Presented By: Keyway

Keyway CEO Matias Recchia on Why Public Data is the Future of Rental Pricing

As the recent RealPage lawsuit underscores the risks of relying on non-public data for rental pricing, tools like KeyComps are leading the way in promoting transparency, fairness and competition. For real estate teams, embracing public data isn’t solely about avoiding legal risks—it’s about building a better, more equitable future for the multifamily rental market.

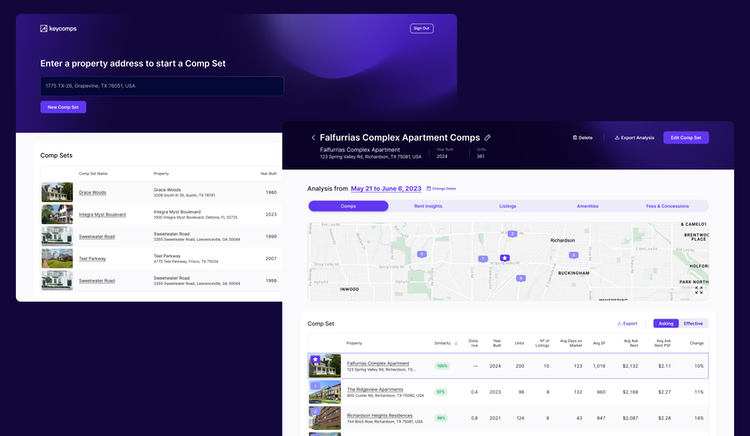

We spoke with Matias Recchia, Co-Founder & CEO of Keyway, the VC-backed AI-powered platform, about the RealPage lawsuit, the importance of public information in driving rental data, the future of data analytics and technology, and how cutting-edge tools like KeyComps are helping real estate teams stay ahead.

Commercial Observer: Can you explain the background of the RealPage lawsuit and why it’s significant for the real estate industry?

Matias Recchia: The RealPage lawsuit is a wake-up call for the real estate industry. The U.S. Department of Justice (DOJ) alleges that RealPage facilitated price-fixing among landlords through its property management software. The software reportedly used competitors’ non-public rental data to recommend rental prices, which allegedly enabled coordination among landlords that potentially hurt competition and inflated rents.

This case is significant for several reasons. First, the case underscores the growing reliance on data and AI in real estate operations, particularly in rental pricing. Second, the case highlights the risks of using proprietary, non-public data to influence pricing decisions, which may raise antitrust concerns. For an industry already under scrutiny for housing affordability issues, this lawsuit brings to the forefront the need for data transparency.

Commercial Observer: How does Keyway’s approach with KeyComps differ from what is alleged in the RealPage lawsuit?

Matias Recchia: At Keyway, transparency is at the core of what we do, and KeyComps reflects that commitment. KeyComps relies exclusively on public data sources to provide accurate rental pricing information.

Public data ensures a level playing field for all stakeholders, including landlords and tenants, where everyone has access to the same information. KeyComps analyzes publicly available rental rates, property characteristics, and market trends to generate reliable comps. This approach eliminates the risks associated with collusion or anti-competitive behavior, for example. Our goal is to empower investors, developers, property managers and lenders to make independent pricing decisions while complying with antitrust laws.

By using public data, KeyComps is built on fairness and transparency, which ultimately benefits landlords, investors and tenants alike.

Commercial Observer: Why is public data so critical for the future of rental pricing and the broader real estate industry?

Matias Recchia: Public data is foundational for fostering trust and fairness in the rental market. It ensures that pricing decisions are made independently and transparently, without relying on sensitive competitor information.

As technology continues to play a larger role in real estate, the industry must adopt tools that uphold and promote these principles. Public data also democratizes access to market insights, which allows smaller players—like independent landlords or smaller real estate firms—to compete with larger institutional players.

At Keyway, we believe that a fair market isn’t just good ethics—it’s good business. Tools like KeyComps are designed to help real estate teams leverage public data for more precise and transparent pricing decisions. This approach not only reduces legal and reputational risks but also enhances the overall market’s integrity.

Commercial Observer: How do you see the RealPage lawsuit affecting the future of technology and data analytics in real estate?

Matias Recchia: The lawsuit will likely accelerate the industry’s shift toward transparency and accountability in how data is collected, shared and used. Companies that rely on non-public data to influence pricing decisions will face increased scrutiny, not only from regulators but also from tenants and other stakeholders. This also highlights the need for real estate teams to evaluate their tech stack. Are the tools they use compliant with legal standards? Are they promoting fair competition? These questions will become increasingly important.

Commercial Observer: What role does AI play in creating a more transparent and competitive rental market?

Matias Recchia: AI is a powerful tool for driving efficiency and insights, but its value is only as good as the underlying data that it uses. For example, at Keyway we use AI to analyze large volumes of public data to identify market trends, generate rental comps, and provide pricing recommendations. This level of automation saves time, reduces human error, and ensures compliance with legal requirements. When AI operates transparently, it builds trust among stakeholders. Public data also promotes transparency between landlords and tenants, which helps to build trust and ensures that rental decisions are perceived as fair and justified.

Commercial Observer: Can you elaborate on how KeyComps benefits real estate teams operationally?

Matias Recchia: KeyComps streamlines the rental pricing process by automating data collection and analysis. Traditionally, compiling rental comps involves manual research, which is time-consuming and error prone. KeyComps eliminates these inefficiencies by analyzing public data in real-time and delivering precise, actionable insights.

For property managers, this means faster and more accurate pricing decisions. For example, a property manager can use KeyComps to adjust rental rates in real-time based on public data trends, which can increase occupancy and tenant satisfaction. For asset managers and investors, it ensures that their portfolios are competitive and aligned with market conditions. Operationally, KeyComps reduces the need for extensive manual labor, which frees up teams to focus on higher-level strategy and value-add work. It’s a game-changer for efficiency, transparency, and compliance.

Commercial Observer: What message do you have for real estate teams navigating these changes?

Matias Recchia: My advice is to embrace transparency and compliance as core principles in your operations. Evaluate the tools and technologies you’re using, and make sure they align with ethical and legal standards. In our case, KeyComps is designed to help real estate teams navigate these changes confidently. By leveraging public data, we ensure that our customers can make independent, informed decisions without compromising fairness or trust.

The RealPage lawsuit is a reminder that the industry is evolving, and those who adapt will thrive. Transparency isn’t only a regulatory requirement—it’s the future of real estate.