Stat of the Week: 190 Basis Points

By Richard Persichetti April 21, 2015 10:55 am

reprints

April is here, which means the start of spring, warmer weather, and one of my most favorite times of year—baseball season. As a New York Mets fan, it is tough to compete with the New York Yankees’ 27 championships, but with a 35-19 record on opening day, at least my Mets claim the best opening day winning percentage in the major leagues at .648.

At the start of the 2015 season, the real estate market might seem like it is in a slump with over 1.7 million square feet of available space added during the first quarter. This is not something new for the current recovery cycle, and despite the rough start, I expect the season to turn around like it has in previous years.

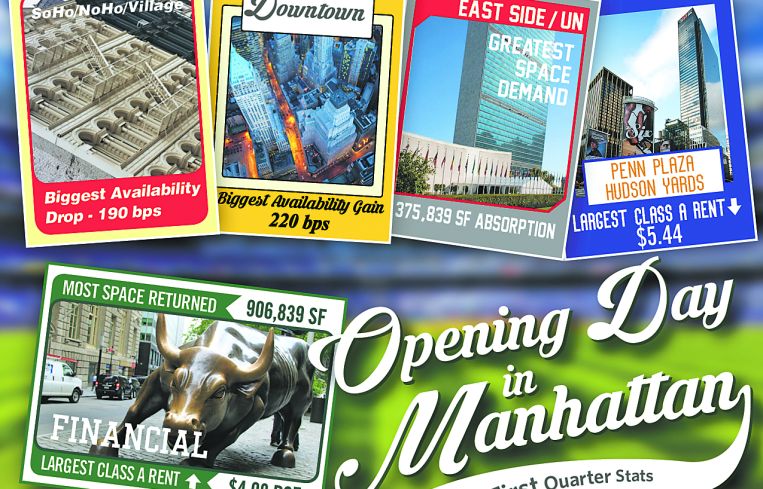

So, let’s take a look at some of the homeruns and strikeouts of the first quarter:

Biggest Availability Drop

Soho/Noho/Village availability dropped 190 basis points during first quarter led by Facebook’s 80,000-square-foot expansion at 770 Broadway.

Biggest Availability Gain

All three Downtown submarkets had an increase of at least 190 basis points due to eight buildings bringing a total of 2.1 million square feet to the market, causing the Downtown availability rate to jump 220 basis points.

Greatest Space Demand

East Side/UN posted positive 375,839 square feet of absorption, fueled by three leases totaling 330,303 square feet in two buildings.

Most Space Returns

The Financial submarket returned 906,193 square feet of space to the market, led by 1.2 million square feet returned at 28 Liberty Street and 55 Water Street.

Largest Class A Asking Rent Increase

Financial increased by $4.98 per square foot to $53.38, mostly due to the influx of space added to the market. To avoid being completely redundant, Flatiron/Union Square also had a $3.43 jump bringing rents in that hot submarket to $87.17, the fifth highest asking rents in Manhattan.

Largest Class A Asking Rent Decrease

Penn Plaza/Hudson Yards asking rents fell by $5.44 per square foot to $62.78. This is not because of a softening market, but because of Markit’s 139,332-square-foot lease drastically reducing the amount of direct space in the submarket.

Although these are the current stats, similarly to baseball season after opening day, there are still 161 more games left to turn the season around.