Eastern Union Funding Tracks Surge in Brooklyn Transactions

By Danielle Schlanger December 1, 2014 3:39 pm

reprints

Brooklyn has yet to burn out, according to new statistics on funding released by Eastern Union Funding, the borough-based commercial mortgage brokerage firm.

According to a press release issued by the company, Eastern Union Funding has recorded $662,703,219 in transactions in the borough to date, compared to $639,603,001 in transactions in 2013. This amounts to a projected 250 closed Brooklyn transactions this year alone (there are currently 232 completed).

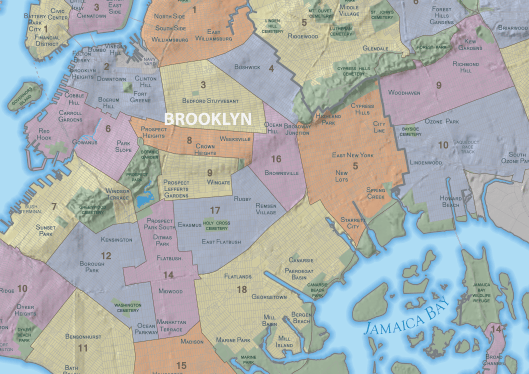

Abraham Bergman, a managing partner and founder of Eastern Union Funding, told Commercial Observer that all of Brooklyn’s distinct, smaller sub-markets “are doing very, very well.” He said that rents were climbing significantly in Bushwick, as well as in Park Slope, North Slope and Sunset Park.

“Even in Sheepshead Bay and Brighton Beach, they haven’t seen the same type of increase [as other areas in Brooklyn], but they have seen a spike in rent,” said Mr. Bergman.

In addition, “there have been a lot of acquisitions,” Mr. Bergman said. “A lot of older buildings are being purchased and rehabbed.”

This year, the firm has arranged funding for multi-family properties on Avenue O, Harman Street and McDonald Avenue, a 42-unit luxury building located in North Williamsburg and a construction project on Box Street, among others.

When asked his predictions for 2015, Mr. Bergman said he anticipated a scenario much like the current one.

“We’ll continue to see a lot of activity in this market,” he said. “I think Bushwick will continue to do very well [and] Williamsburg, both north and south, will continue to do very well.”

Mr. Bergman also stressed Greenpoint’s good real estate fortune and the opportunity there.

“Greenpoint is seeing a very large construction boom,” he said. “[It] has huge potential and will continue to improve. There’s quite a number of projects slated to start construction in Greenpoint.”