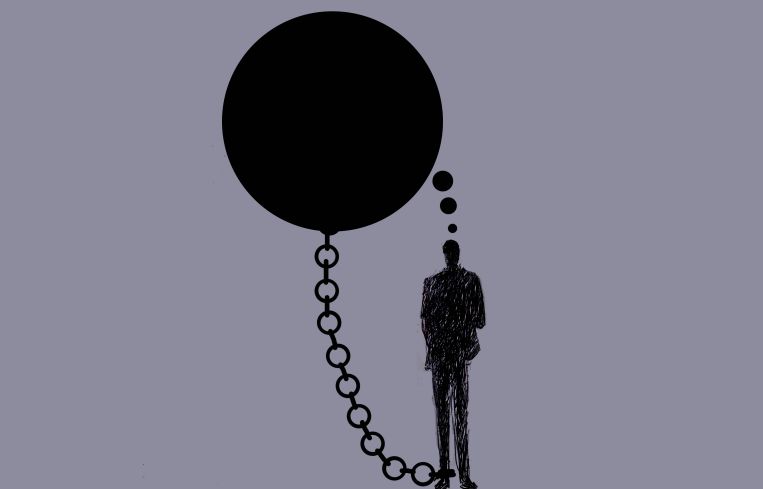

(Illustrations by Kaitlyn Flanngan for Observer)

Horizontal Slice: This was the original game plan: Issuers or B-piece buyers can hold an “eligible horizontal residual interest” in a single class or multiple classes of the conduit. One of the assumptions was that those parties could hold the most subordinated debt in the securitization. Historically, those B-piece buyers invest in that unrated, subordinated debt, sell part of it and earn a mid-teens return. But because of the retention requirement, those B-piece buyers would be unable to sell off any of that investment and make the same profit. In fact, concerns arose that many B-piece players would have to drop out of the market because of the increased capital requirements. In direct response, the industry granted B-piece buyers “veto power,” so essentially, they have the right to kick loans out of a conduit if they are uncomfortable with the underlying collateral.

Vertical Slice: And this is the opposite: Sponsors could hold an “eligible vertical interest” on their books, either constituting a single vertical security or “an interest in each class of asset-backed securities interests constituting the same proportion of each class of ABS interests,” according to a report from Morrison Foerster.

L-Shaped Slice: This one is exactly what it sounds like: A sponsor can take on both a vertical and horizontal interest in a deal. According to a report from Orrick, Herrington & Sutcliffe, the vertical component must be at least 2.5 percent of each class in the deal, while the horizontal slice must equal at least 2.564 percent of the value of the securities (other than what the vertical holds on to). The horizontal component is meant to avoid double counting the 2.5 percent subordinate interest that the sponsor requires in the vertical component.