RCG Longview Originates $25M Condo Inventory Loan for East Village Building

By Danielle Balbi April 21, 2016 5:49 pm

reprints

Tribeca-based development firm OTL Enterprises landed a $25 million mortgage from RCG Longview on a 35-unit multifamily building in the East Village, Commercial Observer has learned.

Eastern Consolidated’s capital advisory division team, comprised of Adam Hakim, Sam Zabala and James Murad, brokered the financing, which carries a two-year term with a one-year extension option.

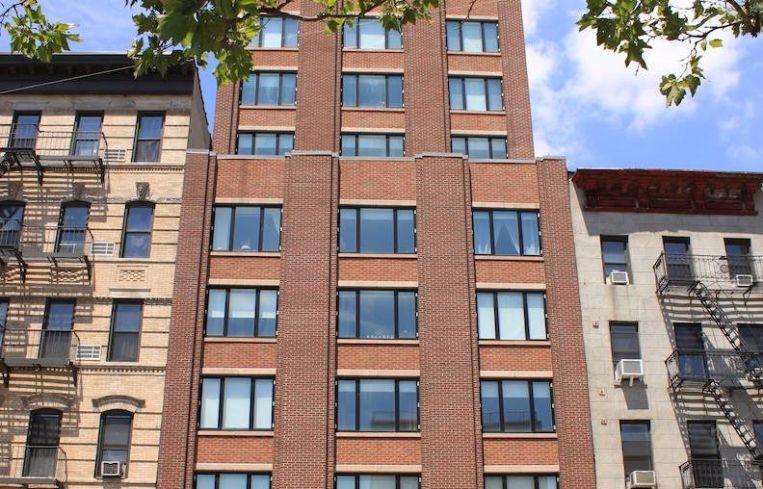

The 10-story building, dubbed the Calyx, at 189 Avenue C between East 11th and East 12th Streets, is comprised of 15 rental apartments, 20 condominium units and two commercial condos. Thirteen of the residential condos are under contract with prices ranging from $545,000 to $1.5 million.

“I would call this an inventory loan—we’re starting to see this happen in the market more where the buyer, our sponsor, OTL, was able to acquire the property in a level of construction distress using [a loan from] Hudson Companies,” Mr. Zabala said. “We were able to refinance that using RCG Longview to provide an inventory loan that should provide some runway, two to three years at least, to sell out the remaining condo units at a lower rate with a longer duration, and new capitalization to account for that timing.”

OTL acquired the property, which was still under development at the time, in March 2014 for just more than $20 million at an auction, Angelo Consentini, the co-founder of OTL, told CO. At the time, the developer received a $10.3 million loan from Hudson Realty Capital to fund its purchase.

After buying the 10-story building, OTL completed construction and had its offering plan for the 20 condo units approved last summer. The newly renovated condos include studios and one- and two-bedroom apartments, with open floor plans, hardwood flooring, renovated kitchens and bathrooms and washer/dryers. Ryan Serhant of Nest Seekers International is handling sales at the building.

Mr. Consentini said the firm is undecided as to whether it will eventually convert the rental units to condos, or if it will maintain some rentals at the site.

“[Eastern Consolidated] was very diligent and very good at finding the appropriate lender,” Mr. Consentini said. “It’s not a typical rental or condo building. It’s a hybrid. And it’s not a typical condo inventory loan. And working with RCG was everything I heard it would be—they were diligent, they were quick and they were timely.”

A representative for RCG did not respond to a request for comment.