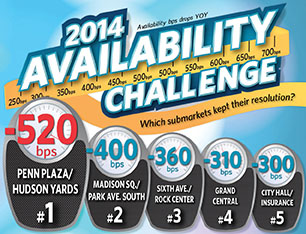

Ah January… single-digit temperatures, New Year’s resolutions and the annual REBNY gala. This year marks the 119th New York real estate event, and in honor of the gala and this year’s six honorees, it’s time to hand out awards. The Stat of the Week awards will go to the submarkets that kept their 2014 resolutions and shed the most basis points off availability. In a year where the Manhattan office availability rate dropped 160 basis points to 9.3 percent, 14 of the 17 submarkets tracked by DTZ had declines in the available supply. Out of these 14 submarkets, five had drops in availability of 300 basis points or more in 2014. They also averaged a combined $4.68 per square foot increase in overall average asking rents—49.6 percent higher than the other 12 submarkets combined. So let’s take a look at the “biggest losers” of 2014.

Ah January… single-digit temperatures, New Year’s resolutions and the annual REBNY gala. This year marks the 119th New York real estate event, and in honor of the gala and this year’s six honorees, it’s time to hand out awards. The Stat of the Week awards will go to the submarkets that kept their 2014 resolutions and shed the most basis points off availability. In a year where the Manhattan office availability rate dropped 160 basis points to 9.3 percent, 14 of the 17 submarkets tracked by DTZ had declines in the available supply. Out of these 14 submarkets, five had drops in availability of 300 basis points or more in 2014. They also averaged a combined $4.68 per square foot increase in overall average asking rents—49.6 percent higher than the other 12 submarkets combined. So let’s take a look at the “biggest losers” of 2014.

#5 City Hall/Insurance: Availability dropped 300 basis points to 7.8 percent and is the lowest of the Downtown submarkets. Overall asking rents jumped $6.44 per square foot to $44.13, the highest out of the top five submarkets.

#4 Grand Central: This submarket still has the highest availability rate of all the submarkets, but slimmed down by 310 basis points to 12.2 percent in 2014. Overall asking rents increased $3.58 per square foot to $68.06.

#3 Sixth Avenue/Rock Center: This area benefited from being the only submarket to post positive absorption over the last seven quarters, and made the most of it in 2014, as the availability rate decreased by 360 basis points to 8.1 percent. Overall asking rents had modest growth, up $1.31 per square foot to $79.40.

#2 Madison Square/Park Avenue South: The lone Midtown South representative had a 400-basis-point loss in availability to 6.6 percent, the second lowest rate in Manhattan. Overall asking rents also jumped $5.85 per square foot to $64.89, surpassing the previous historical high by 14.2 percent.

#1 Penn Plaza/Hudson Yards: The Penn Plaza/Hudson Yards submarket was the hottest submarket of 2014, as the availability rate shed 520 basis points to 7.4 percent. A good portion of this drop can be attributed to the five new leases greater than 100,000 square feet signed in this submarket last year, the most out of any Midtown submarket. It also had the second highest jump in overall average asking rents in Midtown, up $6.21 per square foot to $61.22.

Richard Persichetti is vice president of research, marketing and consulting at DTZ.