U.S. Office Supply Set to Shrink Due to Conversions and Demolitions: Report

By Isabelle Durso June 17, 2025 12:31 pm

reprints

For the first time in roughly 25 years, office supply in the U.S. is set to shrink, with office-to-residential conversions playing a big part.

Over the past few decades, developers — incentivized by low interest rates and federal tax breaks — have built a gluttonous amount of office towers in U.S. cities. This caused a stark oversupply of empty space, especially after the COVID-19 pandemic created an unprecedented spike in hybrid and remote work.

But an end to the oversupply is finally in sight as conversions and demolitions — as well as developer uncertainty as a result of tariffs — finally take their toll on office inventory nationwide.

About 23.3 million square feet of office space is on track to be converted to other uses or demolished this year, significantly outpacing the 12.7 million square feet of expected new office supply, according to a recent report from CBRE, which gathered data from the 58 markets tracked by the firm.

A spokesperson for CBRE did not immediately respond to a request for comment.

Since the pandemic, both demolition and conversion activity have accelerated, with the U.S. office conversion pipeline reaching 81 million square feet of planned projects across 44 markets as of May, up from 71 million square feet across 42 markets six months ago, the report found.

In addition, an annual record of 94 conversion projects totaling 13.1 million square feet were completed in the U.S. in 2024, compared to the average 58 annual office conversions completed from 2018 to 2023, according to CBRE. In 2025, the country is expected to see approximately 68 conversions totaling 12.8 million square feet.

More than 70 percent of the planned and ongoing conversion projects are set to become multifamily properties, with 28,500 housing units already delivered since 2018 and another 43,500 planned, CBRE said. Most conversion activity is taking place in major U.S. cities, including New York City, Los Angeles and Washington, D.C.

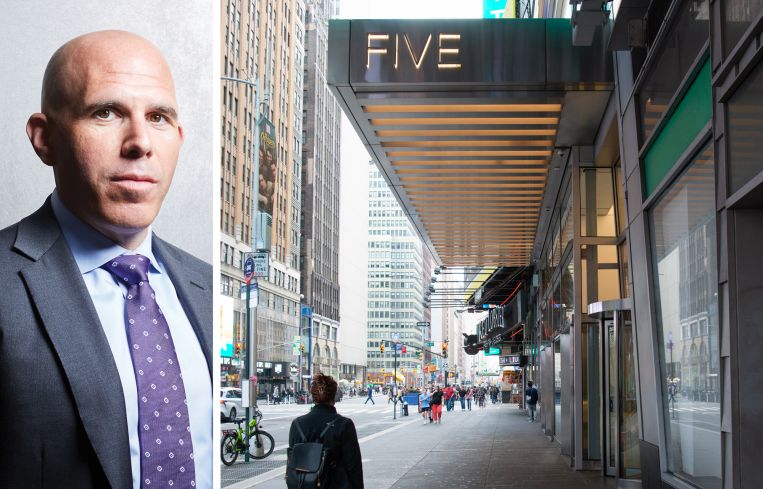

New York City is leading the conversion push with 8,310 new housing units in the pipeline as of February, a large chunk of which will come from major projects such as Apollo Global Management, SL Green Realty and RXR’s conversion of the 1.1 million-square-foot office building at 5 Times Square into as many as 1,250 housing units, and Metro Loft Management and David Werner Real Estate Investments’ plan to turn the former Pfizer headquarters at 235 East 42nd Street into a total of 1,600 units.

Meanwhile, D.C. is planning 6,533 new housing units and L.A. is expected to see 4,388, as Commercial Observer previously reported.

In D.C., private equity firm Henderson Park and L.A.-based real estate investment and development company Lowe are converting the 536,000-square-foot office building at 1250 Maryland Avenue SW into an 11-story, 658,000-square-foot apartment complex with 428 units and 53,000 square feet of retail and commercial space, as CO reported.

And in L.A., multifamily developer Jamison Properties leads the way with a growing slate of office-to resi projects, including its plan to turn the former Pierce National Life Building at 3807 Wilshire Boulevard into 210 apartments, CO reported.

Isabelle Durso can be reached at idurso@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)