Prime Finance Lends $230M for National Multifamily Portfolio Buy

By Danielle Balbi March 29, 2016 11:30 am

reprints

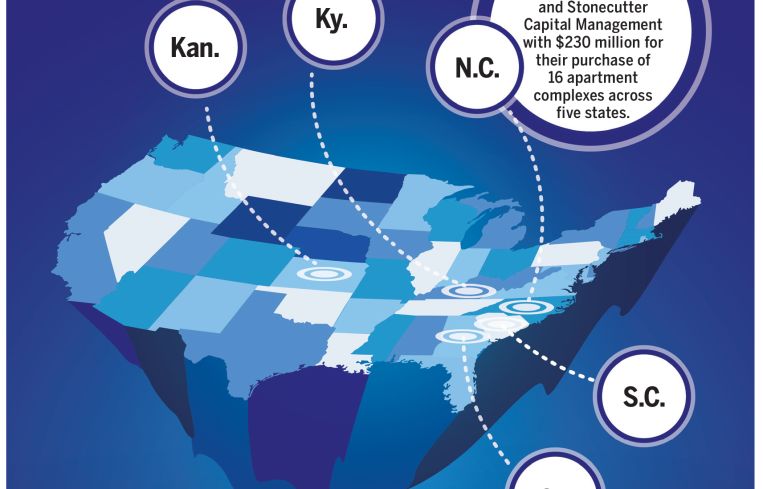

New York-based lender Prime Finance provided a joint venture between Providence Management Company and Stonecutter Capital Management with a $230 million mortgage to fund the purchase of 16 apartment complexes across five states, Commercial Observer can first report.

Law firm Polsinelli represented Prime in the transaction and helped arrange the three-year bridge loan, which also carries two one-year extension options. Prime originated the funds from its fourth fund.

The partnership between Illinois-based Providence Management and New York-based Stonecutter Management is using the funding toward its purchase of 3,800 units in Georgia, Kansas, Kentucky, North Carolina and South Carolina. Of the total $230 million in debt, $20 million is being used for “future advances” or upgrades on the properties, said Maribeth McMahon, one of the lawyers from Polsinelli who worked on the deal.

“We are thrilled to have been able to provide Stonecutter and their partner with financing on this portfolio acquisition,” Jon Brayshaw, the founder of Prime Finance, told CO via email. “Our loan was designed to both finance the acquisition as well as provide capital to help pay for a significant capital improvement program at the properties.”

Both the sale and the financing closed on March 17. The total sale amount was not immediately available.

Given the number of properties and states involved in the transaction, it wasn’t all smooth sailing when it came to finalizing the debt. Different legal jurisdictions and real estate practices made things a little more complicated.

“When you have a multi-property deal like this you have to take into account some of the different laws in different states such as foreclosure laws, and you also, for example, have to get title insurance on all these different properties,” Ms. McMahon said.

The properties include 8000 Waters Apartments at 8000 Waters Avenue in Savannah, Ga.; Colt’s Crossing Apartments at 159 Elkhorn Meadows Drive in Georgetown, Ky.; Brookwood Apartments at 1770 South Rock Road in Wichita, Kan.; Elements on the Park at 10019 Plum Creek Lane in Charlotte, N.C.; and Hunt Club Apartments at 1000 Hunt Lane in Spartanburg, S.C.

In one state in particular there were some environmental issues that presented a challenge.

“In South Carolina there were tremendous floods last fall, so there was some flood damage at some of these properties,” Ms. McMahon said. “Whenever you deal with this number of properties, there’s going to be some odd things that come up.”

Providence Management has been in operation since 1986 and owns and manages multifamily residential communities across the country. Stonecutter Management was founded by Scott Zucker and Robert Kunzweiler in 2012 and invests in multifamily, mixed-use and industrial properties.

Representatives for Providence Management and Stonecutter did not respond to inquiries for comment.