CRE CLO Distress Rate Sheds 180 Basis Points

Commercial real estate collateralized loan obligations (CRE CLOs) continue to exhibit resilience in the face of economic headwinds, with delinquency, special servicing and overall distress rates remaining subdued through September 2025. Drawing from CRED iQ’s proprietary data, this analysis highlights key metrics for commercial mortgage-backed securities (CMBS) and CRE CLO investors navigating portfolio risks.

Delinquency and special servicing dynamics

Delinquency rates in CRE CLOs ticked down to 9.2 percent in September 2025 from 10.7 percent in August, marking a month-over-month decline of 150 basis points (bps). This follows a volatile 2025 first half where delinquency rates peaked at 12.2 percent in February before easing. Special servicing rates mirrored this trend, falling to 7.2 percent from 8.2 percent.

The CRED iQ distress rate (percentage of loans delinquent, special serviced or both) compressed to 11.5 percent in September, down 180 bps from the previous month and 160 bps year-over-year from September 2024’s 13.1 percent. .

September’s distressed pool totaled $6.2 billion across $54 billion in allocated loan amounts, representing just 11.5 percent exposure. Compared to the 2025 low of 10.9 percent in June 2025, September distress increased by 60 bps.

Payment status breakdown

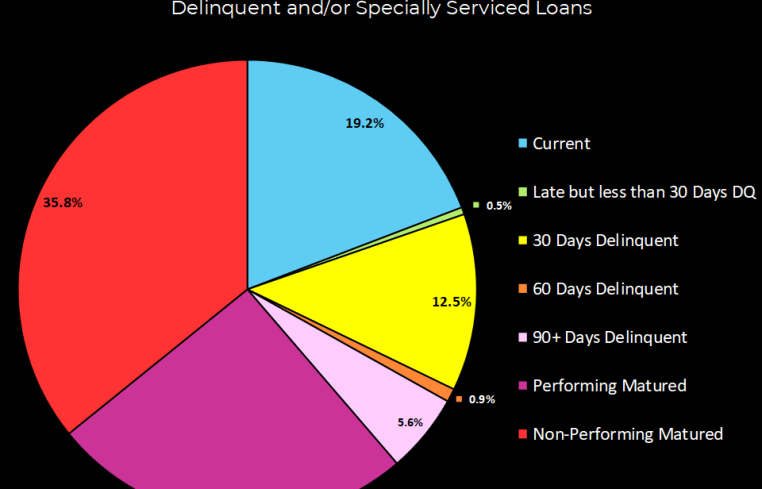

Payment statuses reveal a maturing portfolio, with 61.3 percent of allocated loan amounts in matured loans ($3.8 billion) split between performing (25.5 percent) and non-performing (35.8 percent) categories.

Current loans held steady at 19.2 percent ($1.2 billion), while late payments (30 days delinquent) were negligible at 0.5 percent ($31.2 million). Delinquency buckets dominated distress, with 30-day at 12.5 percent of total allocated loan amounts, 60-day at 0.9 percent, and 90-plus days at 5.6 percent, totaling 19 percent exposure.

This distribution highlights liquidity risks in matured non-performers, yet low early-stage delinquencies (under 1 percent combined late/grace) suggest proactive servicing. Investors should prioritize stress testing for extension risks in leveraged deals.

CRED iQ monitoring indicates potential for further compression if rate cuts materialize, although this could vary by specific property sectors.

Mike Haas is the founder and CEO of CRED iQ.