Presented By: Keyway

How AI is Reshaping Commercial Real Estate: Smarter Decisions, Faster Insights

Commercial real estate has always relied on vast amounts of data—rental comps, occupancy rates, lease terms, and market trends. However, the industry has struggled with fragmented, outdated, and incomplete information, making decision-making more complex than it should be. Traditionally, real estate teams have had to pull data from multiple sources, verify its accuracy manually, and then interpret that data.

AI is changing that outdated process. By automating data collection and structuring unstructured information, AI is providing real estate teams with a more efficient way to analyze markets, manage properties, and make better investment decisions. At the forefront of this transformation is Keyway, a real estate technology company that has developed AI-powered tools like KeyComps for real-time rental comp analysis and KeyDocs for automated document management.

How AI is Automating Real Estate Workflows

AI is playing an increasingly important role in real estate operations by automating complex analyses, identifying patterns, and eliminating inefficiencies. In the past, investors, asset managers, and property managers had to rely on time-consuming manual processes to review spreadsheets, rent rolls, and market reports. Now, AI tools are handling these tasks with greater speed and precision.

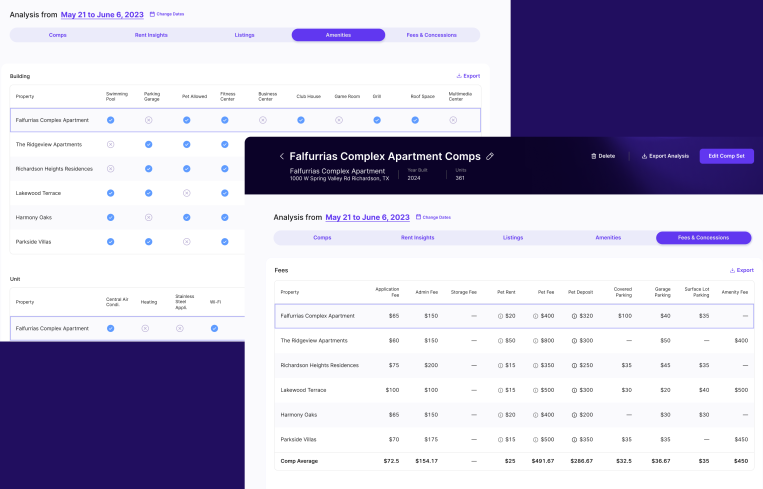

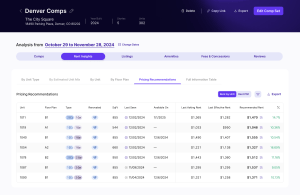

For example, KeyComps automates the rental comp analysis process by pulling in public data to provide clean, verified, and transparent rental comps. Traditionally, investors had to compare rents from multiple sources manually, adjust for differences across units, and verify any concessions. AI simplifies this process by standardizing the data and ensuring accurate pricing decisions in real time.

Similarly, KeyDocs automates lease abstraction and document management, while reducing the time spent reviewing legal agreements. Instead of manually searching for key clauses, AI extracts and highlights critical terms such as escalation clauses, renewal options, and compliance requirements, which helps real estate teams to minimize risk and make more informed decisions.

Solving the Problem of Data Fragmentation

Data fragmentation is one of the biggest challenges in commercial real estate—information is scattered across various property management systems, spreadsheets, leasing documents, and market research reports. AI solves this problem by aggregating data from multiple sources and structuring it in a way that is useful for decision-making.

KeyComps centralizes rental market data from public sources, which allows real estate teams to compare rents, fees, and concessions in real time at the unit level. Instead of pulling comps from different sources and trying to normalize them manually, AI ensures that all data is standardized and accurate for underwriting and pricing.

Similarly, KeyDocs organizes and analyzes critical real estate documents, such as leases, offering memoranda, and zoning reports. AI can extract key terms from multiple documents, which reduces the risk of missing important details and improving efficiency for asset managers and legal teams.

By consolidating fragmented data into a centralized and easily accessible format, AI allows real estate teams to make faster, more informed decisions while reducing errors and inefficiencies.

How AI Improves Decision-Making in Commercial Real Estate

While AI enhances efficiency, its greatest value lies in improving the accuracy of decision-making. Even minor miscalculations—such as an incorrect rent comp or a misinterpreted lease clause—can have major financial consequences. AI mitigates these risks by analyzing data at a scale and precision that humans simply cannot match.

For example, an investor evaluating two properties in the same market may struggle to account for differences in rent concessions or unit renovations. KeyComps automatically adjusts for these variables. This prevents investors from making decisions based on flawed or incomplete data. Similarly, KeyDocs flags inconsistencies in leases, highlights potential liabilities, and ensures that rent escalations and tenant obligations are clearly understood before a deal closes. The ability to identify risks early in the process prevents costly mistakes that manual lease reviews often overlook.

The Future of AI in Commercial Real Estate

AI is already transforming commercial real estate, but its impact will only grow in the coming years. Three major areas will see significant change:

- AI-Driven Underwriting and Market Analysis Will Become the Norm

Investors and lenders are already using AI to assess risk, predict rent growth, and identify emerging market trends. Over the next few years, AI-powered data analysis will shift from being a competitive advantage to an industry standard. - Lease and Document Automation Will Become Standard Practice

The commercial real estate industry has traditionally been slow to modernize its approach to lease management, but AI is accelerating this shift. KeyDocs and similar tools are streamlining document review, tracking compliance, and identifying risks—which reduces the need for manual lease abstraction. - AI Will Drive Operational Efficiency at the Property Level

AI is already making buildings more cost-effective to operate through predictive maintenance, automated tenant communications, and energy management. Property managers who embrace AI will reduce costs and improve tenant satisfaction, which drives tenant loyalty and investment returns.

Final Thoughts

AI and machine learning are fundamentally reshaping commercial real estate by turning unstructured data into actionable insights. Whether through automated rental comp analysis, lease management, or predictive analytics, real estate teams that embrace AI will gain a competitive edge.

As the industry moves toward real-time data analysis and predictive insights, real estate teams that integrate AI solutions into their decision-making processes will be better positioned for success. The future of real estate belongs to those who leverage technology to move faster, operate more efficiently, and make smarter investments—and AI is the key to unlocking that future.