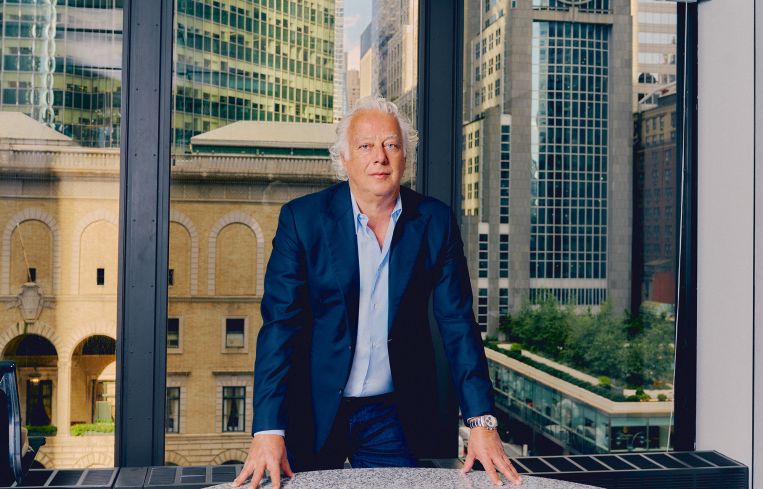

RFR’s Aby Rosen On Midtown Rents, Amazon, Mamdani, the Chrysler Building and More

‘Am I worth a lot less? I promise you I am. I'm still worth more than most, and I feel good about that.’

The name Aby Rosen is one of the few in real estate that has migrated into the wider consciousness.

Aby Rosen the art collector. Aby Rosen who travels in circles with Jeff Koons, Damien Hirst, Ian Schrager, Julian Schnabel and Sir Norman Foster. Aby Rosen the owner of the Seagram Building and the Paramount Hotel among many others. Aby Rosen with the slightly wild hair and signature jeans and sports jacket. (He doesn’t own ties anymore. “I gave them all away.”) Aby Rosen the German son of Holocaust survivors who — with his childhood friend Michael Fuchs — stepped into the New York’s real estate scene almost 40 years ago with none of the expected family connections, and made himself a master of the city.

Of course, Rosen’s success came with its requisite setbacks. He lost prizes over the years like the Chrysler Building. Yet, it has done little to dampen his confidence, his ease or his charm.

And, whatever the downs, the recent ups have been pretty wild. RFR has sold about $2 billion worth of property in the last 18 months. This might sound like a company heading for the exits if you didn’t also take into account just how much property RFR has under its purview ($18 billion to $19 billion worth, per Rosen). Moreover, it recently refinanced the Seagram Building to the tune of $1.2 billion.

One almost feels the energy (but not the anger) in the lobby of Seagram — aka, 375 Park Avenue, where RFR’s offices are located — when one stumbles upon a striking Koons piece of the Incredible Hulk surrounded by golden bugles, situated at the eastern end of the elevator bank.

Hear the roar, Gotham. Aby Rosen has a lot to say.

This interview has been edited for length and clarity.

Commercial Observer: You guys have historically been in a lot of spaces in Midtown. Broadly, how do you view the Midtown market right now?

Aby Rosen: The Midtown market has always been good. It’s now even better. I think people realized if you’re in walking distance to the Upper East Side, the Upper West Side, transportation, Grand Central, Penn Station — that’s the place to be. I think One Vanderbilt did a great job highlighting that. I think resi is pushing down from Midtown toward Grand Central. There’s conversions going on 43rd Street — you know, the old Apple Bank is getting converted to resi; 520 Fifth went to resi, and some office. So that neighborhood’s on fire.

They’d fixed and cleaned up Bryant Park extremely well. I think everybody who invested money there did the right thing — I think hotels, restaurants, transportation is going well, mainly. That’s why Grand Central is, was and will only get better and more in demand.

Are you on the hunt for properties in Midtown?

I’m always on the hunt. I’ve not stopped hunting since I came to this town on Dec. 11, 1987. It’s not surprising that I would like Grand Central — we’ve always been there. We owned 520, 516, 518 Fifth; 521 Fifth; 18 East 41st; 275 Madison; 285 Madison. We owned 475 Fifth, we built a 425 Fifth, a brand-new resi with Michael Graves. We’ve always been in that neighborhood, and still liking it.

One of your huge things this year was the refinancing of the Seagram Building. Can you tell me a little about that?

