Bloomberg Philanthropies Pays Aby Rosen’s RFR $560M for 980 Madison

By Abigail Nehring and Nicholas Rizzi June 7, 2024 1:57 pm

reprints

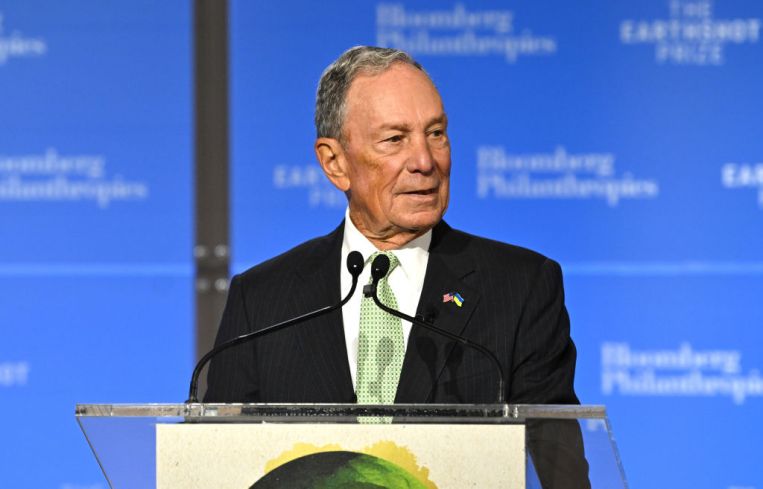

Former New York City Mayor Michael Bloomberg’s charitable foundation, Bloomberg Philanthropies, bought the Upper East Side home of the Gagosian Gallery, according to property records and a source with knowledge of the deal.

Bloomberg paid $560 million to Aby Rosen’s RFR Holding for the property at 980 Madison Avenue, which Bloomberg leased the majority of last year.

The source, who had knowledge of the deal but was not involved in it, said the former mayor plans to use the building for his family office. Another source said no brokers were involved in the deal.

A spokesperson for Bloomberg Philanthropies did not immediately respond to a request for comment, and a spokesperson for RFR declined to comment.

The sale — which was first reported by PincusCo. — closed Wednesday and appeared in property records Thursday.

RFR bought the roughly 100,000-square-foot 980 Madison for about $118 million in 2004 and described it on its website as the “epicenter of the New York art world.” Larry Gagosian first leased space in the property for his eponymous gallery in 1987 and later grew to occupy 56,331 square feet, according to The Real Deal and Artnet.

However, Gagosian was set to get the boot from the property once its lease expires in April 2025 since Bloomberg Philanthropies signed a lease for 115,824 square feet of the property last year, part of that taking over the space occupied by Gagosian, Artnet reported.

In a June 6 letter obtained by PincusCo, Bloomberg informed the building’s current tenants that RFR will continue to manage the property and “very little will be different” for the remaining time before their leases expire.

The sale comes at a time when RFR has been facing some cash issues. The owner has about $2.5 billion in loans either already due or set to mature by next year and has already missed mortgage payments at some of its properties, the Financial Times reported.

RFR was able to secure a $238 million refinancing for the office and retail property at 980 Madison from Credit Suisse in 2021, as CO previously reported. However, a nearly $200 million commercial mortgage-backed securities loan on the property failed its debt service coverage ratio in 2022, but the sale to Bloomberg removed the debt from the watchlist, according to TRD.

Abigail Nehring can be reached at anehring@commercialobserver.com. Nicholas Rizzi can be reached at nrizzi@commercialobserver.com.