SoLa Secures $29M to Expand Community Development Space in South L.A.

The New Markets Tax Credits package comes about a month after the L.A.-based fund landed $35 million toward the construction of a 188-unit project elsewhere in the city

By Nick Trombola April 11, 2025 12:50 pm

reprints

Affordable housing fund SoLa Impact is planning two big commercial projects at one of its South Los Angeles complexes, and just landed a financing project to fund the buildout.

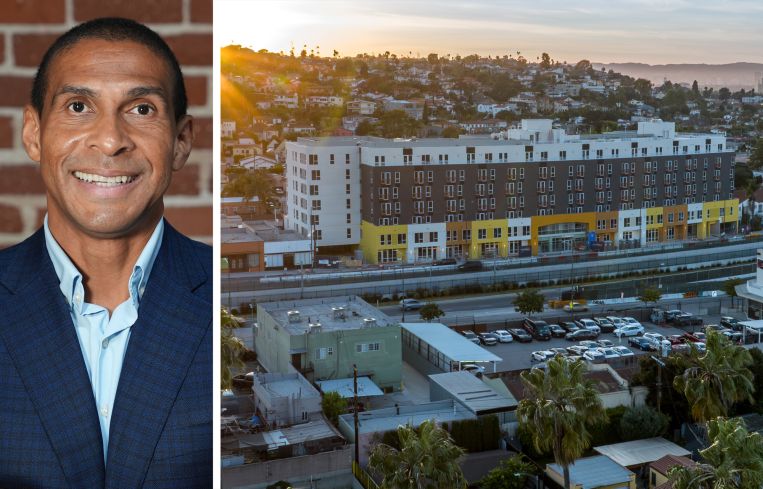

The minority-owned real estate fund focused on affordable and workforce housing secured $29 million toward the construction of two community initiatives at Crenshaw Lofts, a 190-unit, mixed-use affordable development at 4611 South Crenshaw Boulevard. The approximately 15,000-square-foot projects are planned for the ground floor of the development.

The SoLa Tech & Entertainment Center Powered by Live Nation will be a workforce development center set to offer training in tech, music, digital media, live production and entrepreneurship. The Crenshaw Culinary Arts Cafe, meanwhile, will be a nonprofit culinary training center and community cafe. The square footage of both projects was not immediately disclosed. SoLa Tech & Entertainment Center will become SoLa’s second workforce development center in L.A., after the SoLa Technology and Entrepreneurship Center in L.A.’s Florence neighborhood.

The $29 million package is New Markets Tax Credits financing, distributed via a variety of community development entities. Border Communities Capital Company, an affiliate of Chelsea Investment, allocated $13 million; the Los Angeles Development Fund allocated $9 million; and Enterprise Financial CDE, an affiliate of Enterprise Financial Services, allocated $7 million. Valley National Bank and its subsidiary Dudley Ventures will serve as tax credit investors for the financing.

“In today’s volatile capital markets, developers are having to be more creative in finding innovative sources of capital to fund important projects,” Martin Muoto, CEO of SoLa Impact, told Commercial Observer. “In addition, this project is a great example of the power of the Opportunity Zones tax incentives to uplift low-income communities.”

BHI, the U.S. branch of Israel-based Bank Hapoalim, provided $36 million in financing toward the development of Crenshaw Lofts, which began construction in August 2023. PACE Equity also provided $12 million toward that project.

SoLa Impact last month landed a $34.8 construction financing, provided by Acore Capital, for 4301 Vermont, a 188-unit affordable development in L.A.’s Vermont-Slauson neighborhood. Eighty percent of that project’s units are set aside for low-income tenants, with the remaining 20 percent earmarked for moderate-income tenants.

Nick Trombola can be reached at ntrombola@commercialobserver.com.