The 50 Most Important Figures of Commercial Real Estate Finance

By The Editors March 2, 2016 9:00 am

reprints

Every year has a story.

Whether it was the story of the market’s implosion (2008), or Hudson Yards unstoppable momentum (ongoing, but we really felt it in 2014 / 15), there’s some big deal or big project that sets a tone.

In 2015, that tone was set by the $5.3 billion sale of Stuyvesant Town-Peter Cooper Village.

That explains why Alan Wiener—the group head of Wells Fargo Multifamily Capital, which provided Blackstone Group and Ivanhoe Cambridge with a $2.7 billion Fannie Mae-secured loan to make the mammoth purchase—landed the No. 1 spot on our list of the 50 most important people in commercial real estate finance.

It also explains why Blackstone’s Michael Nash and Stephen Plavin—along with Jonathan Pollack, who recently hopped aboard Blackstone from Deutsche Bank—took No. 2. Finally, it’s the reason why the folks at Eastdil Secured—Roy March, Doug Harmon and Adam Spies—landed a coveted No. 5 spot.

Of course, 2015 was about a lot more than the Stuy Town deal.

With real estate folk prepping for the new risk retention rule, which will require commercial mortgage-backed securities lenders to keep 5 percent of a deal on their balance sheets, this has been a very interesting moment for life insurance lending companies to fill the CMBS void. Hence the reason AIG and New York Life Insurance Company were added to the list. (Prudential Mortgage Capital Company and MetLife, which had been on our list last year, moved up slightly.)

Speaking of newbies, we tried to add a lot of new names to the mix: 12 new entries—plus an honorable mention. We also roped in more brokers than we have in years past, as they’re the ones on the frontlines getting deals done. Likewise, it’s difficult to imagine a more important player in this world than the United States Federal Reserve System’s Janet Yellen, the chair of the board of governors, and Daniel Tarullo, a governor of the board, who broke onto the list with a desired No. 20 spot.

But we’ll let the list and the people we’ve chosen tell their own stories.

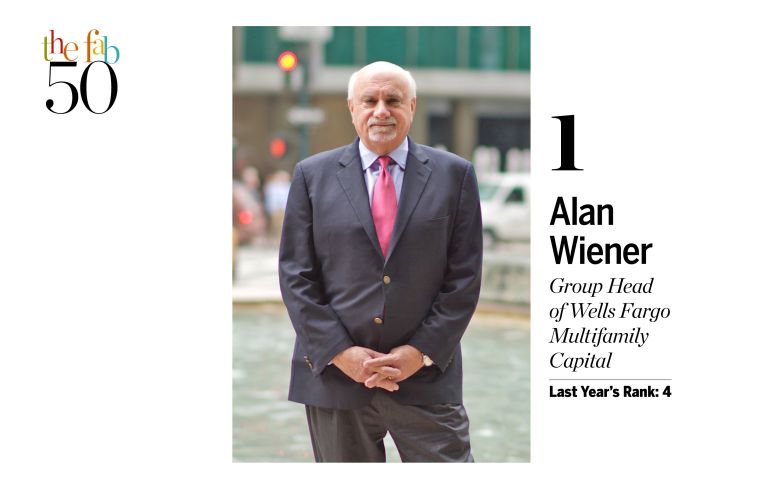

1. Alan Wiener (4)

Group Head of Wells Fargo Multifamily Capital

Mr. Wiener’s multifamily capital team at Wells Fargo has put yet another monumental year behind it. The multifamily group in the bank’s New York office nearly doubled its debt origination for the second year in a row to $15.5 billion in 2015 from roughly $8.5 billion in 2014. “What drove business was a lot of sales of multifamily because it’s a hot commodity,” Mr. Wiener noted.

That being said, his team closed its two largest deals ever: Wells Fargo provided Blackstone Group and Ivanhoe Cambridge with a $2.7 billion Fannie Mae-secured loan to fund the $5.3 billion purchase of Stuyvesant Town-Peter Cooper Village on the East Side of Manhattan and provided Starwood Mortgage Capital with $2.6 billion to finance the acquisition of a national multifamily portfolio from Equity Residential.

“We were really excited to do Stuy Town,” Mr. Wiener said. “It’s an iconic bunch of buildings, and now with the new ownership and the deal they worked out with the city it’s going to be highly stabilized, show income growth and preserve 5,000 affordable units.”

He noted that his team at Wells Fargo has been busy in the government-sponsored enterprise space—Stuy Town being a key example—and has also been active in using its own balance sheet to fund deals.

The team has also focused on the construction of multifamily, and last year provided roughly $200 million to Delancey Street Associates (a partnership between L+M Development Partners, Taconic Investment Partners and BFC Partners) for the development of Essex Crossing on Manhattan’s Lower East Side. Wells Fargo purchased tax credit equities for Sites 2, 5 and 6 and provided debt for Sites 5 and 6.

As for 2015 as a whole, “It’s going to be hard to replicate,” Mr. Wiener said.—Danielle Balbi

2. Michael Nash, Stephen Plavin, Jonathan Pollack (8)

Senior Managing Director and Global Chairman of Blackstone Real Estate Debt Strategies; Senior Managing Director and CEO of Blackstone Mortgage Trust; Senior Managing Director and Global Head of Blackstone Real Estate Debt Strategies

With many titles come many responsibilities—something any of these three Blackstone executives could tell you. Under one roof, the firm operates its origination platform Blackstone Real Estate Debt Strategies (BREDS), its real estate investment trust Blackstone Mortgage Trust (BXMT) and a hedge fund management business that trades commercial mortgage-backed securities. In 2015, BREDS and BXMT lent roughly $14 billion in 2015, more than double the $6.5 billion the company originated in 2014.

Blackstone’s deal volume got a jolt of electricity this year, in part because of its roughly $14 billion portfolio acquisition from GE Capital Real Estate—an investment that furthered the company’s global footprint.

“We’re most proud of the GE deal because it says so many things about our firm and our real estate business,” said Mr. Nash, who has been with the firm since 2007 and spearheaded the growth of BREDS. “[GE] needed a trusted partner that they’ve done a lot of business with over a long period of time, and to be welcome by them, so to speak, when they wanted to do something, was fairly transformative and it was an amazing compliment to [Global Head of Real Estate] Jonathan Gray and the team.”

Because of the massive size of the GE portfolio, Blackstone established offices in Toronto and Mexico City, adding more than 20 people to its global team. A significant new hire was Mr. Pollack, who joined the company in June 2015 after more than 15 years at Deutsche Bank. This January, Mr. Pollack took over Mr. Nash’s old position and now oversees Blackstone’s debt investment strategy across the board.—D.B.

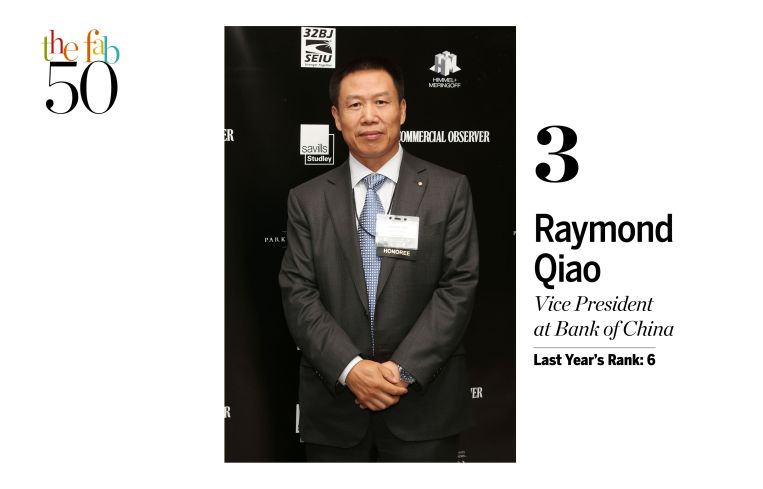

3. Raymond Qiao (6)

Vice President at Bank of China

While Mr. Qiao said Bank of China was honing in on big multifamily deals in 2014, some of its biggest transactions in 2015 were in the commercial space—the reason being, that’s what the bank’s clients were doing.

“The transactions we select are mostly based on client and customer relationships,” Mr. Qiao said. “We’re a relationship-driven lender so the property type can be multifamily, it can be commercial, it can be office.”

Bank of China’s commercial real estate arm closed roughly $5 billion in deals in 2015, up from between $2 billion to $3 billion the year prior.

The lending giant co-originated a $1.5 billion construction loan with Deutsche Bank for Related Companies’ Shops & Restaurants at Hudson Yards on the Far West Side of Manhattan—one of the largest debt deals closed in 2015. Bank of China also refinanced The Eretz Group’s 45-story office property at 295 Madison Avenue with $169 million mortgage.

Bank of China also made a move out of Manhattan and in partnership with SL Green Realty Corp. originated a $403 million recapitalization loan for Industry City in Brooklyn. As part of the deal, $220 million was provided at closing in December 2015, and the remaining $183 million will be doled out over time as the 16-building mega complex is leased up.—D.B.

