Equinix Set to Raise $15B in Joint Venture to Build Data Centers

By Isabelle Durso October 1, 2024 12:06 pm

reprints

Data center developer Equinix has formed a joint venture with Singapore-based wealth fund GIC and the Canada Pension Plan Investment Board (operating as CPP Investments) with the goal of raising more than $15 billion to build data centers across the country, the company announced Tuesday.

Equinix, which operates a network of 260 data centers across the globe, said it intends to use the fund to nearly triple the investment in its existing xScale data center portfolio, which currently is composed of 36 facilities in Europe, Asia-Pacific and the Americas. The fund already has committed investments totaling $8 billion, according to a release.

With the new venture, the firm also plans to build brand-new xScale facilities on “greater-than-100-megawatt campuses” in the U.S. and eventually add 1.5 gigawatts for hyperscale customers, the release said.

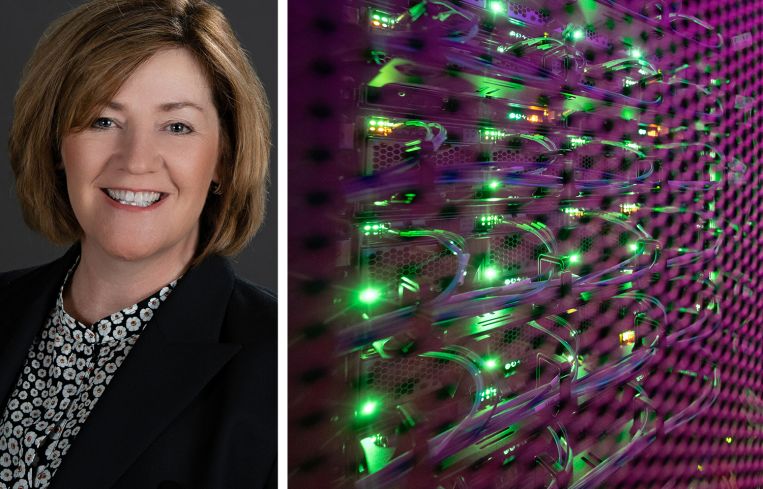

“As the world’s leading companies build out their infrastructure to support key workloads such as artificial intelligence, they require the combination of large-scale data center footprints optimized for AI training and interconnection nodes for the most efficient inferencing,” Adaire Fox-Martin, Equinix CEO and president, said in a statement. Equinix’s offerings, she said, “are uniquely positioned to address this business need, enabling companies to realize the powerful potential of AI.”

Equinix previously partnered with GIC for projects in Asia, but this new venture marks the first time the real estate investment trust has worked with CPP Investments.

As part of the deal, each partner will manage a 37.5 percent equity interest in the joint venture, while Equinix will own a 25 percent stake. The venture is expected to take on debt to eventually raise its total fund, Equinix said.

The deal is expected to close in the fourth quarter of 2024, Equinix said. Morgan Stanley served as a financial adviser to Equinix in the transaction.

“We are proud to expand our years-long partnership with Equinix, addressing a massive and growing demand for digital infrastructure, driven by the rapid advancement of technology, including AI,” Goh Chin Kiong, chief investment officer of real estate at GIC, said in a statement. “Through this joint venture, we look forward to providing the funding needed to develop state-of-the-art digital infrastructure across the U.S. alongside our like-minded partner, CPP Investments.”

Maximilian Biagosch, senior managing director for CPP Investments, which has invested in data centers for several years, said in a statement that Equinix’s investment will “help meet the increasing demand for data centers driven by rapid technological advancements.”

The new venture comes as more companies are looking to expand into data centers and deploy AI in their operations in order to attract major tech tenants like Amazon, Microsoft and Google, Yahoo Finance reported. And that means plenty of money funneling into the market, with global investment in new data center capacity expected to reach $2.2 billion between 2024 and 2028, as Commercial Observer previously reported.

With the surge in demand and construction starts comes worries that the country’s electricity supply won’t be able to keep up with the boom. Data centers are expected to consume 10 percent of the total power consumption in the U.S. by the end of the decade.

Isabelle Durso can be reached at idurso@commercialobserver.com.