Apollo Lends $42M on Ritz-Carlton Resort in the Caribbean

By Danielle Balbi January 25, 2016 5:30 pm

reprints

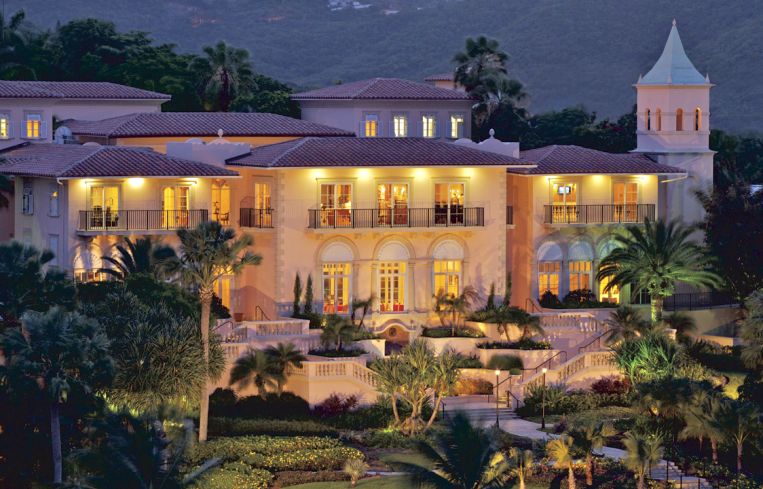

Apollo Commercial Real Estate Finance lent Ashford Hospitality Prime $42 million for its acquisition of The Ritz-Carlton, St. Thomas in the U.S. Virgin Islands, Commercial Observer can first report.

JLL Executive Vice Presidents Kevin Davis and Bill Grice arranged the two-year, interest-only financing, which carries a floating rate of Libor plus 4.95 percent. The deal also carries three one-year extension options, according to a release from Ashford, which did not name the lender.

The Dallas-based real estate investment trust purchased the 180-key resort from Marriott International for $64 million—or $355,000 per room—giving the deal a loan-to-cost ratio of 65.6 percent.

Ritz-Carlton Hotel Company will continue to manage the hotel, which has an average daily rate of $556 and an annual occupancy of 79 percent, as of November 2015. The property’s yearly revenue per available room totals $441, according to the Ashford release.

“The Ritz-Carlton, St. Thomas is a truly one-of-a-kind resort that has set the standard for luxury in the Caribbean for almost 20 years,” Mr. Davis, said in prepared remarks provided to CO.

“Under Ashford’s stewardship, the Ritz-Carlton, St. Thomas is poised to grow its position as one of the leading hotels in the Caribbean,” he added. “Further, this financing illustrates the increasing appetite that lenders have to finance strong assets in the Caribbean.”

The 30-acre oceanfront property sits on Great Bay, on the island’s east coast, and holds two pools, 10,000-square-feet of meeting space, a 7,500-square-foot spa and a 2,000-square-foot fitness center.

The resort was completed in 1996 and recently underwent a $22 million renovation of both guest rooms and communal space. Upgrades included more food and beverage offerings, expanded wedding venue space, and the installation of a power generator, which allows the Ritz-Carlton to operate independent of the island’s electricity system.

Representatives for Apollo Commercial Real Estate Finance and Ashford Hospitality Prime declined to comment.