Acadia Realty Reports Stagnant Earnings But Keeps Focus on Retail

By Isabelle Durso February 12, 2025 2:26 pm

reprints

Acadia Realty Trust’s fourth-quarter earnings remained relatively stagnant compared to previous times, but that hasn’t changed the company’s focus on expanding its street retail across the U.S.

Acadia reported a modest net income of $8.2 million, or 7 cents per share, during the fourth quarter of 2024, up slightly from $8.1 million in the third quarter, according to the company’s earnings report released Wednesday.

That’s compared to a net loss of $1.6 million, or 2 cents per share, over the same period in 2023, the report said.

Still, Acadia’s funds from operations, or cash flow, amounted to $37.8 million during the fourth quarter, an increase from $28.4 million during the same period in 2023, according to the report. Acadia’s portfolio also increased to 95.8 percent leased and 93.1 percent occupied with the real estate investment trust signing more than 50 new leases in 2024.

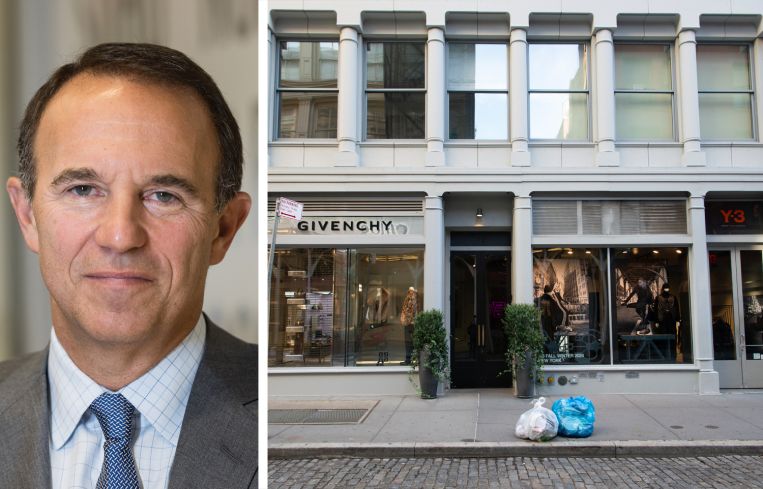

“We feel pretty good, between the external growth and what we’re hearing from our tenants and the strength of our team leasing,” John Gottfried, executive vice president and chief financial officer at Acadia, said during an earnings call Wednesday morning. “We’re feeling pretty bullish about this year.”

Part of Acadia’s strategy going into 2025 is expanding street retail acquisitions in “markets where we can expand and fortify long-term internal growth trajectory,” Acadia CEO Kenneth Bernstein added during the earnings call.

After completing more than $600 million in acquisitions in 2024, Acadia is looking to make more deals in markets such as SoHo, where the company completed approximately $123 million worth of retail purchases in 2024 and at the beginning of this year.

Acadia’s SoHo portfolio now includes 15 properties and 20 retail stores. That includes its $44 million purchase of 92-94 Greene Street last year, its $25 million buy of 73 Wooster Street in January, and its recent $55 million acquisition of 106 Spring Street, according to the report.

Acadia has also been expanding into Williamsburg, Brooklyn, where it bought a trio of retail buildings at 123-129 North Sixth Street for a combined $35 million in October, as well as another retail site nearby at 109 North Sixth Street for $18.9 million.

The REIT plans to expand further into Georgetown in Washington, D.C. — where it owns 36 retail stores on the infamous M Street — and Los Angeles, where it recently signed a new deal at City Center on 6th to replace Whole Foods with an “international grocer,” A.J. Levine, head of leasing and development at Acadia, said Wednesday.

“As we begin the new year, we are well positioned to continue to deliver strong internal growth through the continued strength of our core portfolio, as well as accretive external growth,” Bernstein said in a statement.

Isabelle Durso can be reached at idurso@commercialobserver.com.