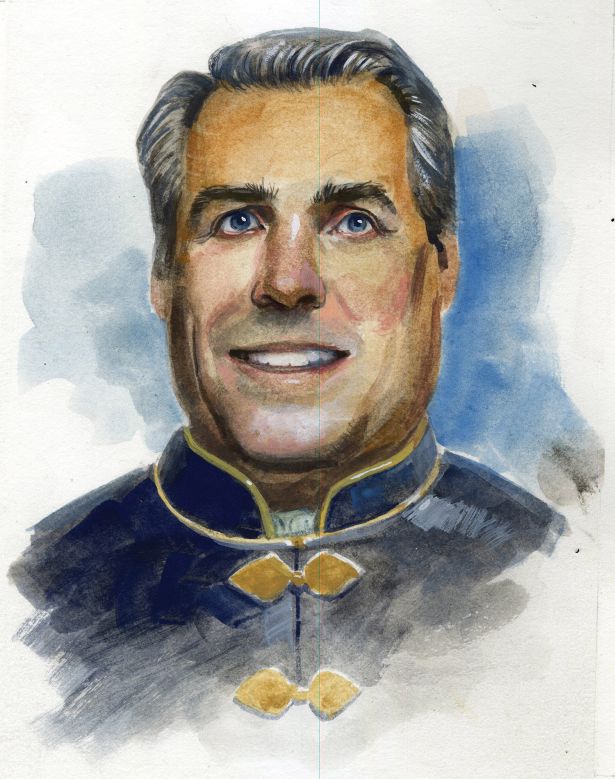

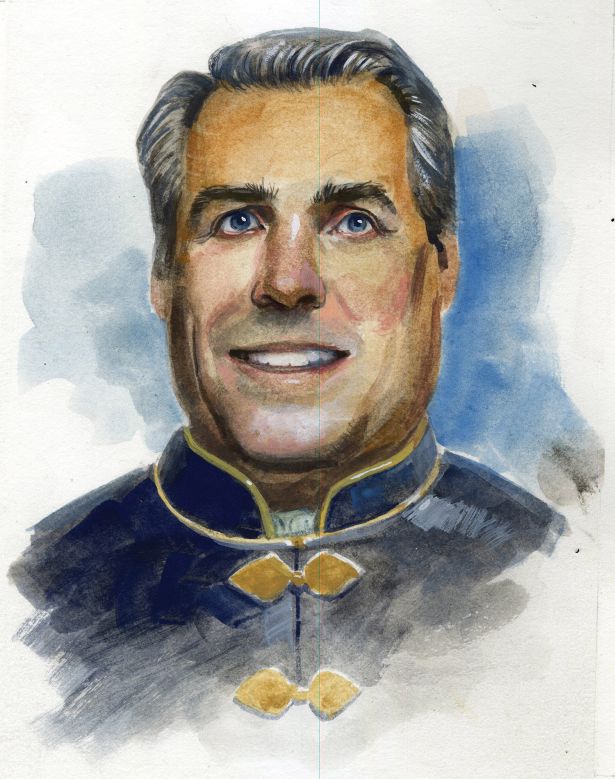

Justin Kennedy

Co-Founder at 3650 REIT

Where in the capital stack are you most comfortable playing today, and where are you finding the best lending opportunities?

More than ever in today’s environment, CRE credit risk and relative value must be assessed on an asset-by-asset basis. Even before new stress added by current rates and spreads, CRE markets across regions, property types and specific property attributes were grappling with material shifts in post-pandemic space demand. This “high variance” — good for some, bad for others — environment demands a property specific approach to leverage levels, loan terms and pricing. In general, however, amid current market and liquidity conditions discussed below, senior credits are offering the greatest risk-reward premium from prior market levels.

What’s your take on an impending recession? How bad might it get, and what are the silver linings (if any)?

This is obviously a hugely complex question that can only be addressed at the highest level. As the recent November jobs report displayed, the U.S. economy and financial market remain surprisingly resilient in the face of the Fed’s dramatic swerve to restrictive policy.

Yet, as Chairman Powell made fairly explicit, ongoing strength likely means that rates are going higher and for longer than many “pivot” believers had hoped. Resilience in the broad economy aside, however, financial conditions are extremely tight, especially as related to foundational credit in mortgage and asset-backed lending markets that are critical to leverage-sensitive sectors such as housing, CRE and autos. With these sectors in rapid slowdown and layoffs announced at a growing number of firms, it is hard to imagine a “soft landing” scenario. The only silver lining we can clearly identify today is that the U.S. remains the strongest of any large economy.

When will we reach the bottom of the market, and when will we see a thawing in the debt markets?

Calling bottoms in market corrections is a tall order, but clearly we aren’t there yet.

Liquidity has contracted materially in our markets, and financial conditions are plainly more restrictive than primary indexes indicate. While the dramatic rate increases and equity markets selloff have generated some early signs of cooling demand, this has zero direct impact on the structural supply-side constraints contributing much of the current inflation momentum. As such, rates are going higher. Indeed — adding to near-certain continued retrenchment in asset values — the scale and pace of Fed tightening injects material dislocation risks (e.g. the U.K. Gilts/LDI meltdown) across global financial markets. The Fed reports it is carefully monitoring liquidity and market function; let’s hope very carefully! As to debt markets thawing, that seems unlikely until we see material evidence of inflation cooling and the Fed turns the focus to boosting liquidity in foundational credit markets.

What keeps you up at night, and what helps you sleep?

Well, in addition to hoping the Fed is laser-focused on market functioning and liquidity, I also wonder how they see the exit ramp from restrictive policy. They say 2 percent PCE. Yet, they simultaneously caveat (correctly) that restrictive monetary policy only acts to curtail aggregate demand and has no direct impact toward actual resolution of the supply-side constraints driving much of the current inflation momentum. Indeed, they leave out the part that high rates and tight lending markets make the investment necessary to solve many supply-side problems more difficult and expensive to finance. Beyond the Fed, it doesn’t help that fiscal and regulatory policies are contributing to many supply-side constraints. As to heartening thoughts, I find comfort in the financial system appearing by most measures far less levered than in 2008, as well as the U.S. retaining its “least dirty shirt” attractiveness for global investors relative to other large markets.

Lighting Round: Would you rather…

Run a marathon or swim in the Gowanus Canal?

Two marathons!

Be a contestant on “American Idol” or be a contestant on

“Survivor”?

“Survivor” is much more relevant to today’s market

Work remote 100 percent of the time or work in an office 100 percent of the time?

100 percent office.

Sit in L.A. traffic for two hours or sit in a stalled NYC subway car for 30 minutes?

L.A. all day!

Fight 100 duck-size horses or one horse-size duck?

One is preferable to 100.

Work in a Michelin-starred kitchen or work in a McDonald’s?

Depends on the job!

Refinance a Class B office property or be locked in a room for a month with Vladimir Putin?

Depends on which Class B office!

Do a 30-day all-haggis diet or extend a suburban mall loan for three years?

Again, depends on the mall!

Lend on the New York office sector, or take a job as a septic tank repairman?

Ah, this one is different. As a sector bet, have to go with septic repair!

Traverse Jurassic Park on foot, or relive 2008?

2008. We already know the way.