Starting a month or two ago, the London Interbank Offered Rate, or “Libor,” the crucial reference index for interest rates in thousands of floating-rate loans, found itself with a new sheriff in town. The change came in response to rate-fixing scandals that emerged after the financial crisis. Bankers in London, it turned out, had submitted bad information to the British Bankers Association, which announced Libor indexes that are relied upon to determine interest rates paid by many floating-rate corporate and real estate borrowers. The bad information meant that loan pricing did not accurately reflect market conditions.

As of Feb. 1, BBA no longer establishes Libor rates, having been replaced by an entity called ICE Benchmark Administration Limited, endorsed by the U.K. government. Going forward, loan documents should no longer mention Libor as announced by BBA, but instead as announced by ICE. As a simpler reference point, loan documents might instead refer to Libor as published in, say, the Wall Street Journal, to avoid confusion and uncertainty in any litigation.

But what about existing loan documents that refer to Libor quotes from BBA? Most such documents say what happens if the lender or administrative agent decides Libor is unavailable or no longer works, though some of those provisions may need to be stretched to their breaking point to apply to the present situation. A few loans might shift to prime-based pricing—usually more expensive and hence likely to lead borrowers to agree to substitute ICE for BBA. The lender may also have the right to specify a substitute reference rate. Under those circumstances, which will exist for most loans, lenders should have little trouble shifting from BBA to ICE.

However, what if the loan documents mention BBA pricing but don’t mention successors or alternatives? For example, someone may have decided to shorten the documents a bit by deleting “all that Libor boilerplate,” which never seemed to add much value anyway. Although shorter documents may sound great, that particular deletion could leave a lender without a contractual right to force a shift from BBA to ICE. What then?

Some law firm client alerts on this topic helpfully suggest that the lender should amend the loan documents to change BBA to ICE. But amendments require the borrower’s concurrence. What if the borrower and the lender are no longer friends? In that case, if a particular set of documents doesn’t contain the Libor boilerplate, the borrower could use the lender’s request for an amendment to try to change other terms in the loan documents.

The lender would then need to argue that any reference to BBA “must have” been intended to include any successor or replacement rate setting mechanism, even if the documents didn’t say that. The lender would invoke legal principles like “impossibility,” “mutual mistake,” “course of dealing” (if the borrower accepts ICE pricing for a while without objection) and “equity, fairness and justice.” The documents might also require the borrower to “generally cooperate” with future amendments. One way or another, the lender should prevail—but no one would guarantee that.

A difficult borrower might, however, argue that the borrower “negotiated for” a BBA price index, so nothing else is valid; and if BBA no longer announces Libor, then interest cannot be determined and hence need not be paid. The argument, of course, sounds absurd. It is, however, no less absurd than arguments that goal-oriented judges have, as an aberration, accepted in their efforts to keep homeowners in houses or commercial tenants in leased premises, or to protect debtors in bankruptcy.

In the rare case where a lender has a problem because the documents don’t support a simple substitution of ICE for BBA, the lender might want to “clarify” the documents quickly and unobtrusively. Or, the lender might make a conscious decision to live with any risk—probably very small—and mitigate it by establishing a clear written record that the borrower accepted a switch from BBA to ICE. The lender’s position hardly seems outrageous or inequitable, because ICE is not supposed to change the overall Libor process, just execute it more rigorously.

Stepping back from the details, what does all of this say about how loan documents should deal with future hypothetical eventualities? These documents seek to address at length every possible eventuality, however unlikely. But if attorneys cut back on some of the volume, such as deleting the Libor boilerplate, then we increase the risk that the documents won’t adequately handle some left-field event. If the courts seem reasonably capable of filling minor gaps, as seems likely here, might we get by with a more minimalistic approach to documents?

Thanks to Christopher Carolan of Seyfarth Shaw LLP, who consulted on this article.

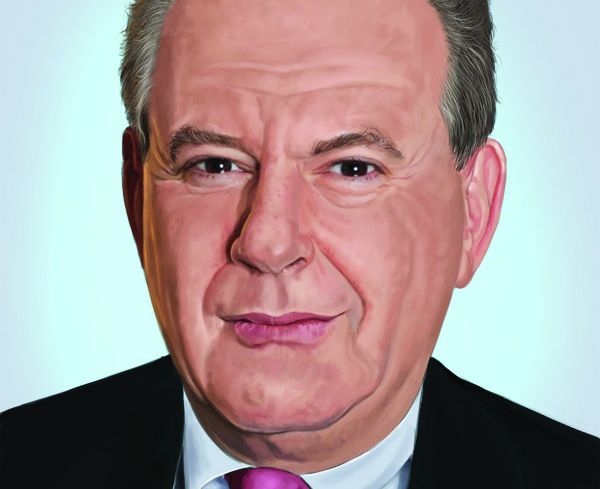

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at joshua@joshuastein.com.