Report: Ground Retail Rents Rise Along 13 of 17 Corridors

By Tobias Salinger October 30, 2014 12:30 pm

reprints

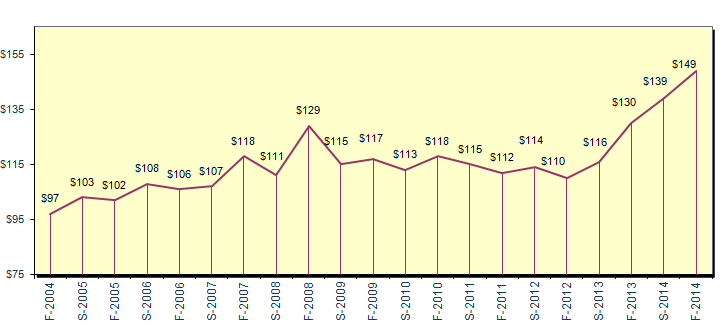

Median retail asking rents in Manhattan grew eight percent in the last six months and 12 percent over the past 12 months, according to the latest biannual retail report released this morning by the Real Estate Board of New York.

Median retail asks for all kinds of spaces now run for $104 per square foot versus $93 per square foot last fall, while average ground floor rents increased along 13 of 17 corridors tracked by the report. The stretch of Fifth Avenue between 49th and 59th Streets remained the most expensive retail area in Manhattan at a median asking rent of $3,500 per square foot and its closest competitor, a Times Square area that encompasses Broadway and Seventh Avenue between West 42nd and West 47th Streets, stayed in second place with a median asking rent of $2,225 per square foot, the report found.

Yet other areas of Manhattan have also seen large gains in their ground-floor asking rents in the past six months, the report says. Average asking rents jumped 23 percent in the Flatiron District along Fifth Avenue between 14th and 23rd Streets to $403 per square foot from $329 last fall, while Madison Avenue between East 57th and East 72nd Streets saw asks grow 24 percent to $1,709 per square foot from $1,380 in the past 12 months. And average Herald Square asking rents have bulged by 21 percent to $891 per square foot from $738 per square foot in the fall of 2013, figures from the report show.

New leases announced over the summer such as the move by Saks Fifth Avenue and its parent company to Brookfield Place, the announcement that Neiman Marcus will anchor the Shops at Hudson Yards and the potential first brick-and-mortar store for Amazon.com on West 34th Street show how retailers are eyeing new bigtime tourist and office tenant draws, said Steven Spinola, president of REBNY.

“Higher retail rents have become concentrated around major attractions like the World Trade Center campus and Macy’s flagship store, which maintain high visibility and foot traffic,” Mr. Spinola said in a prepared statement. “Continued growth in retail demand and diminishing supply are driving up asking rents, particularly along Madison Avenue and around Herald Square. The city’s leading retail brokers who comprise our retail advisory group also tell us that retailers are increasingly looking to have a hand in shaping the city’s vibrant retail landscape in order to drum up excitement around their growing brands.”