Stat of the Week: 25.7 Percent

By Richard Persichetti January 27, 2016 2:19 pm

reprints

The Park Avenue submarket had the greatest performance of the 20 Manhattan office submarkets in 2015. Increased demand led to a 420-basis-point year-over-year decline in the vacancy rate to 9 percent. The next closest submarket was Greenwich Village/Noho with a 350-basis-point drop. Overall absorption totaled positive 1.2 million square feet, and accounted for 36.1 percent of the positive absorption in Midtown. Total leasing activity was robust with 2.9 million square feet leased or renewed, which, as stated in last week’s column, accounted for 13.3 percent of the Park Avenue total inventory, tops in Manhattan.

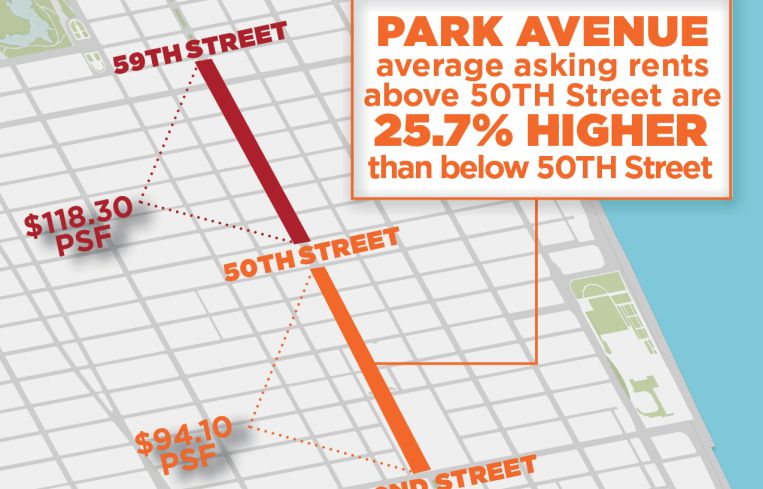

Asking rent increases were also solid in 2015, as direct Class A asking rents jumped 6.4 percent to $99.03 per square foot. Despite the average asking rent reaching above $99 per square foot for the first time in 81 months, rents are still 19.9 percent off historical highs for this submarket, when the average was $123.75 per square foot in 2008. When examining the Park Avenue submarket—which includes all office buildings along Park Avenue from 42nd to 59th Streets—there is a true division of the building stock below and above 50th Street.

Buildings above 50th Street along Park Avenue demand a premium and direct average asking rents are 25.7 percent higher than buildings below 50th Street. For buildings north of 50th Street, direct asking rents averaged $118.30 per square foot at the end of last year, up 12.6 percent from 2014. Asking rents in these buildings range from $75 to $181 per square foot. For buildings south of 50th Street, the direct average asking rent reached $94.10 per square foot, a 9.1 percent year-over-year increase. Asking rents in these buildings range from $64 to $145 per square foot. The vacancy rate for buildings above 50th Street is tightening, down 270 basis points in 2015 to 6.7 percent, while the vacancy rate in buildings below 50th Street dropped significantly last year, 760 basis points to 11 percent.