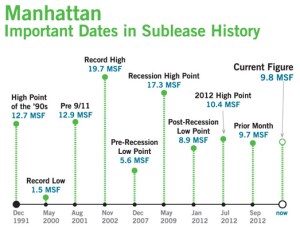

After easing in both of the previous two months from its 2012 high of 10.4 million square feet in July, overall sublet availability reversed course to close October at just over 9.8 million square feet. Interestingly, this is almost exactly the monthly average, going back nearly 21 years, of just under 9.9 million square feet.

Though there has been talk of Sandy-displaced Downtown firms taking at least some of the “plug-and-play” sublet space available in Midtown, it likely will not make much of a dent in the figure. At this point, many tenants with multiple offices are finding a way to desk-share at another location or work from home.

There is a certain similarity to the early 2000s playing out today, although in not quite as extreme a way. In 2001, Manhattan was entering a recession just when the dot-com bust occurred, and thus by August of that year, total sublet availability had already soared to 12.9 million square feet from its low point (since the early 1990s) of 1.5 million square feet in May 2000. Not long after 9/11 (in November 2002, to be exact) the figure topped 19.7 million square feet. Many tenants who were displaced due to 9/11 relocated at least temporarily to plug-and-play space either in Midtown South or Midtown.

During the most recent downturn, sublet availability jumped to 17.3 million square feet (in May 2009) from its post 9/11 recovery point of just over 5.6 million square feet in December 2007. By January of this year, it had fallen to 8.9 million square feet—and though it has bounced around since that time, it remains almost 1 million square feet higher than it was at the beginning of the year.

The sublet climb has occurred in all three major submarkets. That said, 70 percent of the sublet space on the market today is essentially from 34th Street north to 62nd Street—i.e., Midtown Manhattan. A big part of the problem is the continued cutback in employment within financial services (though it is certainly not the only industry adding to the sublet woes). With the election now behind us, but the fiscal and regulatory cliffs still ahead, it may take at least a few more quarters to work off this sublet fat.

Robert Sammons, Cassidy Turley