Gemini Real Estate Auctioning Properties Worth $200M Amid Suit

By Liam La Guerre September 10, 2015 8:42 pm

reprints

Gemini Real Estate Advisors has filed a Chapter 11 bankruptcy to auction four properties worth nearly $200 million, while it’s founders are fighting in court.

The North Carolina-based firm filed with the U.S. Bankruptcy Court in the Southern District of New York yesterday, and asked for a judge to put the properties on auction through a 363 bankruptcy sale, which allows the sale of a property with a lien.

The properties involve the Jade Hotel at 52 West 13th Street, Wyndham Garden at 37 West 24th Street, Best Western Seaport at 33 Peck Slip, and a development site near Bryant Park at 36 West 38th Street. Each of the properties already had offers from buyers.

Bridgeton Holdings was seeking to purchase the 113-room Jade Hotel for $78 million and the Wyndham Garden for $57 million. Morning View Hotels, a firm from California, has a bid of $37.3 million for the Best Western Seaport. And Hansji Corp. offered $25.5 million for the development site. The auction could begin in November pending judge approval.

“Given everything that was going on in the world with interest rates, we anticipated that 2015 would be good to sell,” Gemini president Dante Massaro told Commercial Observer. “Our instincts were right.”

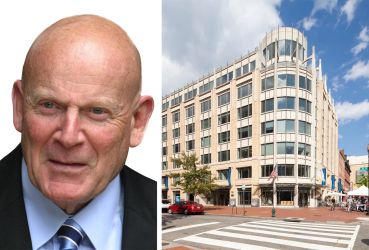

Among possible bidders will be Gemini’s former president, William Obeid, who is suing both Mr. Massaro and their other co-founder, Christopher La Mack. The trio founded the real estate company in 2003. Each founder shared one-third interest in the company.

But in 2013, Mr. Obeid, who was the face of company and ran the successful hotel division, felt he should get more of the pie. After telling his co-founders how he felt, they removed him from the role as president of the company and “set out to destroy the hotel division,” according to Mr. Obeid’s lawyer Stephen Meister.

Mr. Obeid filed a lawsuit against Mr. La Mack and Mr. Massaro last year and put lis pendens, which is a filing with the court that shows there is a lawsuit regarding title of land pending, on the properties.

Mr. Massaro said they filed for bankruptcy to get the lis pendens removed so they can continue with the sales. He added that they just want to make up with Mr. Obeid.

“I think it’s unfortunate and we recently asked for mitigation for this case,” Mr. Massaro said. “I hope our former partner takes us up on that. We hope we can sit down and work things out even though it’s been a long time.”

But Mr. Meister disagrees, and said he has not heard of any request to meet and mitigate the lawsuit.

He claims that in a meeting earlier this year he proposed that the company put the properties on auction so his client could also receive the benefit from the highest bid, and he would remove the lis pendens. However, Mr. Massaro also asked that he drop the lawsuit in exchange, which Mr. Meister declined.

“I told the [bankruptcy] judge this is very odd, because they are claiming that this is an emergency, but I proposed the very same thing,” Mr. Meister said. “Now they are going to get an auction without canceling the lawsuit, like I proposed. Why didn’t they do that before?”