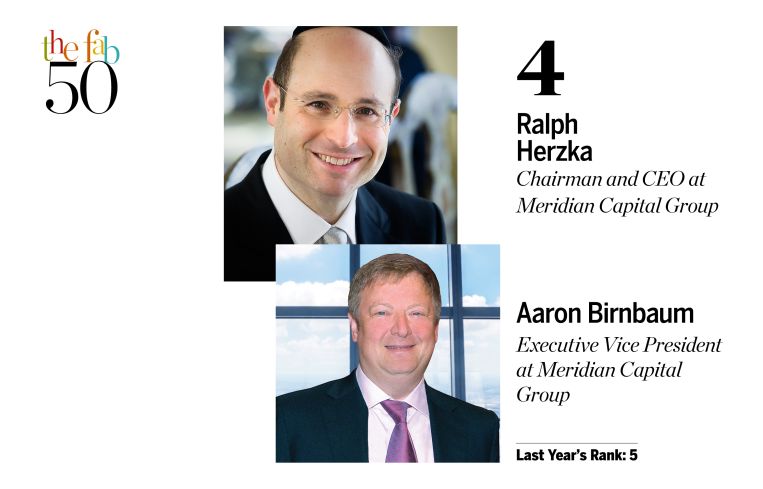

4. Ralph Herzka and Aaron Birnbaum (5)

Chairman and CEO; Executive Vice President at Meridian Capital Group

Meridian Capital Group just celebrated its 25th anniversary, and the Manhattan-based brokerage certainly built up to it.

Founding members Messrs. Herzka and Birnbaum along with partners Avi Weinstock and Jeff Weinberg oversaw a total of $35 billion in financing across more than 3,900 transactions nationally in 2015, up $5 billion from 2014.

The bulk of last year’s business, totaling $21 billion, was completed in Manhattan, Brooklyn, Queens and the Bronx. The team arranged some of the city’s largest deals, including a $785 million loan for RXR Realty for the Helmsley Building at 230 Park Avenue; a $592 million loan for Blackstone Group and Fairstead Capital for the acquisition of the Caiola Portfolio, comprised of 24 apartment buildings in Manhattan; and $345 million in financing for Chetrit Group and Clipper Equity’s condominium conversion project in Gramercy Park.

In April 2015, the brokerage launched Meridian Investment Sales, headed by Eastern Consolidated’s David Schechtman, Lipa Lieberman and Abie Kassin and Cushman & Wakefield’s Helen Hwang.—D.B.

5. Roy March, Doug Harmon and Adam Spies (New)

CEO; Senior Managing Director; Senior Managing Director at Eastdil Secured

When you follow the gold rush in commercial real estate sales, you can almost expect to see the name Eastdil Secured somewhere in the mix. The Wells Fargo subsidiary is one of the most connected brokers in the U.S. with major developers, lenders and institutional investors using its expertise to find the right buyer or secure the best financing deal.

While the firm seldom discusses its transaction publicly, its brokers are often found negotiating some of the most sizable deals in New York and across the country.

Among the firm’s top debt deals last year, Eastdil secured a $2.7 billion loan for Blackstone Group and Ivanhoe Cambridge for the purchase of Stuyvesant Town-Peter Cooper Village in December. That same month the firm closed a $1.25 billion mortgage for Paramount Group at 1633 Broadway, a 2.6-million-square-foot office tower led by Landesbank Baden-Wurttemberg. (Eastdil did $52.4 billion in financing in the U.S. in 2015 and another $14 billion in Europe.)

In April, the brokerage arranged $1.25 billion in financing led by Deutsche Bank, Morgan Stanley, Goldman Sachs and Citigroup for the Crown Building at 730 Fifth Avenue, which Jeff Sutton and General Growth Properties purchased for $1.78 billion.—David Jones

6. Steve Kenny and Brad Dubeck (19)

East Region Real Estate Executive; Commercial Real Estate Banking Executive for New York and New Jersey at Bank of America Merrill Lynch

Bank of America Merrill Lynch’s commercial real estate banking team saw double-digit growth in its origination volume across the East Coast in 2015. Mr. Kenny said he expects the bank to grow its business again in 2016, but at a more modest level.

Indeed, Bank of America kicked up its transaction volume to $15 billion in 2015 from $9 billion in 2014 along the Eastern Seaboard. The bank has made an especially huge play in New York, an effort headed by Mr. Dubeck and his Manhattan-based team. The New York and New Jersey CRE group were responsible for the origination of $4.3 billion in debt last year, more than doubling its $1.7 billion total in 2014.

“We tried to focus on core clients, what their needs were and what their big deal needs were so we could use our balance sheet scale to take a deal out of the marketplace and execute for the client,” Mr. Kenny said.

And big deals they did make: Mr. Dubeck’s team headed a $640 million construction loan with Wells Fargo for Tishman Speyer’s three-tower luxury residential development in Long Island City—a closing quickly followed by a $690 million loan on which the bank acted as the lead agent for Related Companies’ construction of an office condominium tower at 30 Hudson Yards.

“Generally speaking, the growth we were able to achieve in 2015 was really created by the lending community having a big appetite for real estate,” Mr. Dubeck said. “It’s not just us but the banks we work with and the timing and opportunity with our clients—it was sort of the stars aligning.”—D.B.

7. James Carpenter and John Adams (7)

Senior Executive Vice President and Chief Lending Officer; First Senior Vice President and Chief Administrative & Senior Lending Officer at New York Community Bank

If you tinker around with New York City Department of Finance records, you’ll find that one bank has dominated the boroughs of this city as the most prolific multifamily and commercial real estate lender in deal volume for the past three years: New York Community Bank.

Operating out of Hicksville, N.Y., the bank has grown from a $3 billion loan portfolio in 2000 to nearly $32 billion as of earlier this year. (With the bank’s additional assets, that figure rises to $49 billion.)

Mr. Carpenter has been a senior executive vice president and chief lending officer at NYCB since 2006, and Mr. Adams has been with the bank for 32 years, leading a team that has grown to 85.

Most of New York Community Bank’s loans are the unshowy kind, ranging between $3 million and $20 million, which means a lot of its activity goes under the radar. But at least one deal last year did not go unnoticed: the announcement in October that it plans to acquire and merge with Astoria Bank in a $2 billion transaction.—Max Gross

8. George Klett (9)

Executive Vice President and Chairman of the Commercial Real Estate Committee at Signature Bank

The joke about Mr. Klett is that when he was starting out, he couldn’t get a job as a garbage man. (Back in the 1970s, when he was a young father and determined to keep food on the table, he passed the test to become a sanitation worker but wasn’t hired.)

He’s come a long way from trash-collector reject.

“Last year, we closed $6 billion in loans—almost 1,200 deals. On average, we do 100 loans a month pretty consistently, which is what most banks do in a year,” Mr. Klett said about Signature Bank, where he is the executive vice president and chairman of the real estate committee.

Signature’s loans have run the gamut from under $1 million to over $100 million. (Mr. Klett’s portfolio is a staggering $17.8 billion.) And the lender started off the year with a bang: In January, it closed on a $135 million loan to A&E Real Estate Holdings to purchase the Riverton apartment complex at 45 East 135th Street and 10 East 135th Street. (Fun fact: About 10 years ago, when Mr. Klett was at North Fork Bank, he wrote a $110 million loan for Riverton.)

The bank has been punching strong since—Signature just closed on a $100 million loan on the 209-unit multifamily Kips Bay apartment complex at 377 East 33rd Street.

When going to the figurative real estate races, Mr. Klett said, most people bet on location (i.e., the horse). “We’re betting on the jockey—the guys who have been around a long time, can make their payments, know what they’re doing. Those are the guys we want to have relationships with.”—M.G.

9. Matt Borstein and Ed Adler (2)

Head of Global Commercial Real Estate at Deutsche Bank; Head of U.S. Origination, Underwriting and Asset Management at Deutsche Bank

During a year of high-profile departures, internal restructuring and increasing market turbulence, Mr. Borstein, the head of global commercial real estate at Deutsche Bank, oversaw an impressive 2015, where the bank continued to be the go-to lender on some of the biggest deals of the year.

Mr. Borstein, who left Eastdil Secured to join Deutsche Bank in 2010 as managing director in whole loan trading in the commercial real estate group, stepped up to the plate right after the defection of Jonathan Pollack to Blackstone Group. (Mr. Adler remained as managing director of Deutsche Bank.)

Despite concerns by the massive internal restructuring, Mr. Borstein said that positives will come out of the moves.

“I think, at the bank level, the bank has become much more streamlined and less bureaucratic,” he said.

Even with the recent upheaval at the German banking giant, Deutsche Bank has not wavered in its commitment to back major assets and major investors here in New York.

