Flatiron Realty Snaps Up Brooklyn Multifamily Portfolio for $102M

Derby Copeland Capital provides $90 million acquisition loan and $8 million funding facility as part of transaction

By Andrew Coen January 13, 2025 7:15 am

reprints

A Brooklyn multifamily portfolio owned for generations by the Pintchik family has traded hands. .

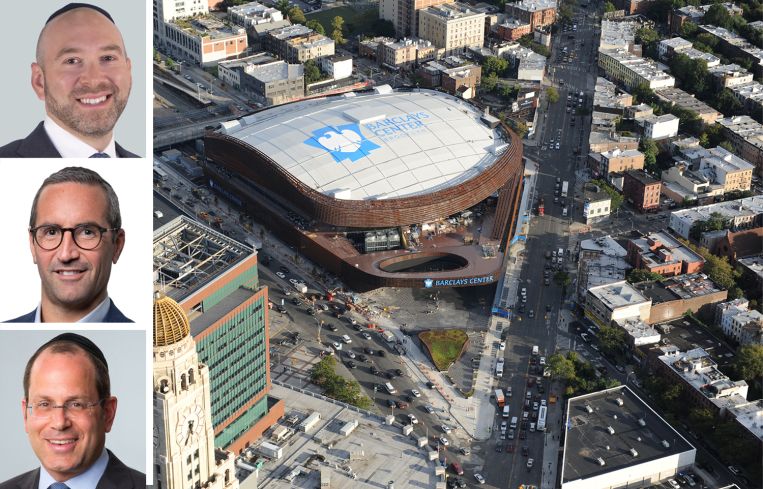

Flatiron Realty acquired the 26 apartment buildings near Barclays Center in Prospect Heights for $102 million, Commercial Observer has learned.

Derby Copeland Capital supplied a $90 million acquisition loan and an $8 million future funding facility for capital improvements in the portfolio, which includes 14 buildings on Flatbush Avenue, 11 on Bergen Street and one on Dean Street.

The financing closed late Friday and was negotiated by CBRE with a debt and structured finance team led by Shamir Seidman, Judah Hammer and Jeff Feldman. The deal was in collaboration with Meridian Capital Group’s Avi Weinstock and Daniel Neiss.

Raven Property Advisors’ Rich Velotta brokered the sale

“The Prospect Heights submarket is an area that is only in the early stages of becoming a retail and residential destination neighborhood, and we look forward to seeing what the future holds,” Seidman said in a statement.

Flatiron, which is owned by Michael Ostad and Ed Ostad, now owns Prospect Heights portfolio after the Pintchik family owned the buildings for many decades. The 26-building portfolio includes 80 apartment units and 32 retail spaces that span 40,000 square feet of commercial space.

The Pintchik family owns a number of buildings throughout Brooklyn, including landmark hardware stores and 13 eponymous paint stores. As one of its noteworthy development projects, the family undertook a transformation of a stretch of Bergen Street from Flatbush Avenue to Fifth Avenue into a retail destination, as CO previously reported.

“It took the previous seller a generation to assemble this portfolio,” Michael Ostad said in a statement. “We feel so fortunate to have the opportunity to acquire it all at once in such a premier Brooklyn submarket with unmatched geographical proximity and scale.”

Officials for Derby Copeland Capital did not immediately return a request for comment.

Velotta said the transaction stood out because of the history of the properties in an area of Brooklyn near Barclays Center with big economic demand drivers.

“Portfolios like this, consisting of small to midsize mixed-use buildings, are rarely aggregated on this scale, particularly in the same neighborhood,” Velotta said in a statement. “The buildings have been part of generational family ownership, so opportunities like this for a purchaser are truly once in a lifetime.”

Andrew Coen can be reached at acoen@commercialobserver.com