CMBS Cap Rates Steadily Increasing

The CRED iQ research team focused upon the underwriting of the latest market transactions in our most recent report as we wanted to understand the key loan metrics across this universe to get a real-time sense of the current environment and lending trends.

CRED iQ analyzed underwriting metrics for the new CMBS conduit deals issued since our previous report in October. We reviewed 819 properties associated with 284 new loans totaling just over $7 billion in loan originations that have been packaged into CMBS securitizations. Our analysis examined cap rates, interest rates and debt yields. We further broke down these statistics by property type.

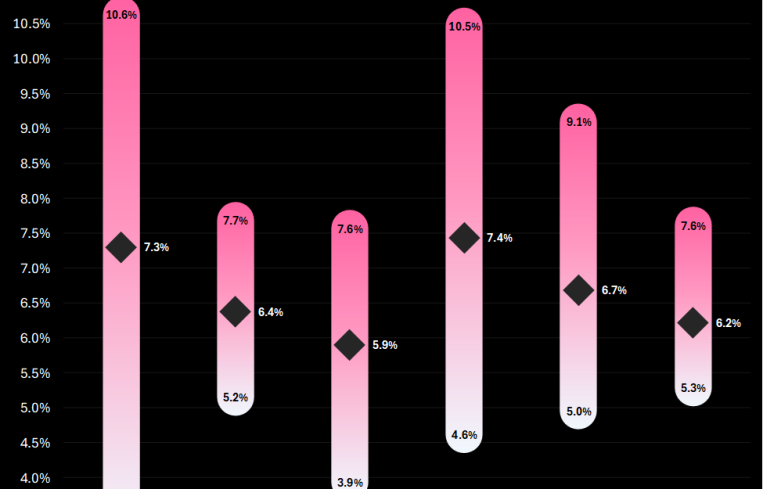

Office cap rates ranged from 4.6 percent to 10.5 percent with an average of 7.4 percent, which is up from 7.16 percent in the third quarter of 2024. Multifamily cap rates ranged from 3.9 percent to 7.6 percent with an average of 5.9 percent, which is up from an average of 5.77 percent in Q3 2024. Retail cap rates ranged from 5 percent to 9.1 percent with an average of 6.7 percent, which is up from an average of 6.45 percent in Q3 2024.

Cap rates for industrial assets ranged from 5.2 percent to 7.7 percent with an average of 6.4 percent, which is up from 6.24 percent the previous quarter. Self-storage cap rates ranged from 5.3 percent to 7.6 percent with an average of 6.2 percent, which is up from an average of 5.86 percent in the 2024 third quarter. Hotel cap rates ranged from 3.3 percent to 10.6 percent, with an average of 7.3 percent, which is down from an average of 7.8 percent in Q3 2024.

Office interest rates ranged from 3.4 percent to 7.9 percent with an average of 6.7 percent, which is down from 6.9 percent in Q3 2024. Interest rates for multifamily loans in CMBS deals ranged from 5.2 percent to 7.7 percent with an average of 6.6 percent, which is up slightly from an average of 6.55 percent in the prior quarter. Retail interest rates ranged from 3.7 percent to 7.9 percent with an average of 6.5 percent, which is down from an average of 6.58 percent in Q3 2024.

Average interest rates for industrial assets ranged from 3.5 percent to 7.9 percent with an average of 6.4 percent, which is slightly down from 6.45 percent the previous quarter. Self-storage interest rates ranged from 5.5 percent to 7.2 percent with an average of 6.3 percent, which is down slightly from an average of 6.34 percent in Q3 2024. Hotel rates ranged from 5.5 percent to 8 percent with an average of 6.9 percent, which is down from an average of 7 percent in Q3 2024.

Debt yield trends for offices ranged from 8.5 percent to 17.1 percent with an average of 13 percent, which is down from 13.2 percent in Q3 2024. Average debt yields for multifamily loans in CMBS deals ranged from 7.5 percent to 14.4 percent with an average of 9.5 percent, which is down from an average of 9.93 percent in the prior quarter. Retail debt yields ranged from 8.3 percent to 17.8 percent with an average of 11.6 percent, which is up slightly from an average of 11.55 percent in Q3 2024.

Comparing loan volumes to our October report, the self-storage segment saw a 254 percent increase in properties — the highest of all property types. Hospitality came in second with a 147 percent increase.

Meanwhile multifamily and office notched the greatest decreases in property/loan volumes at minus-55 percent and minus-50 percent, respectively. From a deal balance perspective, self-storage saw the greatest increase since October (plus-103 percent), while hospitality (minus-29 percent) and office (minus-27 percent) logged the biggest decreases.

Mike Haas is the founder and CEO of CRED iQ.