The bank originated $11 billion in loans backed by New York City real estate, including $3.4 billion in commercial mortgage-backed securities and maintaining about $7.6 billion on its balance sheet.

Among its biggest deals, Deutsche Bank was the sole bookrunner and lead manager on a $1.34 billion loan on 3 Bryant Park, an acquisition by Ivanhoé Cambridge and Callahan Capital, the single largest asset financing in New York history that was sole managed.

The lender also led $1.4 billion financing at 11 Madison Avenue for SL Green Realty Corp.

“The basic theme for us is we continue to be massive believers in New York,” said Mr. Borstein.—D.J.

10. Brian Baker (10)

Managing Director and Global Head of Commercial Mortgages at J.P. Morgan Securities

Under Mr. Baker’s leadership, J.P. Morgan Chase’s CMBS division has averaged $14 billion in loan volume over the last three years—in 2015 originating a total of $14 billion.

Last year, Mr. Baker and his team closed a number of the city’s biggest deals. J.P. Morgan Securities led a $1.3 billion financing for Seritage Growth Properties for 235 retail locations as well as the financing of Ziel Feldman’s HFZ Capital Group for the acquisition of 76 11th Avenue along the High Line.

In July 2015, J.P. Morgan Chase provided a $1 billion loan to Ivanhoé Cambridge for 1211 Avenue of the Americas. The bank closed on a $938 million loan for Lone Star Funds on a 104-property office portfolio and loaned $425 million to Rudin Management Company at 32 Avenue of the Americas for a telecom/office tower.

“The volatility has slowed down transaction activity some, but we remain active with the lending and trading businesses,” Mr. Baker said. “The activity level has picked up in the last few weeks.”—D.J.

11. Robert Merck and Gary Otten (12)

Head of Real Estate and Agricultural Investments; Head of Real Estate Debt Strategies at MetLife

Money is the lifeblood of the real estate industry. And the amount of real estate money loaned out by insurance giant MetLife keeps flowing.

Debt originated by the commercial real estate wing of the company was up 18 percent in 2015 to $14.3 billion from $12.1 billion a year earlier. Under the leadership of real estate chief Mr. Merck and real estate debt strategies head Mr. Otten, the company expanded its lending overseas with $1.6 billion in real estate loans in the United Kingdom as well as $200 million-plus in Mexico.

MetLife’s highlight deals conducted stateside include a $505 million first mortgage on the Loews Universal Orlando Hotel portfolio in Florida, a $400 million first mortgage for the Columbia Center office tower in Seattle and a $255 million first leasehold mortgage on Rudin Management Company’s 1675 Broadway in Midtown Manhattan.

“We remain focused on being the leading commercial mortgage lender in the insurance company space and hope to exceed our 2015 production levels this year,” Mr. Merck said in an email. “In 2016, the market should offer ample opportunities for equity deals. Our investment management business is also a priority. Similar to previous years, our 2016 strategic focus is on investing in high-quality assets in major markets.”—Terence Cullen

12. Gino Martocci and Peter D’Arcy (26)

Executive Vice President; Regional President of New York City and Long Island at M&T Bank

“Towards the second half of last year, some of the choppiness in the capital markets reminded people of the value of through-cycle lenders,” Mr. D’Arcy said.

Indeed, Messrs. Martocci and D’Arcy have been working at M&T for more than 20 years now, and 2015 marks another year of growth for the Buffalo, N.Y.-headquartered bank. Its real estate team originated a total of $10 billion last year, up from roughly $6 billion in 2014.

Of the $10 billion, $3 billion has been in New York City alone. Last year, one of the largest deals M&T closed was a $300 million senior loan for the Fisher Brothers and Witkoff Group’s 111 Murray Street in Manhattan. Deutsche Bank purchased half of the debt, and the loan was syndicated further.

M&T also completed a $180 million direct bond placement on behalf of Two Trees Management Company for the construction of a 15-story, 80/20 residential building on the site of the old Domino Sugar factory in Williamsburg, Brooklyn. The bank served as the lead agent on the deal, and Wells Fargo purchased half of the bonds. A little further south, at 71 Smith Street in Boerum Hill, M&T provided the Carlyle Group and development firm Flank with a $175 million construction loan for a 20-story condominium and hotel project.—D.B.

13. Doug Mazer and Kara McShane (14)

Managing Director and Head of Real Estate Capital Markets; Managing Director and Head of Commercial Real Estate Capital Markets and Finance at Wells Fargo

Mr. Mazer and Ms. McShane are instrumental to Wells Fargo’s commercial estate businesses and have both overseen continued growth on their respective teams. Last year was no exception.

Ms. McShane, based out of Wells Fargo’s New York City office, must have a very tight schedule given all of the activities she oversees at the bank. As head of commercial real estate capital markets and finance, she focuses on commercial real estate debt capital markets and structured finance—which runs of the gamut of commercial mortgage-backed securities and commercial real estate collateralized loan obligation securitization to loan pricing, hedging, structuring and distributing bonds, B-notes and mezzanine debt.

Last year, all of the businesses Ms. McShane manages saw year-over-year revenue growth of 16 percent. Her team closed 82 securitizations totaling $67 billion, up 12 percent from 2014. Of those deals, Wells Fargo led or co-led 49, totaling $34.8 billion, up 15 percent from the year prior. That being said, Ms. McShane’s capital markets and finance team was the top Freddie Mac CMBS bookrunner, the top CRE CDO and resecuritization bookrunner, the top CRE non-performing loans CMBS bookrunner and the top multi-borrower single-family rental bookrunner.

Similarly, Mr. Mazer has been just as busy. His real estate capital markets team finished the year as the top CMBS lender in conduit deals by loan count and second CMBS lender in conduit deals by volume. Mr. Mazer specializes in the origination of non-recourse term loans, which can be securitized or held on a balance sheet. In 2015, Wells Fargo’s loan volume shot up 20 percent from the year prior, with a total of $10.4 billion in both CMBS and balance sheet originations.

The bank co-originated a $1.4 billion CMBS loan on the iconic 11 Madison Avenue and co-lent another $1.4 billion CMBS loan on the MetLife Building at 200 Park Avenue. On the balance sheet side, Wells Fargo provided a $140 million loan on the 200,000-square-foot E Walk Retail complex on 42nd Street in Times Square.—D.B.

14. Michael Lehrman and Anthony Orso (1)

Co-CEOs and Co-Founders at CCRE

As one of the fastest growing issuers of commercial mortgage-backed securities financing in recent years, Messrs. Orso and Lehrman, the co-founders and co-CEOs at CCRE, realized they needed to adjust to the changing market dynamics in the commercial real estate lending world.

The CMBS side of the business was relatively flat in 2014, when the company reported $6.68 billion on 313 CMBS deals.

However, CCRE has almost doubled its agency lending, becoming the fifth-largest Fannie Mae and Freddie Mac lender in the U.S. last year with $5.5 billion in agency loans. In total, the firm closed almost $12 billion in volume in 2015.

“For us we’ve expanded pretty rapidly on the agency lending side,” Mr. Orso said. “I think what we’ve done is we started a focus last year on expanding into the affordable and low-income housing and finance and healthcare worlds.”

Among the key financing deals spearheaded by CCRE, the firm led the financing on a 2,566-key, full-service hotel portfolio of seven properties in Florida, California, Virginia, Ohio and New Mexico in February 2015.

The lender also provided $215 million for a mixed-use project at 215 West 34th Street, which is expected to include a 43-story hotel by Joseph Cayre’s Midtown Equities.—D.J.

15. David Schonbraun (11)

Co-Chief Investment Officer at SL Green Realty Corp.

SL Green Realty Corp.’s Mr. Schonbraun works to oversee the lending arm of the real estate investment trust, which is also New York City’s largest commercial landlord.

The co-chief investment officer said SL Green generated $1.8 billion in debt by the close of 2015, of which the company held on to $850 million. That’s a step up from a year earlier, when the REIT generated $1.7 billion and held on to $800 million.

Asset types ranged from multifamily to typical office in Manhattan to repositioned offices in the outer boroughs, he said, including Industry City in the Sunset Park section of Brooklyn. Mr. Schonbraun and colleague Rob Schiffer worked on a deal last year with Bank of China that generated $403 million in new financing for the 6-million-square-foot complex, which is owned by Jamestown, Belvedere Capital and Angelo, Gordon. Bank of China acted as the senior lender, while SL Green retained the mezzanine debt.

“We put together a facility to help take out their existing mortgage,” Mr. Schonbraun said. “Importantly for them, [it had] a large future-funding component to continue the great redevelopment they’ve done there repositioning the asset, upgrading it, which is something they’ve been doing but obviously takes a lot of capital to do.”—T.C.

16. David Lehman (15)

Global Head of Real Estate Finance at Goldman Sachs

Offering commercial mortgages of no less than $5 million to stabilized-only industrial and multifamily residences, hotels, retail and office, the Goldman Sachs Real Estate Finance group was created in 2014.

