CRE CLO Distress Rate Tops 15%

The CRED iQ commercial real estate collateralized loan obligation (CLO) distress rate added 130 basis points in January, reaching a new high of 15.1 percent. A year ago, the distress rate was only 8.6 percent, but distress has been steadily rising as these floating-rate loans are failing to pay off at their maturity dates. Underpinning the distress rate, December’s delinquency rate came in largely flat at 11.7 percent, while the special servicing rate saw a slight decrease from 9 percent to 8.8 percent following a 180-basis-point increase in December.

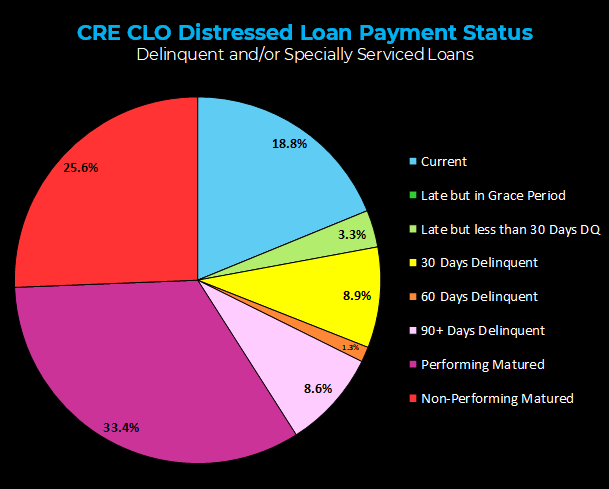

The CRED iQ distress rate includes any loan that is reported 30 days (or worse) delinquent, past its maturity, specially serviced or a combination of these. We also examined the most recent property-level net operating income figures and compared them to underwritten expectations.

Looking across payment status, 33.4 percent of loans are performing matured (a level that is mostly flat from the previous month). The data also showed 25.6 percent of loans were non-

performing matured, down from 31.6 percent the prior month, resulting in 59 percent of the CRE CLO loans in our study being past their maturity dates (down from 65.3 percent in December’s report).

The data showed 18.8 percent of the CRE CLO loans are current. Combining current loans with the loans that are considered late (within the grace period or less than 30 days delinquent), the percentage increases to 22.1 percent.

Delinquent loans that have not passed their maturity dates accounted for 22.1 percent of the CRE CLO delinquent loans, up from 20.1 percent in the previous month.

Analysis scope and methodology

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Our team examined $75.6 billion in active CRE CLO loans. Many of these loans originated in 2021 at times where cap rates were low, valuations were high, and interest rates were lows. Today, these loans are starting to run into maturity issues given the spike in interest rates.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto and TPG. The vast majority of the $79.1 billion in CRE CLO loans are structured with floating rates with three-year loan terms equipped with loan extension options if certain financial hurdles are met.

Mike Haas is the founder and CEO of CRED iQ.