Look, Seagram will always demand the highest rents, or one of the highest rents, in town. We always push the rents pretty far up. We renovated the building once Wells Fargo left — installed a playground in the lower level, which is a 35,000-square-foot kind of amenity basketball court, meeting spaces. Plus, redoing the Seagram restaurants, which was in those days the Four Seasons — now they’re the Grill, the Pool and the Lobster Club. We spent 40 million bucks upgrading those restaurants, and they are now among the top-grossing restaurants in this Midtown area.

I think the modernization of 375 is going on a constant basis. When you own the landmarks, you can’t stop. You are basically always adding new things to it to keep it relevant, to keep it modern, to keep it active. We just installed three new sculptures of Koons down in the lobby — the Hulk, which shows strength and resilience, which is definitely something that RFR has always been associated with. This town has cycles, as you know, and we live with the cycles, and we lose some luster once in a while, and then we shine again. That’s the name of the game. And anybody who doesn’t know that is a fool.

So, after a period of nothing going on, the recap market is there. Our loan matured, we took one extension, then executed this year a great $1.2 billion financing — no mess, straight securitized paper. And cash flow is going up, and going up, and going up. Demand for the space is incredible. We have tenants who want to expand, and we cannot always accommodate them. Clayton Dubilier was here for 25 years. They needed more space, we couldn’t give it to them, and they moved. There’s another tenant who we are looking to help expand, but we are at the seams. We bought it in 2000, the net operating income was $13 million. Now the NOI is approaching roughly $100 million.

Art has been such a big part of your image. How do you think the art scene has changed in New York?

Look, I think it has and it has not changed. There’s a lot more primary galleries that popped off the last 20, 30 years, because there was such a trend and such a desire to explore fresh new art, young artists.

The better dealers, the better auction houses that now have private sales, are basically working on quality. It’s all about quality, quality, quality — recognizable art, stuff that has been around for 20, 30, 40 years. I think there’s a trend to quality that also happened with residential, that has happened with housing, that has happened with office space. We all learned that quality is good. Better quality, the longer longevity, the less volatility.

The art market is changing. If you look at the art fairs, they are not all about the art, they are about pumping merchandise — they’re pumping labels, they’re pumping logos. Private bankers have hijacked the art fairs. There’s a UBS lounge, there’s a Credit Suisse lounge, there is a Wells Fargo lounge. The residential developer suddenly has a booth where they’re peddling and selling art, selling their residential high-rise. You go to Miami Basel, and it becomes like a cross promotion, and, indeed, if you end at 12 o’clock, you don’t even know where you are. Did you go to a fashion show? Did you go to an art placement? Did you go to somebody’s house because it’s for sale? So, it has all melted and mixed together.

But the newbie — the newcomer with fresh clean money — he’s having the time of his life. He’s invited, he’s hosted, he can mingle with celebrities. It’s a very nice environment if you’re looking for that kind of easy entry into socialization.

Discovering the new artist, though, does seem to be the problem.

If you’re a fashionista you’re going to off-label places. You go to certain places in Japan. You look for the best denim and the newest this, and the newest that. I find this exciting, but I’ll concede others find it pretty boring.

I wanted to ask about the Chrysler Building. Tell us the story from your perspective?

It’s a story that was told already before, so I’m not going to rehash it. So, Chrysler we bought. We brought in an Austrian partner — a friend of ours, a company called Signa. We did a lot of work with them — shopping centers, offices — in Europe. Signa got into financial troubles, and filed a $30 billion bankruptcy, which didn’t help. But that’s the partnership you choose.

So, we took over that partnership at one point, funded ongoing shortfalls. COVID hit. Everybody got nervous. Nobody wanted to invest. We then continued to rehab the building, couldn’t finish up the job with Cooper Union [the ground lease owner].

They were slightly, how would I say, complicated. Not because they wanted to be complicated, just because I think they’re academics. They are basically a learning institution, and, for them, real estate is something that they’re all scared of. So, they have 20, 30 people; there’s a bottleneck; nobody made decisions; they were unreasonable.

We always believed this was a partnership — they did not see this as a partnership. They saw this as “I own the land, I make the rules, you work for me, because you are paying me rent, and I’m gonna give you as little rope as possible.” I believe if you look at successful leasehold fee ownership structures, you got to work together. We didn’t see that. That’s why at one point we gave back the keys and said, “Have a nice day.”

