Do We Really Have To Use A Delaware LLC?

By Joshua Stein March 4, 2014 10:00 am

reprints

Substantial commercial real estate loans, especially those destined for securitization, usually require the borrower to form a single purpose Delaware limited liability company to own the property. The requirement has become so prevalent that it’s just part of the territory. But why can’t we use a New York LLC? What’s so bad about New York?

For the most part, that’s the wrong question to ask. One should ask instead: What’s so good about Delaware? The answer is: plenty. And New York seems to have shown no interest in trying to emulate the Delaware example as a way to attract entity formation to the state and demonstrate New York’s new (claimed) friendliness to business. It may be too late anyway.

Delaware starts with a long history of corporate and LLC law. The legislature pays attention to issues that arise in the LLC world, resolving them when necessary. For example, in 2012, the Delaware courts had some trouble with the question of whether a managing member of an LLC owed a “fiduciary duty” to other members if the documents didn’t address the question. After a bit of judicial excitement, the legislature resolved the question for the future by saying that managers did owe such a duty but could negate it by including an appropriate waiver in the LLC’s governing agreement. New York law may not allow that.

In the course of dealing with that issue, Delaware’s highest court reaffirmed the strong principle of Delaware law that, to the maximum extent possible, the Delaware courts like to read any contract and then enforce it as written, without injecting judicial discretion (i.e., uncertainty) into their application of the words of the contract. The market seems to think Delaware courts do a better job of that than do the New York courts. (In this regard, the California and New Jersey courts exist in a whole separate universe of their own.)

Because of Delaware’s propensity to enforce the words of a contract as written, the state’s law also offers comfort on the one provision of an LLC agreement that some lenders care about above all others—the requirements that the LLC must satisfy before it can file a voluntary bankruptcy petition. If the LLC documents require approval from, e.g., an independent director, the lender will want to know that the courts will enforce that requirement.

As a result, at least for many securitized loans, the rating agencies want to see an opinion of counsel confirming that a court will probably enforce any such requirement in an LLC agreement. Delaware law firms have become very comfortable about issuing those opinions. In New York, they are not part of the territory at all.

Other miscellaneous provisions of Delaware law will often work better than similar provisions in New York. Mergers of LLCs are easier in Delaware. Although both New York and Delaware require the LLC to indemnify its managers for certain liability, Delaware defines the scope of that indemnity more broadly and more consistently with ordinary expectations. Delaware offers some flexibility and certainty in some other areas too technical to mention here. And, of course, New York has an expensive publication requirement, which can be avoided entirely if a Delaware LLC will not own property in New York.

More generally, the Delaware courts are thought to do a better job of interpreting and applying Delaware LLC law, usually in a way that matches industry expectations and the words of the statute.

Should New York consider modifying its LLC law to match Delaware’s? The idea has some appeal to it. If Delaware law works better, then perhaps New York could do its business community a favor by importing Delaware law. That idea seems unlikely to ever see the light of day, though, given the overall effectiveness and creativity of our great state’s legislative system. And even if New York adopted Delaware law wholesale, New York would still lack a court system that approaches future LLC issues the way Delaware’s courts probably will.

As a result, Delaware retains a huge competitive advantage—and marketplace lead—in the business of forming LLCs and then maintaining and updating public records of those LLCs, as well as collecting an annual fee from every LLC formed. If New York decided to capture those revenues, that would hardly move the fiscal needle in Albany, but it might make a good statement about New York’s friendliness to business.

Unless and until that happens, we should all expect to keep forming Delaware LLCs for substantial commercial real estate loans. (Thanks go to Tom Kearns of Olshan Frome Wolosky LLP, whose comments at the commercial real estate financing seminar I chaired last week contributed significantly to this month’s column.)

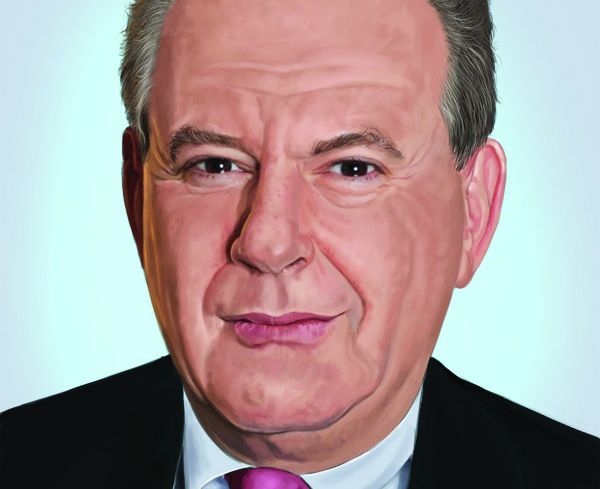

Joshua Stein is the sole principal of Joshua Stein PLLC. The views expressed here are his own. He can be reached at joshua@joshuastein.com.