9 West 57th Street, Others Across Fifth, Command Highest Rent in Manhattan

By Jotham Sederstrom November 6, 2012 7:30 am

reprintsThe Madison/Fifth Avenue submarket has the most expensive office space in Manhattan and the highest vacancy rate in Midtown, as the owners of its trophy buildings hold out for top-dollar rents.

“The reality is that for tenants who want to have [a] premier office environment with premier views of the city, there’s no such thing as pre-recession or post recession,” said Scott Panzer, vice chairman of Jones Lang LaSalle, who has the task of signing up tenants for one of the biggest vacancies in the city, at 9 West 57th Street. The owner of that building, Sheldon Solow, is looking to get rents as high at $200 a square foot, more than twice the average for the district and more than three times that for all of Manhattan.

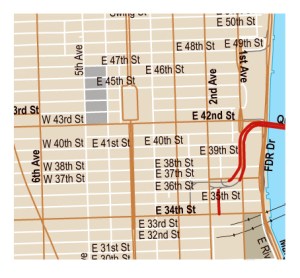

The 50-story tower, known for its concave-sloping black glass façades and the fat red numeral 9 on the 57th Street sidewalk, is about one-third vacant, according to JLL’s website. Available spaces range from 3,210 to 247,400 square feet.

The vacancy stems from Bank of America’s move from the 1.4-million-square-foot building to 1 Bryant Park, which opened in 2010. Cushman & Wakefield estimates that 9 West 57th Street accounted for 2.8 percent out of the 15.4 percent vacancy rate in the submarket in the third quarter and added almost $15 to the area’s average asking rent, which was $95.01.

Mr. Panzer said a plan to divide some floors into pre-built spaces suitable for smaller financial firms such as hedge funds is producing results. Within the past 30 days, he said, a private equity firm completed a deal for a space on the 49th floor at “just under $200 a foot,” and a private family fund just signed up for a pre-built on the 31st floor at $190 a square foot.

The building offers “first-rate” power and cooling systems and efficient floorplates with very few columns—”a tribute to Sheldon’s forward thinking,” Mr. Panzer said. “The upper floors have unprecedented iconic views north, south, east and west.” The rentals in lower part of the building are significantly lower and competitive with other iconic buildings in the area, he said.

“The building always has a fair amount of interest and activity, and we have more activity that we didn’t have before,” Mr. Panzer said. “We show the building no less than seven or eight times a week for space above the view” and “two to three times a week” for the lower floors.

For Manhattan as a whole, financial services tenants represented only 11 percent of new leases for the quarter, according to a report by the tenant advisory firm Cresa. Leasing has been slow prior to the election, which will help settle U.S. economic, tax and regulatory issues affecting financial firms, said CBRE Vice Chairman Stuart Eisenkraft. Mr. Panzer predicted a spate of leasing activity in Midtown in the new year, once the implications of the election are clear and tenants start to focus on their space needs.

“All of those buildings are holding their values, and landlords are being patient in those markets about renting space,” Mr. Panzer said. “Until we get through this election period, no one’s really going to pull the trigger until they understand how the world’s going.”