At the time, Mr. Lehman was pronounced global head. (A representative for Goldman declined to comment.) Commercial Mortgage Alert estimates the team originated $9 billion in commercial mortgage-backed securities in 2015, up from about $8 billion in 2014.

And the firm’s “social impact” team, the Urban Investment Group, is en route to an approximately $500 million investment in Essex Crossing, the $1 billion redevelopment of the Seward Park Urban Renewal Area, with some $200 million already committed, including a $95 million loan to Delancey Street Associates (led by L+M Development Partners, Taconic Investment Partners and BFC Partners) to build 55 condominium units at 236 Broome Street.—Sara Pepitone

17. Jeffrey DiModica and Barry Sternlicht (24/3)

President and Managing Director of Starwood Property Trust; Chairman and CEO of Starwood Capital Group and Starwood Property Trust

Mr. Sternlicht’s Starwood Property Trust, a division of his private investment firm Starwood Capital Group, is still on top as the nation’s largest commercial mortgage real estate investment trust.

Mr. DiModica, the president of Starwood Property Trust, oversees the day-to-day operations of the firm, which has a portfolio that grew to more than $9.1 billion in 2015. Between its lending services and real estate investment, Starwood closed $5.8 billion in transactions last year.

Mr. DiModica, who has an MBA from Dartmouth College, assumed his role in September 2014, replacing Boyd Fellows. Mr. Fellows, Stew Ward, Chris Tokarski and Warren de Haan left Starwood and recently formed ACORE Capital. (Just one year out of the gate, ACORE already earned its own place on our Power 50 list.)

Despite the departures, on the lending side last year, the firm originated more than $2.3 billion, including a $257 million loan for the acquisition and development of the Pacifica San Juan housing project. In addition, the firm completed two separate $600 million equity purchases last year—one for a 13-property office portfolio in Dublin and the other for a 32-building multifamily portfolio throughout Florida. Starwood also originated $2 billion in commercial mortgage-backed securities.

“We have grown to become a tremendously diversified and scalable business,” Mr. DiModica said. “The success we’ve achieved is due in large part to our scale. With a deep bench of roughly 2,000 commercial real estate professionals between Starwood Capital Group and Starwood Property Trust, we are well positioned to adeptly move between sectors to find the best risk-adjusted returns.”—Liam La Guerre

18. James Flaum (18)

Managing Director and Global Head of Commercial Real Estate Lending at Morgan Stanley

Mr. Flaum’s first foray into commercial real estate was in 1993 with an investment in a Florida mall to test the market during the crash. (Before that, he had obtained an accounting degree from the University of Michigan and an MBA in finance and administration from New York University.)

He joined Morgan Stanley the year after and launched the firm’s now two-decade old CRE lending business, which, as Mr. Flaum said, is “still going strong.”

Last year the group originated approximately $16 billion of CRE loans globally, $8 billion of bank loans and $8 billion of commercial mortgage-backed securities loans, rendering Morgan Stanley one of the largest global CRE lenders.

Recently, the firm closed a $700 million bank loan for Vornado Realty Trust for 770 Broadway, the former Wanamaker department store, now an office building. Morgan Stanley also provided a whopping $1.7 billion loan, its biggest of 2015, to fund Blackstone Group and Wells Fargo’s $23 billion purchase of General Electric’s real estate debt and equity portfolio.—S.P.

19. Paul Vanderslice (17)

Co-Head of U.S. CMBS at Citigroup

Mr. Vanderslice led Citigroup’s CMBS team through another big year, having originated $9 billion in 2015, a 25 percent increase from the year prior. The bank served as the lead or co-lead bookrunner on 27 deals.

“Citi’s platform is a true team effort,” Mr. Vanderslice said. “The firm has one of the longest standing tenures in the business and has many highly experienced transactors and closers. Key members of the group have worked together for a long time.”

Indeed, he has been with the bank for more than 25 years and has held his current position as co-head of U.S. CMBS for more than a decade.

Mr. Vanderslice’s team started 2016 off strong, providing a $300 million, 10-year loan to Haymes Investment Company for the refinancing of 5 Penn Plaza in Midtown Manhattan, as Commercial Observer reported.

In a December interview, Mr. Vanderslice told CO that much of the demand for CMBS in 2016 will be a result of the refinancing wave.

“It’s a built-in current supply, and certainly a built-in for future supply,” he said. “Unlike other markets, you almost have a floor on the new issue volume because you have all of these loans coming due.”—D.B.

20. Janet Yellen and Daniel Tarullo (New)

Chair of the Board of Governors; Governor of the United States Federal Reserve System

Ms. Yellen and Mr. Tarullo aren’t elected officials but play key government roles as chair and as a governor, respectively, of the Board of Governor at the United States Federal Reserve. The commercial real estate world also pays close attention to testimonies made by them since they dictate what will happen with interest rates and lending regulations.

In 2014, Ms. Yellen made history when she became the first woman to chair the Fed, guiding the country’s monetary policy as interest rates continued to hover around zero.

Last year, a little move by Ms. Yellen caused a huge wave when she announced that interest rates on short-term loans would increase 25 basis points. The real estate world is still mulling what the effects of that minor jump will be in the long run, but several industry vets told Commercial Observer in December that the hike would mostly impact borrowers seeking construction and bridge loans.

As the Fed’s key bank regulations enforcer, Mr. Tarullo floated the idea last fall that the regulatory body would increase post-stress test capital requirements on the nation’s biggest banks. Mr. Tarullo, appointed to the Fed’s board in 2009, has also testified to Congress about the need to regulate nonbank lenders—such as private equity firms, real estate investment trusts and commercial mortgaged-backed securities originators.—T.C.

21. Jeffery Hayward and Michele Evans (21)

Executive Vice President of Multifamily; Senior Vice President and Multifamily COO at Fannie Mae

Fannie Mae had an exemplary 2015, continuing to demonstrate its commitment to affordable multifamily housing in the U.S. Along with its lender partners, the agency provided $42.3 billion in debt last year, bringing its year-end book of business to more than $211 billion. Roughly $3 billion of the debt Fannie Mae provided was through Multifamily Affordable Housing loans. Of the total 569,000 multifamily units the multifamily powerhouse financed, more than 90 percent were considered affordable or workforce housing.

“What drove our business in 2015 was a keen focus on listening to what our partners need and delivering creative solutions to help them be successful in the multifamily market—achieving profitable business for us and our lenders, while maintaining great credit quality,” said Mr. Hayward, who has been with Fannie Mae since 1987. “Our partners have counted on our risk-sharing platform for the last 28 years, and they know we are here for them.”

Of the most iconic deals Ms. Evans (who joined the company in 1992) and Mr. Hayward’s team led was the $2.7 billion mortgage for Blackstone Group and Ivanhoe Cambridge’s buy of Stuyvesant Town-Peter Cooper Village on the East Side of Manhattan. As a part of the Blackstone’s deal with the City of New York, 5,000 units of workforce housing were maintained at the 11,000-unit property.—D.B.

22. David Brickman and John Cannon (20)

Executive Vice President for Multifamily Business; Senior Vice President of Production and Sales and Marketing at Freddie Mac

If anyone in the commercial real estate lending space emerged as a major force in 2015, it was Freddie Mac, the national government agency that secures much of the multifamily lending in the U.S.

Freddie Mac reported $47.3 billion in loan purchases and bond guarantees in 2015, including a record high of $5 billion in financing loans for low-income residents and $2.6 billion in loans for small apartment properties.

Mr. Brickman said that the government-sponsored enterprise, or GSE has greatly expanded the types of loans it invests in, leading to significant growth in the type of properties and borrowers it works with. About $17 billion in loan volume includes investing in loans for senior housing, manufactured housing communities, affordable housing and smaller multifamily properties. Mr. Brickman originally joined Freddie Mac in 1999, after working at PricewaterhouseCoopers, where he co-led the firm’s Mortgage Finance and Credit Analysis group.

Mr. Cannon joined Freddie Mac in 2012 after working at Berkadia Commercial Mortgage, where he was an executive vice president, leading the firm’s conventional mortgage banking network, investment sales and GSE lending.

The agency backed an $878 million property loan for the Park LaBrea in Los Angeles, the largest apartment community on the West Coast, with 4,245 units spread over 18 high-rise towers and 175 garden-style apartment buildings. The loan, for borrower Prime Residential, was the largest single property loan ever purchased by Freddie Mac.

Significant loans in New York included backing a $161.3 million refinancing by Prudential Mortgage Capital Company for 80 Lafayette Street, a 262-unit student dorm at New York University in February 2015.—D.J

23. Chad Tredway and Greg Reimers (25)

Head of Commercial Term Lending East; Managing Director and Northeast Regional Manager of Real Estate Banking at J.P. Morgan Chase

J.P. Morgan Chase saw a huge year, with its commercial term lending, community development banking and real estate banking teams originating a total of $32 billion.

