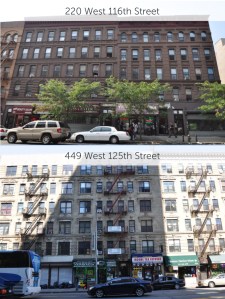

Springhouse Partners Nabs Two Harlem Buildings for $15.4M

By Lauren Elkies Schram and Gus Delaporte July 9, 2014 3:30 pm

reprintsSpringhouse Partners has scooped up two mixed-use primarily rent-stabilized buildings in Harlem from Teaneck, N.J.-based Treetop Development for $15.4 million, Commercial Observer has learned.

One of the buildings is a 46,080-square-foot, five-story, 40-unit walk-up at 220 West 116th Street between Adam Clayton Powell Jr. and Frederick Douglass Boulevards. The other building is a 16,382-square-foot, six-story, 19-unit walk-up at 449 West 125th Street between Morningside and Amsterdam Avenues. The seven retail spaces in the two buildings are occupied by a Petopia pet supply store, a pharmacy, a daycare center, a beauty salon, as well as other businesses.

The buildings are located in close proximity to Columbia University and Springhouse Partners was attracted to the portfolio due its location, as well as the neighborhood’s strong retail corridor and continuing gentrification, said Adam Verner, the president of Springhouse Partners.

Springhouse Partners has focused much of its recent activity on the Brooklyn market. As previously reported by Commercial Observer, the firm partnered with Avenue Realty Capital in the $18.2 million acquisition of 902-908 Bedford Avenue last fall.

Treetop Development “was able to generate a significant return for investors in less than two years, while the buyer can look forward to significant rental upside on two continually strengthening retail corridors,” said Victor Sozio, vice president of Ariel Property Advisors, in a prepared statement. He and colleagues Shimon Shkury, Michael A. Tortorici and Jesse Deutch represented both sides in the deal.

The two buildings, which Treetop Development bought in November 2012 for $8.8 million, underwent extensive renovations in the 1990s.

“Value added multifamily buildings in Upper Manhattan are in high demand and this transaction and the high internal rate of return illustrates the strength of this market,” said Adam Mermelstein, a principal of Treetop. “With the sale of these properties, we’ve now sold more than 200 units in 14 buildings in the Upper West Side in the past three months. This investment strategy has us well positioned to pursue several new acquisition opportunities in this market in the second half of 2014.”