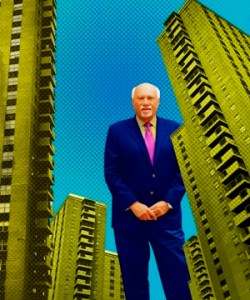

Wells Fargo’s Alan Wiener: Massive Multifamly Biz and Unwelcomed Guests

By Carl Gaines May 30, 2012 12:03 pm

reprintsAlan Wiener called the whole thing “weird.” And for several reasons it was a somewhat unusual scenario—two bus loads of folks from the Bronx 99% Spring, an Occupy Wall Street offshoot, gathered on his lawn Saturday April 14, 2012, a beautiful spring day. The buses had pulled up to the private drive leading to his Rye home as men, women and children took the short walk to Mr. Wiener’s property (click through to the end to read the letter the group left him).

Heidi Hynes, a spokeswoman for the group, told The Mortgage Observer that they chose Mr. Wiener “because he’s in charge of multifamily mortgages and because the Bronx is filled with multifamily housing.” Also, she said, he lives in Rye, which wasn’t far to travel. According to Ms. Hynes, Mr. Wiener is part of the predatory banking system that had over-financed mortgages and then received bailout money from the government, even as programs for poor kids in the Bronx were cut.

Here’s where it gets weird, at least somewhat. Mr. Wiener, as group head of Wells Fargo Mulitfamily Capital and a 2012 Power 100 award winner, is inarguably part of a massive banking system. He’d be the first to tell you that the bank did roughly $6.5 billion of permanent multifamily lending last year, making it the largest such lender in the country.

The bank also sat atop the Mortgage Bankers Association’s list of commercial real estate/multifamily finance firms for 2011 in a vast number of categories, including the broad category of total originations. In the New York tri-state area, tucked among these originations are all the projects one would expect—like the $525 million Wells Fargo provided for Gotham West. It held $150 million.

But the bank also originated a $531 million Freddie Mac loan to refinance Starrett City in 2009, keeping 5,881 housing units affordable for another 30 years. Upcoming this year, in a deal that he anticipates will close by late summer, is an intended $600 million loan to refinance the Bronx’s Co-op City, which would keep its 15,000 units affordable for another 35 years.

Adding to the weirdness factor, Mr. Wiener served for several years in the late ‘70s and early ‘80s as the New York director for the U.S. Department of Housing and Urban Development, during which time the agency insured and funded over 50,000 new and renovated multifamily units.

As part of the Wells Fargo system, Mr. Wiener’s dominion is vast and the result of the bank’s long-standing role as a big commercial real estate lender. “We’re a huge real estate bank,” he told The Mortgage Observer recently in his office. “Our philosophy is who we lend to. If you look at the downturn in ’08, Wells fared fine. And why did it fare fine? Because of who we lend to. We actually like to get paid back.”

Today that means financing deals for the likes of the Gotham Organization, Starwood, Blackstone and the Related Companies—all organizations able to see an upside to building ever-popular multifamily housing in New York City, where the 421-a tax abatement means most rentals go up as 80/20 projects.

Mr. Wiener said that Wells Fargo has a large pipeline of 80/20 program developments going into 2012 and 2013 and that they’re “with the normal guys you’d think we’d do business with.”

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)