I don’t want to blame my partner for not being able to fund — but it didn’t help. I blame myself for having not seen the difficulty with an institution like Cooper Union to come to a smart resolution. So, we lick our wounds, we move on, we lost a couple of hundred million bucks, and we go to the next asset. Whoever’s stepping in, I wish them luck.

What do you think they need to do to be successful?

I told them so many times, they know exactly what they need to do. They need to get in bed with somebody, create a partnership, a venture, a kind of alignment, and then let’s make money together. If only one says, “I want, I want, I want, I want,” and “I don’t care what you do, and if you can hang yourself, fine,” it’ll fail. But they want it all. They want control, they don’t want to participate in the downside, they only want the upside.

Believe it or not, I’m still in it to participate in that bidding again — because I still believe that I’m very much the right venture partner with Cooper to do this. I invested a couple hundred million bucks, I don’t mind putting in another $100 to $200 million to do that. So we are still monitoring what’s happening there, especially owning the development site next door. They’ll come back to us eventually if they can’t figure it out. Or if they don’t come back, it’s fine too — I wish them all the best.

You guys had a big sale to Amazon at 522 Fifth Avenue. Tell us a little bit about that.

We bought 522 also five and a half years ago. It was a sale-leaseback with Morgan Stanley’s private wealth office. The retail was owned by Deka Immobilien. We started our redevelopment plan. Then the note was sold to somebody else — and SL Green came in and bought the note to redevelop it with us — and we were ready to go. Amazon knocked at our door, saying, “Do you want to sell it?” And I said, “I want X.” They said, “What about Z?” We agreed to 450 million bucks.

And nine days later it was out the door — signed.

Oh, my God.

When Amazon wants something, they’ll get something done. We have a lot of Amazon relationships back on the West Coast. We own a lot of properties with them, and they were as great of a buyer as you will ever see. Smart, educated, knowledgeable. The real estate team was fantastic, and it was painless, which was nice to say in today’s environment.

We paid SL Green off — they made a hefty profit and we moved on, and there’s nothing wrong with a good sale.

You did another sale with Bloomberg Philanthropies?

Yes. Mike is an old friend of mine, and I leased him the building a year and a half ago. He took the whole building. The upper floor was on a lease, and then three months later, I said, “You know, Mike, you should have bought the building.” He said, “Yes, but you were so stubborn.” I said, “Maybe I’m a bit less stubborn.”

Again, two days later, we agreed on a price — and two days later, he closed on the property. So he said, “Sign and fund.” I said, “Mike, you don’t know what that is.” And he said, “I promise you, I know exactly what that is.” So we signed it, and he funded two days later. I mean, he wrote a $560 million check! Which was a great price, but it was a great buy for him because he already had a 30-year lease and now he controls the destiny of the property. Everybody was happy.

It shows you that even in a market where there are questions, that if you have great, great product and you have the right person who wants it, who needs it, or who understands what long-term New York investment is all about, you can get your price. I had to get some office space for my wife, who’s a psychiatrist in the building. It was the only negative. But she forgave me when I told her how much I sold it for.

Was Bloomberg your favorite mayor since you’ve been here?

He’s my favorite person — period. For a variety of reasons. He’s clear, he has a message, and he’s selfless, spending 12 years running this town. The people that came after him, obviously, we all know, didn’t do such a great job. And, hopefully, we get a decent mayor next month. We’ll see.

I’m not very hopeful that if the wrong mayor gets elected that this will be helpful for the city. I think it will be detrimental and that it will be a disaster. But this is a democracy and everybody has the right to vote. And, if this town is stupid enough to vote the people in that they shouldn’t vote in, that’s their choice.

But you’re not going to leave …

No. Where am I going to go? I like Florida, but two days a year. This is where I live, this is where I work. This is where I have the majority of my net worth. My kids are here. My friends are here. I’m not running for the hills. Will I work harder to make sure that if [Zohran Mamdani] really gets elected — which I don’t think he will, even though I’m one of the few people who still thinks that Andrew has a chance to win, especially if the Sliwa vote disappears or gets marginalized — the damage is less? Yes. But he will do damage to this town.

Forget about how far to the left he is. He’s just not qualified as an operator. You need to have a qualified guy. Give me a great qualified Republican, and I’m the first guy who’ll vote him in, even though I’m a die-hard Democrat. But at this point I want quality. Give me people who are capable. Andrew Cuomo is more than capable.

What’s financing like? Where’s your money coming from?

