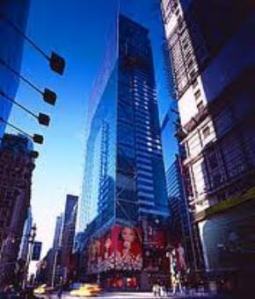

Times Square Capital Makes a Home in Times Square in a Complicated Four-Way Deal

By Karsten Strauss February 1, 2013 4:20 pm

reprints

Times Square Capital has landed at 7 Times Square, taking over the entirety of the building’s 42nd floor in a deal that saw four different parties get what they wanted.

Time Square Capital – as part of a full relocation from its headquarters at 1177 Avenue of the Americas – took 28,415 square feet of space once occupied by London-based law firm Ashurst, which had downsized to a 20,000 square foot subleased area on the building’s 19th floor once occupied by law firm Day Pitney, which also moved to a smaller space in 7 Times Square.

Times Square Capital’s agreement will keep the company in place for ten years, giving building owner, Boston Properties, the long term tenant it desired. “If anyone had changed (their minds), the whole thing would have fallen apart,” said a source familiar with the transaction.

Times Square had sought a new office in the Times Square and West Side area for over a year before settling on its new home. Negotiations began in the fall of 2012 and the deal closed in December.

Known as the Times Square Tower – or 1457 Broadway – the building was constructed in 2004, having been designed by David Childs of Skidmore, Owings & Merrill. Times Square’s new digs on the 42nd floor of the 47 floor building boast panoramic views of the surrounding metropolis. The building features about 1.2 million square feet and is located on the south side of 42nd Street between Broadway and 7th Avenue.

CBRE brokers Ben Friedland and Silvio Petriello orchestrated the deal on behalf of Times Square Capital and declined to comment for this article.

Boston Properties was represented by in-house broker Adam Frazier, who did not respond to several calls for comment on the matter. Cresa broker Marcus Rainer represented Ashurst in its negotiations. He did not respond to a call for comment by press time.