“Last year we saw strong performance in the local economy, with good job creation and continued low interest rates generating a healthy amount of real estate activity,” Mr. Reimers said. “As we get deeper into the real estate cycle, and given turbulence in capital markets, we will continue to manage our business responsibly through the cycle and provide creative and straightforward financing solutions to our diverse client base.”

In New York alone the J.P. Morgan Chase provided roughly $4.2 billion in financing in 2015. “New York is a top priority for our commercial real estate business, achieving growth of over 20 percent in 2015 demonstrates our commitment,” Mr. Tredway said. “Our goal is to provide an exceptional client experience and supply liquidity to our customers consistently over the long term.”

The Chicago native took over as head of the bank’s commercial term lending business for New York, Boston and Washington, D.C., in 2013 and has continually grown the group’s pipeline with a focus on New York. Last year, his team lent $78.5 million against 10 Manhattan apartment buildings owned by Sackman Enterprises.

Mr. Reimers’ real estate banking team also completed some big deals in the city, including a $158 million construction loan for Rose Associates and Benenson Capital Partners’ construction of a 368-unit 80/20 residential development at 210 Livingston Street in Brooklyn.

“We are thrilled to continue our involvement in the revitalization of Downtown Brooklyn and proud to support New York City’s affordable housing programs,” Mr. Reimers said. “Our long-term clients, Benenson Capital Partners and Rose Associates, are bringing an exciting new development to this increasingly dynamic market.”—D.B.

24. Greta Guggenheim (45)

CEO of TPG Real Estate Finance Trust

Last year was a pretty good one for Ladder Capital, the real estate investment trust that Ms. Guggenheim—along with Brian Harris and Michael Mazzei—founded in 2008. But sometimes you have to move up the ladder.

In August, Ms. Guggenheim packed it in and (as of January) took over the role of chief executive officer of TPG Real Estate Finance Trust, the firm’s recently founded origination and acquisition arm.

In January 2015, TPG, the Fort Worth, Texas-based equity behemoth (with $75 billion in assets) launched its real estate finance shop with a $2.5 billion buy of high yield real estate debt from Deutsche Bank.

For Ms. Guggenheim, it’s the latest in a distinguished career; after earning degrees at Swarthmore College and the Wharton School, she started off at Credit Suisse and served as a managing director at Bear Stearns and UBS before becoming a managing director and head of origination for Dillon Read Capital Management.—M.G.

25. Peter Nicoletti; Aaron Appel; Dustin Stolly; Keith Kurland (38)

Executive Managing Director; Managing Director; Managing Director; Executive Vice President at JLL

JLL’s New York-based debt and equity platform outdid itself in 2015, sourcing $9.4 billion in debt, up from $7 billion in 2014.

“New York truly established itself as the premier global commercial real estate market in 2015,” said Gavin Morgan, New York Capital Markets head at the firm. “With recent FIRPTA [Foreign Investment in Real Estate Property Tax Act] reforms taking effect, we expect additional foreign capital to pursue New York real estate, making the market more liquid and competitive than ever before while also increasing demand and pricing for trophy real estate assets.”

While Mr. Nicoletti is focusing on large portfolio transactions across the country and New York City office financings, his colleagues Messrs. Appel, Stolly and Kurland have been bringing in plenty of New York business for the brokerage.

Mr. Appel oversaw a $725 million debt and equity package for JDS Development and Property Markets Group’s 111 West 57th Street along Manhattan’s Billionaire’s Row and brokered a $97 million loan to refinance Crown Acquisitions’ seven-property retail portfolio in Brooklyn and Queens.

Mr. Stolly arranged a $370 million loan for Edward J. Minskoff Equities’ refinancing of 51 Astor Place in Manhattan’s East Village and a $90 million loan for Paramount Group’s acquisition and repositioning of 670 Broadway in Midtown South.

Mr. Kurland kept busy in Brooklyn, arranging a $104 million acquisition and construction mortgage for Quinlan Development Group and BLT at 41 Flatbush Avenue. He also worked on a $58 million debt and equity raise for the construction of an 80,000-square-foot condominium development at 275 Fourth Avenue in Park Slope.—D.B.

26. David Durning (27)

President and CEO of Prudential Mortgage Capital Company

Prudential Mortgage Capital Company has seen consistent performance over the last several years, its global debt originations totaling $14.7 billion in 2015, very much in line with its $15 billion average for the last three years.

The life company lender, which currently has more than $87.5 billion in assets under management, lent $1.9 billion internationally, including first-time deals in Australia, France and Spain. Mr. Durning said he hopes to further Prudential’s success internationally and is looking to do follow-on transactions in some of those new markets.

Domestically, Prudential lent more than $12.7 billion in the U.S. and nearly $3.4 billion in conventional and affordable multifamily loans with Fannie Mae, Freddie Mac and the Federal Housing Administration. In early January, the firm provided a $74.4 million loan to AEW Capital Management for the Alexan Solero Apartments in Fort Lauderdale, Fla.

“Our appetite for 2016 is $15 billion ... at least,” Mr. Durning said. “If we can find more opportunity, that would be terrific. As we look at the landscape of opportunity today, we think that the regulatory changes in the CMBS market will provide good opportunities for portfolio lenders like us, especially in some of the larger loans.”—D.B.

27. Larry Kravetz (22)

Managing Director, Head of CMBS Finance at Barclays Capital

Last year, Barclays Capital lent a total of $7.1 billion, a big increase from the $4.9 billion the firm deployed in 2014, and something Mr. Kravetz, the managing director and head of CMBS finance at Barclays Capital, can be very happy about.

“Last year, a big part of the increase for us was that we led or co-led [12] standalone securitizations,” Mr. Kravetz said. “It was significant compared to 2014 were we led- or co-led three. That was the biggest reason for our growth spurt.”

Barclays Capital was the sole manager that gave $650 million in financing in December 2015 to developer Jay Paul Company to refinance construction debt for the first phase of Moffett Place—a three building, 933,056-square-foot office complex in Sunnyvale, Calif. The property is fully leased to Google.

In another West Coast transaction, Barclays Capital completed a seven-year, $450 million loan to J.P. Morgan Chase’s subsidiary J.P. Morgan Asset Management for the acquisition of a 98 percent stake in the 1.1-million-square-foot Market Square in San Francisco from Shorenstein Company. Twitter is headquartered at that property.

Mr. Kravetz, a father of two from Peabody, Mass., joined Barclays Capital in 2011, after leaving G2 Investment Group. Prior to that, Mr. Kravetz worked for Lehman Brothers from 1992 until the company’s bankruptcy in 2008.—L.L.G.

28. Jerome Sanzo (New)

Executive Director, Head of Real Estate Finance at Industrial and Commercial Bank of China (ICBC)

Mr. Sanzo joined Beijing-based ICBC in January 2015 as executive director and head of real estate finance to start a Commercial Real Estate group in New York. ICBC’s New York Branch finances Class A real estate projects across the country, working with the largest top-tier North American developers and Chinese investors, he told Commercial Observer.

Mr. Sanzo said that he enjoys working at a major international financial institution—the biggest bank in the world—and also enjoys teaching at NYU’s Schack Institute for Real Estate. “Working with younger people and with students keeps me young,” said the man who led his team to about $2.5 billion in new commitments in 2015. That includes a $360 million condominium construction loan for 100 East 53rd Street, sponsored by RFR Realty and China Vanke/China Cinda; a $325-million seven-year loan secured by a fully occupied office building, the Sothebys headquarters at 1334 York Avenue (ICBC joint led this deal with HSBC); and a $200 million condo conversion loan for the MiMA Tower on West 42nd Street sponsored by Kuafu Properties and Shanghai Construction Group.

“This is an interesting time of global cross-border investment, and I am happy to be in the midst of it.”—S.P.

29. Robert Verrone and Christopher Herron (30)

Principal; Managing Director at Iron Hound Management Company

Mr. Verrone is a jack of all trades in the real estate finance business. He originates. He brokers. He restructures.

The Bear Stearns veteran, who founded Iron Hound in 2009, works closely with Mr. Herron, who manages the firm’s restructuring platform and debt and equity advisory business. Mr. Verrone’s team tacked on another $1 billion to their business in 2015, finishing the year with $4 billion in deals behind them.

While Iron Hound operates nationally, some of its biggest deals were done in New York. Perhaps the most iconic deal Mr. Verrone has worked on was Industry City. He stood by the property back when it was Bush Terminal, restructuring its original debt, and eventually partnering Cammeby’s International and FBE Limited with Jamestown, Angelo, Gordon & Co. and Belvedere Capital to revitalize the 6-million-square-foot industrial complex in 2013. Last year, Mr. Verrone arranged a $403 million financing package for the new partnership, which included a $220 million loan provided at closing with a $183 million good news facility from Bank of China and SL Green Realty Corp.

The firm also kept busy with its one-year old lending arm, IH Capital, which works in conjunction with Bank of New York Mellon Corp. Last year, the partnership originated a $120 million loan to refinance the Hollister Co. flagship at 600 Broadway in Soho for Aurora Capital Associates, A&H Acquisitions and Crown Acquisitions.

