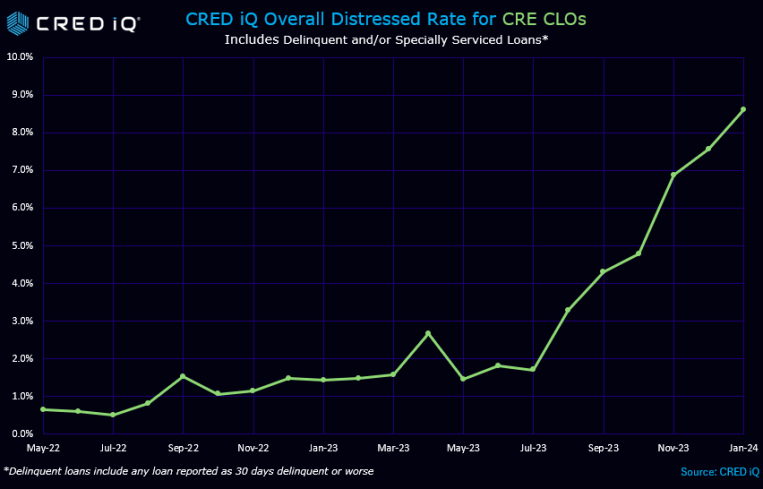

CRE CLO Distress Rates Surge Over 440% in 12 Months

CRED iQ dived deeply into the commercial real estate collateralized loan obligation (CLO) ecosystem to better understand the rapidly growing distress rates in this space. We excluded CRE CLO deals from our monthly delinquency reports but decided to zero in on this important sector on a stand-alone analysis. Following the news of Arbor Realty Trust’s distress level recently, we also wanted to understand how other CRE CLO issuers are faring in this marketplace.

CRED iQ’s Overall Distress Rate for CRE CLO surged in 2023 — from 1.4 percent to 7.4 percent — and jumped even further in January to 8.6 percent. This metric includes any loan that reported 30 days delinquent or worse as well as any loan that is with the special servicer.

Outstanding CRE CLO loans amount to approximately $80 billion in loans. The vast majority of these CRE CLO loans are structured with floating-rate debt with three-year loan terms equipped with loan extension options if certain financial hurdles are met. Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto and TPG.

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Many of these loans were originated in 2021 at a time when cap rates were low and valuations high, along with low interest rates, and are now starting to run into maturity issues given the spike in rates.

CRED iQ’s analysis uncovers that, in the course of 12 months, the amount of CRE CLOs under distress ballooned from $1.3 billion in February 2023 to over $6.8 billion as of the latest January 2024 reporting period. Distress levels grew over 440 percent over the past 12 months. The sudden spike started happening in July and August, when distressed rates were around 1.7 percent, and then each month started increasing by an average of 1.2 percent. The latest distressed levels total 8.6 percent for all of CRE CLO loans as of January 2024.

An example of CRE CLO office loan

700 Louisiana and 600 Prairie Street is a 1,259,314-square-foot high-rise office property in Downtown Houston. It is backed by a $232 million initial loan with a fully funded commitment of $252 million. The interest-

only loan failed to pay off at its September 2023 maturity date and has only paid through September. The 56-story office tower was built in 1983 and renovated in 2011. The asset was appraised at $403 million at underwriting in June 2023 based on 66.7 percent occupancy as of April 2019. A 0.77 debt service coverage ratio (DSCR) and 65.8 percent occupancy were reported in the September 2023 financials. The largest tenant, TransCanada USA Pipeline, represents 23 percent of the net rentable area (NRA) with a lease scheduled to expire in February 2036. The remaining tenants each represent 4 percent or less of the NRA.

A look at multifamily CRE CLO loan

An example of upcoming distress despite a “current” loan status is Caden at East Mil apartments, a 768-unit multifamily property in Orlando backed by a $98.9 million loan that was originated by Arbor. The loan is scheduled to mature in October 2024 with a fully extended maturity date in October 2026. The most recent financials from year-end 2022 reported a 0.65 DSCR, down from 1.56 in September 2021. The property was 96.2 percent occupied and valued at $120.1 million in September 2021, at underwriting. Occupancy at the property fell to 85.6 percent as of November 2023.

Mike Hass is the founder and CEO of CRED iQ.