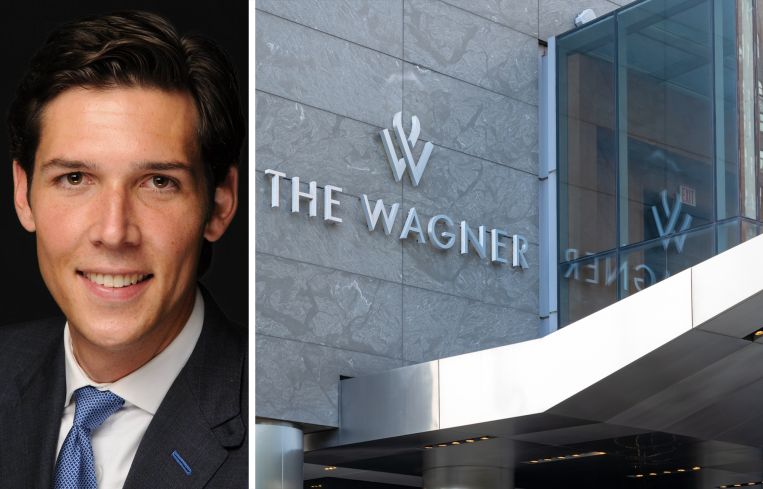

Fallen Battery Park Hotel to Rise Again After $110M Acquisition

The news marks a happy ending after a three-year bankruptcy nightmare while possibly setting a new precedent for selling property in bankruptcy

By Larry Getlen September 19, 2025 6:26 pm

reprints

After years of inaction amid a quagmire of bankruptcy, the former Wagner Hotel at 2 West Street in Battery Park City, which not long ago was a Ritz-Carlton-branded property, will become a luxury hotel once again. The move follows Silver Creek Development purchasing the leasehold interest on the building’s hotel condo portion out of Chapter 11 bankruptcy for $110 million.

Adam Etra at Newmark and Greg Corbin and Chaya Milworn at Northgate Real Estate represented the property through Chapter 11, with Newmark handling the particulars of the property and Northgate navigating the transaction through bankruptcy.

The purchase leaves the Scottsdale, Ariz.-based Silver Creek — Managing Director Charles Essig reportedly led the company’s efforts on the project — with the lower 14 floors of the 39-story mixed-use tower. The floors total 355,000 square feet, and include 298 guest rooms averaging almost 500 square feet each, plus nearly 17,500 square feet of meeting and banquet space, a restaurant and bar, a spa, and a fitness center.

The remainder of the building consists of 113 Ritz-Carlton-branded condos.

According to Etra, Silver Creek plans to upgrade the property and establish it once again as a luxury hotel.

“Their business plan is to renovate and reposition the hotel,” Etra told Commercial Observer. “There will be substantial dollars invested, and it will be operated as an upscale or luxury hotel when it reopens, likely within the Marriott family. It will include a lot of amenities, a ballroom, and a lot of meeting space. It will be positioned as a luxury hotel downtown that will compete with some of the top hotels in the Financial District.”

The Wagner opened in 2002 as the Ritz-Carlton. It was bought by Urban Commons in 2018 and rebranded as the Wagner, but it landed in bankruptcy protection by 2022.

According to Corbin, the bulk of the heavy lifting in navigating the hotel through the bankruptcy process was handled by Silver Creek’s lawyers, Steven Smith and Avery Mehlman, partners at law firm Herrick.

“Silver Creek Development acquired the $96 million senior secured note before the bankruptcy,” said Smith, who placed this acquisition around late 2021 or early 2022, and said that the hotel went into bankruptcy in November 2022.

Silver Creek became the debtor-in-possession, or DIP, lender and funded the Chapter 11 case in order to “allow the debtor entities to run a transparent marketing and sale process,” Smith said.

Independent fiduciaries took control of the debt, and Northgate and Newmark were then hired to handle the marketing and sale of the property.

Silver Creek was the winning bidder in mid-2023, but then the company needed to “work out a global deal with the Battery Park City Authority, who owned the land,” said Smith. He noted that building residents and the hotel workers union were also a factor in negotiations.

“There’s a series of very complicated, outdated, intertwined ground lease documents that governed this property for 25 years that needed to be redone to allow a new hotel to come in and become profitable, essentially,” said Smith. “And so we were referred to a mediation within the Chapter 11 case.”

Smith said that the case remained in mediation for 13 months, which he said was the longest mediation of his career, “evidencing the complexity of the case.”

“We finally achieved a global deal between those four parties — actually five parties, the fifth being the debtor entity itself,” said Smith.

“We moved toward plan confirmation at the end of September, and the court confirmed the plan and approved the sale to Silver Creek free and clear of all liens, claims and encumbrances, over the objection of a mechanic’s lien holder.”

Smith notes that this resulted in a bankruptcy court decision that has “been published and has really important implications for lien holders and selling property in bankruptcy.”

Smith said that after a “massive global deal” had been arranged to resolve the then-$100 million debt, one mechanics lien holder with a $183,000 claim objected.

“He said, ‘You cannot sell free and clear of my claim.’ And the court said, ‘Yes, we can,’” said Smith. “The implications are, if a secure lender commences a foreclosure before the bankruptcy, no lien holder or other junior creditor in the bankruptcy can effectively hold up the sale free and clear if it could have been compelled to accept the money satisfaction. That’s a new direction for this.”

After all this, city and state approvals were still required, which took another 11 months, and the deal was finally approved in August.

“They are now working towards relaunching a luxury brand hotel under a new flag in Battery Park City,” said Smith.

Corbin referred to this as one of the most challenging transactions he’s ever handled, noting that it required a tremendous team effort to bring it to fruition.

“This was a building with lots of layers of complexity, moving parts, and stakeholders each pursuing their own objectives,” said Corbin. “Only through the coordinated effort of brokers, CROs, attorneys, and financial advisors were we able to accomplish the heavy lift required to close.”

At this point, the parties are optimistic for the property’s potential.

“It should do very well, given all the positive momentum in New York on the demand side, from a hotel perspective,” said Etra. “It’s been a saga to get to this point, but I think the hotel’s best days are ahead.”

Silver Creek Development did not immediately respond to a request for comment, and Urban Commons could not be reached for comment.

UPDATE: This article was updated to include additional information about the effort to complete the deal.

Larry Getlen can be reached at lgetlen@commercialobserver.com.