On the brokerage side, Iron Hound served as the broker on two big deals for Chetrit Group. Mr. Verrone arranged a $115 million floating-rate loan from Fortress Investment Group to refinance debt on the landmarked Dime Savings Bank of New York building at 9 DeKalb Avenue and fund the acquisition of an adjacent property at 340 Flatbush Avenue Extension in Brooklyn. That same week, Mr. Verrone closed another $70 million loan from SL Green to fund Chetrit’s redevelopment of a stretch of vacant retail at 251-257 West 34th Street in Midtown Manhattan.—D.B.

30. Jeff Fastov (new)

Senior Managing Director at Square Mile Capital Management

Mr. Fastov has led the commercial real estate lending business at Square Mile Capital Management since he joined the firm from Credit Suisse in 2013—and it looks like he’s doing his job well.

Square Mile more than doubled its debt financing volume in 2015 to $1.6 billion, across a total of about 30 deals. Among the larger deals the firm has closed was a $205 million construction loan for Lightstone Group to develop the Marriott Moxy Hotel at 485 Seventh Avenue in Times Square.

The lender also closed a $58 million loan for Long Island City-based Acumen Capital Partners to acquire the old Pfizer headquarters building in Brooklyn.

Square Mile has found new financing deals outside of New York, including a high-end condominium.

He said that turbulence in the commercial mortgage-backed securities market and increased regulatory pressures on commercial banks are creating new opportunities for Square Mile to provide necessary capital.

“We don’t expect this to change in the coming year. In fact those markets may get more uncertain,” Mr. Fastov said. “This is driving increased demand for capital from our borrowers and equity partners because as an invest-and-hold balance sheet lender, our funding is largely immune to this volatility.”—D.J.

31. Greg Murphy (32)

Managing Director and Head of Real Estate Finance Americas at Natixis Real Estate Capital

Mr. Murphy has been with Natixis Real Estate Capital since 2000 and oversees a team of about 50 professionals, where they focus on loan originations, transaction management, asset management and real estate capital markets.

Mr. Murphy guided his team through what he considered a most interesting year in 2015, as a number of global market events led to a great deal of volatility that made the last few months of the year a bit turbulent.

“The year ended with a lot of great volatility and difficulty in our markets that went right into 2016,” he said.

The lender reported about $3.5 billion in loan volume in 2015, which is flat compared to last year’s figures. Still Natixis was involved in some key financing deals in New York City and across the country.

Under Mr. Murphy’s leadership, the lender provided $315 million through a five-year, fixed-rate commercial mortgage-backed securities deal last September to refinance One Court Square, a 52-story office and retail tower in Long Island City, under a joint venture led by Savanna.

Natixis also led the senior debt in the $345 million financing of Gramercy Square, the Chetrit Group and Clipper Equity’s condominium conversion from July 2015. The financing included a $280 million senior loan and $65.5 million mezzanine loan and was syndicated to five other lenders.—D.J.

32. Douglas Tymins (New)

President and CEO of AIG Global Real Estate

Following the year-end dismissal of four senior members of the group, Mr. Tymins, the president and chief executive officer, was tasked with overseeing AIG Global Real Estate’s investment and development platforms and for developing and implementing its business strategy.

Mr. Tymins, who has a bachelor’s degree from Arizona State University and started his real estate career in 1985 at the Trammell Crow Company, is also chair of the AIG Global Real Estate’s Investment Committee. He did not wish to comment, but the life insurance lending giant was responsible for some major deals in 2015: a $785-million acquisition loan to RXR Realty to purchase the Helmsley Building at 230 Park Avenue; a $190-million refinancing with Goddard Investment Group to upgrade its I.M. Pei-designed Fountain Place (1445 Ross Avenue, Dallas), a 60-story office tower; $100 million to GFI Capital Resources Group to replace an $83 million loan from HSBC for 1186 Broadway (the Ace Hotel) and the adjacent 14 West 29th Street.—S.P.

33. Gregg Gerken and Roy Chin (35)

Senior Vice President and Head of U.S. Commercial Real Estate Lending; Regional Director for Commercial Real Estate at TD Bank

Under the leadership of Messrs. Gerken and Chin, TD Bank officials said the bank improved its efforts to consolidate metropolitan coverage and target larger clients such as real estate investment trusts, funds and multifamily mortgage providers.

Mr. Gerken said that as a group, “new business commitments” increased 29 percent to $5.5 billion from $4.3 billion a year ago.” He reported that new business commitments in the New York City market rose 23 percent compared with 2014 figures.

According to the Mortgage Bankers Association, TD Bank ranked seventh in loan volume with $2.92 billion in commercial real estate loans.

Among the lender’s major financing deals in 2015, the Toronto-headquartered bank provided a $95 million loan to refinance Rabsky Group’s Leonard Pointe development at 395 Leonard Street in Williamsburg, Brooklyn.—D.J.

34. Matt Galligan (31)

President of Real Estate Finance at CIT

CIT Real Estate Finance is the fifth start-up for Mr. Galligan, the four-year-old group’s president who said he gets a thrill out of creating high-performance teams. This one provides stabilized, value-add and construction loans between $20 million and $50 million to office, retail, industrial and multifamily developers. And they do perform.

In 2015 the team was responsible for such deals as a $56 million senior secured floating rate facility on the 62-million-square-foot Marketplace Center in Boston and a $16 million, 30-month loan with two one-year extension options to build a 489-million-square-foot class A industrial distribution center in South Brunswick, N.J. Mr. Galligan said his greatest achievement in 2015 was integrating the real estate departments of CIT and One West Bank.

“The acquisition allowed us to increase our portfolio from $2 billion to $5 billion and diversify the portfolio by geography, product type and size of loans.”

Looking ahead, he said, “Valuations do not have to change much for control of deals to move from the sponsor to private equity firms whose horizon is short term with a long-term asset. This is an entirely new dynamic which has to play out.”—S.P.

35. Mark Talgo (New)

Senior Managing Director and Head of New York Life Real Estate Investors

“We enjoyed a record year in 2015 with nearly $10 billion in new transactions across our commercial lending, equity, and real estate securities businesses,” Mr. Talgo said, adding that he is proud to lead such a talented team.

“New York Life Real Estate Investors has grown to over $46 billion in assets under management,” Mr. Talgo said. In April 2015 the company arranged the purchase of real estate mortgage and mezzanine loans totaling $1.4 billion, on behalf of New York Life Insurance Company, backed by industrial real estate totaling 34 million square feet within 171 properties. Recently, the team originated a floating rate loan for the purchase of Prospect Hill Office Park located in Waltham, Mass., with an initial funding of $53.5 million and an additional earn-out.

Mr. Talgo, a member of Commercial Real Estate Finance Council, the Real Estate Board of New York, Urban Land Institute and Pension Real Estate Association, joined the firm in 1985. He has a bachelor’s from Lake Forest College and a master’s in real estate from New York University.—S.P.

36. Rick Lyon and Ben Stacks (23)

Executive Vice President and Head of Commercial Real Estate; Market Manager for Greater New York Commercial Real Estate Banking at Capital One

Capital One’s portfolio of loans for commercial and multifamily real estate totaled more than $25.6 billion as of the end of 2015, an uptick from the previous year when they had a $23.1 billion debt portfolio.

A major highlight of last year for Capital One was a $180 million loan to Vanbarton Group and Metro Loft Management to convert 180 Water Street in Lower Manhattan from an office tower to a multifamily apartment building. Brookfield Asset Management also provided $60 million in mezzanine financing in the deal, which closed in July 2015.

Mr. Stacks, Capital One’s market manager for greater New York commercial real estate, oversees a portfolio of loans of approximately $7 billion, which includes a diverse asset class of office, retail and residential properties. And Mr. Lyon is the executive vice president and head of commercial real estate for Capital One.

In another gem from 2015, Capital One completed a $150 million loan to Newmark Holdings in August to refinance 40 Worth Street, a 16-story Tribeca office and retail building.

In March 2015, Capital One lent $32.5 million to Jamestown for the purchase of a six-story office building in San Francisco’s South of Market district at 731 Market Street, also known as the Bancroft Building.—L.L.G.

37. Simon Ziff, Patrick Hanlon and Russ Schildkraut (28)

President; Principal; and Principal at Ackman-Ziff

Ackman-Ziff reported $6 billion in volume for 2014, but the final totals for 2015 came in slightly below that figure as about $2 billion in deals were pushed into the first quarter of this year, including a $225 million construction loan in Manhattan and $520 million in debt and equity in Washington, D.C.

“We anticipate 2016 to 2017 will see a lot more equity recaps of overleveraged assets, which we are well positioned to execute due to our equity and structured finance focus,” Mr. Ziff said.

