CBRE Report: Manhattan Office Market on Pace for Record Year

By Tobias Salinger July 15, 2014 12:00 pm

reprints

After a first half of 2014 with 15.5 million square feet of leasing activity, the Manhattan office market is maintaining a pace that could net the most new leasing since 2000, according to new data released by CBRE today.

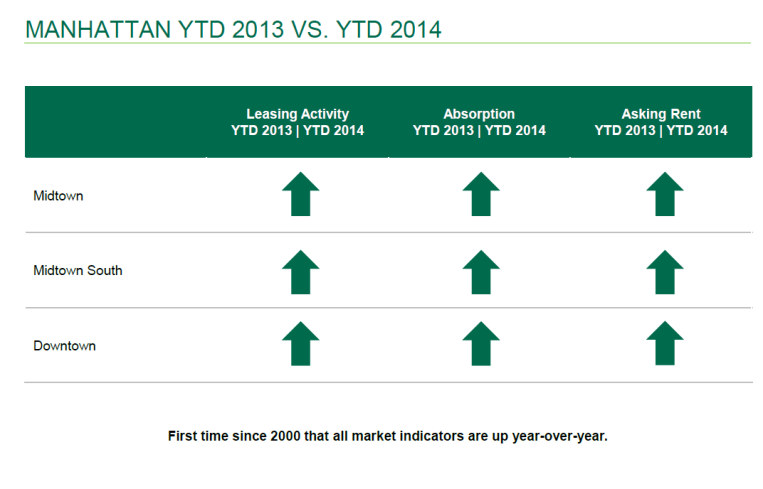

The Downtown market in particular boomed with vacant office space blocks of 250,000 square feet or greater falling from 10 at the start of the year to five in the new report, but leases, asking rents and absorption rates increased over figures from last year in Midtown, Midtown South and Downtown.

“The second quarter is the first quarter since 2000 that all major indicators in Midtown, Midtown South and Downtown improved year over year,” said CBRE Vice Chairman Peter Turchin in a prepared statement. “Although there has long been an impression that the Manhattan office market is a ‘zero sum game market’—one market benefits at the expense of another market—that’s not true today.”

Midtown’s average asking rent rose to $73.82 per square foot from $69.51 per square foot at this time in 2013, while those of Midtown South escalated to $66.86 per square foot from $63.44 per square foot and Downtown rates increased to $49.04 from $47.13.

The 43 percent surge in leasing in the Downtown area from 2.4 million square feet during the first two quarters of 2013 to 3.5 million square feet during the first half of 2014 erases any discussion of a so-called “glut” in the area dominated by new availabilities at Brookfield Place and World Trade Center, Mr. Turchin told a group of reporters at an unveiling event this morning.

“In January, we had 10 blocks of space, and we’re at five today,” said Mr. Turchin. “In a six-month period the number of spaces has dropped by half. I don’t think we’ve ever seen this kind of dropoff in such a short period of time.”