We have a great balance sheet ourselves, but, again, we are allying ourselves with long-term strategic investors. Europeans, high-net-worths, U.S. companies, some German, some Middle Eastern. We have a list of people who we can tap all the time into something — so we can just bid on something we see today.

People still love real estate, people believe in New York. It’s not going anywhere, even if the wrong mayor gets elected. We’re raising money for a new retail platform. I still believe in New York retail. We believe in office. Hotels is not really what I am focusing on anymore. I’m shrinking my hotel commitment. I used to own 12 hotels. I think I’m down to seven. Hopefully, by next year, I’ll be down to zero. I love hotels, but you’ve got to be in the hotel business and only in hotel businesses.

There’s Mamdani. There’s also Donald Trump. Has he put a chill on investment in America?

There’s a reason why there’s a certain type of person that doesn’t invest in America right now — I don’t think it’s necessarily the Trump effect. I do believe that there’s other opportunities to invest in growth markets like the Middle East and Eastern Europe and Asia. The Middle Eastern investor who used to come here and invest heavily is investing in his own neighborhood and country. The Europeans are licking their own wounds, because they are going through a huge reshuffle. But it will change again with the opportunistic buyers — the guys who can take some risks. The families are coming back. The high-net-worth networks are coming back.

But there’s just less demand for investments in America, and I don’t think that’s Trump-related. As much as everybody wants to say something negative about Trump — and I was not always a silent critic — he’s done a great job in that America is still thriving, our economy is booming. I think he has taken care of some of the border issues. He’s not the devil that everybody made him sound. Again, I look at results, and, at this point, I am not unhappy where he’s going.

I ran into Gaby and Charlie Rosen outside. So tell me a little bit about the future of RFR.

The future of RFR is that slowly but surely those two are growing into the role of leading this firm. I love what I do, but I trust them to be equally as good as I am or better, and I think they have the capacity. We’ve become more “executive committee,” a little bit more of a corporate mindset, but still a private company. It’s not my way or the highway kind of a mindset.

Tell me about your 42nd Street project.

This is the property that’s called the Trylons, which is the pyramid that was a Philip Johnson, not-so-pretty-design that he did shortly before he passed. And it’s a development site that has great frontage at 155 East 42nd Street. All the leases are expiring and we can build a 350,000- to 450,000-square-foot building there, so we did some zoning studies; we hired an architect.

And you’re in the Miami market.

Yeah, Miami, we have a development site and office building on Biscayne. We have Norman Foster to design a hotel/condo product there. It’s a huge, 1,000-foot tower, and we are going to the market to look for a hotel-slash-brand operator next month and we are going up to build something wow.

I’ve heard the story that you and Michael Fuchs were childhood friends. When did you guys decide you wanted to go into business together?

We decided very early on that we like each other and there’s a good chance we’ll be friends for a lifetime. When we were young, we traded bicycles. When we were older, we traded stock. We started a company in London trading stock, and then Michael created a company trading cars.

While we’re in university, we started investing in real estate together, and we have been doing things together since, for 50 years. He’s more in Europe, so he’s focusing more on Germany. In the long run, I will probably run and own in America, he will run and own in Germany because he’s there physically. But we still speak twice a day and, you know, we go skiing and sunshining together, and our kids play and know each other. So, it’s been a really interesting friendship-slash-business partnership-slash-surrogate brotherhood relationship.

You’ve had a lot of highs. There have been lows. You’ve been knocked down a bit. Tell us about getting back up.

You know, when you have that much, you’re never really down. If you have five properties and you lose three? Sucks. I had 95 properties, I lost 15 or 10 by selling or downgrading — not so bad. Nobody should feel bad for Aby Rosen. Also, we have great inventories. So, when you need money, you need to sell. Hence 980 Madison. Hence the W in South Beach, which was sold for $430 million. We sold stuff in New York. We sold 522 Fifth.

So the last 18 months we sold about $2 billion worth of inventory. I call it deliberately “inventory,” even though those are properties that I care and love for. But, in the end, it’s merchandise. It’s non-emotional inventory. We are growing again because we love this business.

Am I worth a lot less? I promise you I am. I’m still worth more than most, and I feel good about that. Do I need less in the future because I’m getting older? We all need a lot less. How many blue jackets do you need? How many suits do you need in your closet? You don’t need 10 houses. I have five — and that’s four too much.

Max Gross can be reached at mgross@commercialobserver.com.