Among the firm’s notable deals last year, were $210 million in B-note and mezzanine debt at 184 Kent Street and $175 million in financing at a hotel, retail and condominium development at 71 Smith Street, both in Brooklyn.

Mr. Schildkraut noted that the uncertainty in the capital markets has led to financing deals taking a little bit longer to close, in particular within the commercial mortgage-backed securities space. “Pricing has widened out significantly from where it was six months ago,” he said.—D.J.

38. Thomas Hyland and David Aloise (44)

Senior Vice President and New York Market Manager; Executive Vice President and Regional Executive at PNC Real Estate

Led by Mr. Hyland, senior vice president and New York market manager, and Mr. Aloise, executive vice president and regional executive, in 2015 PNC Real Estate originated $1.45 billion in new deals in the New York metro area across 45 loans.

“One of the biggest changes in the past year has been the volatility in CMBS market,” Mr. Hyland said. “For PNC, this has led to term loan opportunities at increased spreads.”

Representative of the group’s success are two of its biggest deals in New York City: a $126 million construction loan for 510 West 22nd Street, an 11-story, 175,000-square-foot office building in Chelsea and a $154 million construction loan for 4212 28th Street, a 58-story multifamily project in Long Island City.

“PNC’s strong balance sheet gives us the opportunity, disciplined lending ensures smart decisions, but our connection and commitment to our clients to do what is needed for successful fulfillment of their financing needs is the difference at PNC,” Mr. Hyland said.—S.P.

39. Warren de Haan, Boyd Fellows, Chris Tokarski and Stew Ward (New)

Managing Directors at ACORE Capital

Messrs. de Haan, Fellows, Tokarski and Ward have been working as a team for 20 years at four successive commercial real estate finance companies, during which time they have originated 4,000 commercial real estate loans.

It’s this track record and the relationships that accompany it that have made the nascent company a success in a short amount of time.

“I don’t think anyone’s gone from zero to 90 miles an hour in five minutes,” Mr. Fellows said.

The four managing partners launched San Francisco-based ACORE, an acronym for Alpha Commercial Real Estate, in early May 2015. A few months later the private balance sheet lender made its first loan. Today, the company, with its 42 employees in four offices, has closed about 40 loans.

“We have closed or committed to $2.6 billion in loans since then,” Mr. de Haan said. “That is huge, huge volume in the market.”

The vast majority of the deals, Mr. Fellows noted, are in the $100 million or $120 million range. Most recently, the company bought a $200 million portfolio of six loans from a public entity, but Mr. de Haan said he couldn’t disclose more information by publication time.

Commercial Observer reported last month that ACORE provided $118 million in debt for Treetop Development’s acquisition of eight buildings in the Queens neighborhoods of Flushing and Elmhurst.—Lauren Elkies Schram

40. Mike Tepedino and Michael Gigliotti (New)

Executive Managing Director; Executive Director at HFF

HFF has been a major commercial real estate player around the country, but the brokerage’s New York-based Executive Managing Director Mr. Tepedino has spearheaded the firm’s increased presence in the city, and his office arranged more than $4.5 billion in debt deals last year.

“HFF’s general philosophy is we think the clients and the people in the business know what we do, and we don’t need to go around and brag about it,” Mr. Tepedino said.

Among its key New York City deals, the firm secured a $556 million construction loan for 425 Park Avenue on behalf of the borrower L&L Holding Company and GreenOak Real Estate. The firm also arranged $110 million in loans from J.P. Morgan Chase and Helaba for 180 Madison Avenue.

Mr. Tepedino originally joined HFF in 1997 from Legg Mason Real Estate Services, where he was a director. He is a member of the firm’s executive committee and leadership team, overseeing the company’s New York, New Jersey and Philadelphia offices. From 2005 to 2015 he closed more than $21 billion in transactions, according to the firm.

Mr. Gigliotti joined HFF in September 2006 from Craig Davis Properties in Cary, N.C., where he worked in acquisitions and leasing for four years. Mr. Gigliotti has been involved in $10 billion in commercial real estate transactions.—D.J.

41. Christopher LaBianca (34)

Managing Director and Head of Originations at UBS

Mr. LaBianca, who joined UBS almost three years ago, oversaw $3 billion in debt origination in 2015, roughly the same as the year prior. He attributes most of the activity to low interest rates and borrowers wanting to refinance.

“As long as you can get leverage at an attractive coupon, then [commercial mortgage-backed securities] is the product,” Mr. LaBianca said.

Last year, his team provided a $350 million loan to refinance The Davis Companies and Marcus Partners Charles River Plaza North, a research facility in Boston leased by Massachusetts General Hospital. More locally, UBS refinanced a 24-story office building at 525 Seventh Avenue in Midtown Manhattan on behalf of Olmstead Properties.

Looking ahead, Mr. LaBianca agrees with much of his counterparts in the CMBS world and said that 2016 may be a bit of a challenge.

“There’s obviously a lot of volatility in the market right now, and that volatility hasn’t even factored in the regulatory implications of what’s coming down the pike,” he said. In the meantime, Mr. LaBianca said what he can do is provide “lots of transparency with clients.”

“They have a lot of questions about the market, who is active and what people are doing, so we’re staying in front of clients and keeping them up to date,” he said.

As far as the regulatory changes go, the positive is that “what comes out of it will be a stronger industry,” Mr. LaBianca said.—D.B.

42. Steven Kohn (New)

President of Cushman & Wakefield Equity, Debt & Structured Finance

Mr. Kohn, who has 35 years in the real estate business, is the president of Cushman & Wakefield Equity, Debt & Structured Finance.

Mr. Kohn, 56, has led C&W teams in advising some of the biggest financing deals last year in New York City, including finding the $650 million refinancing of 590 Madison Avenue for the State Teachers Retirement System of Ohio. In that deal, the pricing wasn’t the real challenge but the timing was, he said.

“It’s a fundamental asset and very strong sponsorship,” Mr. Kohn said. “The time was a bit challenging in that we’re looking for financing in the last quarter of the year and volatility increased in the summer.”

But he added, “It was never a challenge about getting it financed. It was about what was the final price going to be.”

In another large transaction last year, Mr. Kohn, an alum of Bucknell University, and colleagues John Alascio, Alex Hernandez, Chris Moyer and Alex Lapidus represented affiliates of a joint venture led by Savanna in arranging fixed-rate financing of $315 million from Natixis Real Estate Capital.

Mr. Kohn and his colleagues arranged $240 million in construction financing from Brookfield Asset Management for Vanbarton Group and Metro Loft Management’s conversion of 180 Water Street from an office building to a 565-unit rental apartment tower.—L.L.G.

43. Josh Zegen (41)

Managing Principal and Co-Founder of Madison Realty Capital

Mr. Zegen, a co-founder and managing director of Madison Realty Capital, finds himself in a somewhat unique position in the commercial lending world. While many other firms have run from the volatility that gave pause to the market during the second half of 2015, he sees opportunity.

“We’re starting to see a lot of volume because of the uncertainty in the market,” Mr. Zegen said. “We’re seeing some banks and funds pulling back.”

The Manhattan-based firm reported about $1 billion in commercial real estate financing last year with most deals running anywhere from $10 million to $125 million. The firm completed another $400 million in real estate purchasing.

A large percentage of the deals come about because new regulations, like Basel III, have made it more difficult for developers to obtain condominium and construction financing so when sponsors have been unable to find new equity to close a financing deal, that is often when MRC steps in.

Among the more complicated deals MRC closed was the $107 million financing for Fortis Property Group to help fund its acquisition of the 357,000-square-foot Long Island College Hospital real estate portfolio in Brooklyn.—D.J.

44. Rex Rudy (New)

Executive Vice President, National Manager Commercial Real Estate at U.S. Bank

Mr. Rudy joined U.S. Bank in Charlotte, N.C., last May. It was, he told Commercial Observer, the defining moment of a year that included operating as left lead and administrative agent on the $580 million refinancing of the 1.1-million-square-foot Manhattan Mall at 100 West 33rd Street, the group’s largest transaction.

Mr. Rudy obtained both a bachelor’s degree and MBA from Ohio State University. Throughout his quarter-century-long career in banking, “One of the defining principles has been to do the right thing for clients,” he said: Offering neutrality when providing an analysis and recommendation, for example, or advising a client on a recast with a competitor versus a brand new transaction with his firm.

“This philosophy really drives our team to put ourselves into the shoes of our clients and make long-term decisions that will support the growth and prospects of our clients and partners.” Mr. Rudy’s team recently secured a $51 million acquisition loan for a hotel property in Southern California.—S.P.

45. Gary Magnuson and Patrick Burns (New)

Head of Commercial Real Estate Finance; Managing Director of Institutional Real Estate at Citizens Bank

Not everyone comes out stronger after a divorce, but for Citizens Bank, separating from Royal Bank of Scotland last November was emancipation (Citizens became a wholly owned subsidiary of RBS Group in 1988).

Now the Providence, R.I.-headquartered bank is an independent, publicly traded company and aspires to become a top-performing regional bank.

According to Mr. Magnuson, RBS had a “detrimental affect” on Citizens because RBS was “overweight” globally and trying to push its “real estate exposure down.”

Despite the Nov. 3, 2015, split, the Citizens’ commercial real estate finance loan originations grew by 15 or 16 percent last year with mid- to large-sized sponsors. Its outstanding debt grew to $8.5 billion at the end of 2015 from $7.2 billion at the beginning of last year. Mr. Burns anticipates the company settling into a more normalized 5- to 8-percent growth this year. The Commercial Real Estate Finance division’s sweet spot is between $25 million and $75 million loans, Mr. Burns said.

For example, last June, Citizens provided a $28 million construction loan to Jonathan Rose Companies for the residential component at BCD:A (Brooklyn Cultural District: Apartments) in Brooklyn.

In New York City alone, a market the company is looking to beef up, Citizens grew its commitments by more than 20 percent to $1.7 billion today.—L.E.S.

46. Willy Walker (29)

Chairman and CEO at Walker & Dunlop

Walker & Dunlop is a great place to work, if being listed three times as one of the best workplaces in the country by Fortune magazine is any indication.

“It’s a great group of people because of the corporate culture [and] because we put our people first,” Mr. Walker said. “We treat our clients with respect and care. We’ve been growing so fast we pay our people more and more each year.”

Last year was a big one for Walker & Dunlop.

Mr. Walker, who’s based in the firm’s headquarters in Bethesda, Md., said his firm saw, “record revenues, record EBITDA [or earnings before interest, taxes, depreciation and amortization] [and] record loan origination volumes and saw their servicing portfolio grow to over $50 billion.”

That refers to total revenues of $468.2 million, up 30 percent over 2014, and adjusted EBITDA of $124.3 million, up 47 percent year-over-year.

The number of transactions rose 56 percent in 2015 from 2014 to $17.8 billion. Walker & Dunlop did its biggest deal ever—a Freddie Mac-backed $1.3 billion 70-property portfolio refinancing for Holiday Retirement all over the U.S., which closed at the end of 2015.

The October 2015 acquisition of investment sales platform Engler Financial Services allowed for the company’s “entry into the multifamily investment sales business,” Mr. Walker said. “We want to continue to grow that business in 2016.”

Since going public five years ago, Walker & Dunlop has seen market capitalization growth exceeding $1 billion last November, up from $220 million in December 2010.—L.E.S.

47. Matthew Downs and Herbert Kolben (New)

Senior Regional Manager; Senior Vice President at Ullico’s Real Estate Investment Group

Senior Regional Manager Mr. Downs and Senior Vice President Mr. Kolben of Washington, D.C.-based Ullico—Union Labor Life Insurance Company—only lend on union-built projects; their fund currently stands at $2.5 billion, and they committed to more than $1 billion in deals in 2015.

That total included a $167 million construction loan for the development of a mixed-use retail mall and 175-key hotel in Oahu, Hawaii, the group’s biggest deal in terms of dollars.

It also committed $100 million to each of two 80/20 residential developments on the West Side of Manhattan and was designated construction administrative agent.

Last year’s biggest accomplishment, however, said Mr. Kolben, who has more than 40 years of real estate experience and is responsible for Ullico’s mortgage and real estate investments, was the birth of his granddaughter and the engagement of his daughter.

The team recently provided a $141 million construction loan on a mixed-use retail and multifamily project in Center City, Philadelphia, Pa.

“We appreciate this recognition,” said Mr. Downs, who served as New York Chapter president of the Real Estate Lenders Association National Board from 2013 to 2015. He is responsible for mortgage loan originations throughout the Northeast region. “We are only as good as the clients we work with, and we are thankful for the long-standing relationships and our clients’ support of union labor.”—S.P.

48. Brian Harris and Michael Mazzei (45)

Co-Founder and CEO; President at Ladder Capital

Originally founded in 2008, Ladder Capital, a Manhattan-based real estate investment trust with branch offices in Los Angeles and Boca Raton, Fla., completed its first full calendar year as a publicly traded company on the New York Stock Exchange after an initial public offering in February 2014. The firm has specialized in placing loans on the middle market, ranging from $5 million to $250 million in fixed rate loans or from $10 million to $75 million in for floating rate loans.

In 2015, the firm originated roughly $2.6 billion in mortgage debt during the first three quarters of 2015. Among its top deals last year was a $160 million mortgage for the Trump Organization on 40 Wall Street, a landmarked 72-story, 1.3-million-square-foot office tower in Manhattan’s Financial District.

Ladder also provided $104 million through an 18-month nonrecourse loan for the acquisition of a nine-parcel development site in Long Island City for developer Jia Shu Xu of C&G Empire Realty.

Mr. Harris said that when the securitization market became a lot more treacherous during the second half of 2015 following the devaluation of Chinese currency, “We avoided a lot of the large loans in New York,” he noted. “The single asset securitization business was kind of a rough place to be.”—D.J.

49. Daniel Harris and Kirk Lloyd (New)

Executive Vice President and Chief Lending Officer; Senior Vice President at Dime Savings Bank of Williamsburgh

Although it’s new to the list this year, Dime Savings Bank of Williamsburgh has been playing it big in New York since its founding in 1864. Under the leadership of Messrs. Harris and Lloyd, the commercial real estate and multifamily lending wing of the bank has been silently serving as one of Gotham’s most prolific lenders, hitting an origination record of $1.4 billion across roughly 400 loans in 2015.

“The market was incredibly strong in 2015,” Mr. Harris said. “Acquisitions were up and refinances continued strong, even though rates increased slightly mid-year. Since the Treasury rate increases in mid-2015 were more than reversed in the first few weeks of 2016, we expect no slowing of loan opportunities.”

While Dime primarily lends mortgages in the range of $1 million to $20 million, it will stretch for the right opportunity. Most recently, the team closed $51 million in financing for a four-property portfolio in Manhattan’s Murray Hill.

“Coming off a record year of over $1.4 billion in commercial loan originations, the Dime’s most originations over our 150 years in business, we deeply appreciate our dedicated brokers and borrowers who have worked with us to make this happen,” Mr. Harris said. “We also want to recognize our outstanding team at Dime who day in and day out bring the most competitive offerings to the market and ensure that each deal is handled quickly and flawlessly.”—D.B.

50. Mark Brown (New)

Managing Director and Head of Commercial Real Estate at Credit Suisse

Credit Suisse originated roughly $6 billion in securitized debt in 2015, according to Commercial Mortgage Alert, and is projected to do the same this year.

The largest conduits that the firm issued last year were CSAIL Commercial Mortgage Trust 2015-C3, C2 and C1, each carrying a balance of $1.42 billion, $1.38 billion and $1.21 billion, respectively, according to data firm Trepp.

Zurich-based Credit Suisse funded a portion of a $1.2 billion fixed-rate loan for Simon Property Group on The Galleria, a 2.4-million-square-foot mall in Houston. J.P. Morgan Chase led the financing, which also included funding from Barclays and Morgan Stanley.

Mr. Brown, who joined Credit Suisse in September 2013, serves as a managing director in the firm’s investment banking division in New York. He also heads the commercial real estate team within the securitized products and asset finance group.

A graduate of William Patterson University, Mr. Brown is a commercial mortgage-backed securities veteran of more than two decades. Prior to Credit Suisse, he was a senior managing director at BGC Partners. Before that, he was a founding member of 801 Capital Finance.—L.L.G.

Honorable Mention: Benjamin Miller

CEO and Co-Founder of Fundrise

Fundrise, an online real estate platform founded in 2012, is looking to shake up the marketplace.

“In the last year, our business has really evolved and at the end of last year we launched the first online real estate investment trust we call the eREIT,” Mr. Miller, 39, said. “It’s been way better than expectations and what makes it so innovative is that it’s a public REIT. So anybody can invest in it. You don’t have to be high-net worth.”

In fact, the minimum investment is $1,000. The average investment in eREIT, however, is $5,738, according to data from Fundrise’s Jan. 7 public disclosure.

One serious advantage of investing through eREIT, Mr. Miller said, is the lower fees (only a 1 percent ongoing asset management fee if the investor achieves a 15 percent annual yield), and nothing up front.

The crowdfunding platform is pacing its raise.

“We don’t want to raise too much money too quickly,” Mr. Miller said. To that end, the company has only opened half a dozen windows for a maximum investment of $2 million to $5 million, which in one recent session sold out in eight minutes.

“It’s a real innovation because it cuts a lot of costs and the middlemen out of the system,” said Mr. Miller, who co-founded the company with his brother Daniel Miller. (Daniel Miller left the company last October, as Commercial Observer reported at the time.)

Nearly 30 people work for Fundrise, based in Washington, D.C. The firm, which is active in more than 25 markets and raised a $35 million Series A funding round in May 2014, has made investments in 3 World Trade Center and the new Ace Hotel Pittsburgh.—L.E.S.