CMBS Interest Rates Down Since July

CRED iQ analyzed underwriting metrics for the latest eight new-issue commercial mortgage-backed securities (CMBS) conduit deals that debuted since our previous report in July. We reviewed 499 properties associated with 304 new loans totaling just over $7 billion in loan originations. Our analysis examined interest rates, loan-to-values (LTV), debt yields, and CRED iQ cap rates. We further broke down these statistics by property type.

The average interest rate across all loans and property types was 6.6 percent, and the LTV was 54.9 percent. The implied cap rates averaged 6.34 percent in the analysis with debt yields averaging 14 percent .

Not surprisingly, our analysis confirmed interest rate reductions across all property types since our July report. Reductions ranged from 1.8 percent in mixed-use to industrial’s reduction of 8.8 percent.

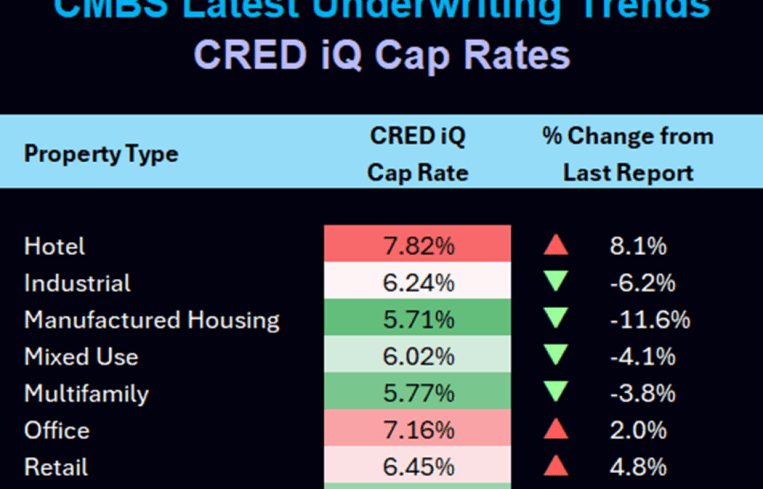

Apart from industrial and manufactured housing, LTV levels notched decreases in all other property types. Cap rates saw reductions in five of eight property types. Debt yields were a mixed bag with surges in multifamily and self-storage.

The office segment saw interest rates drop 42 basis points from 7.32 to 6.9 percent. Debt yields for the sector increased from 12.09 percent to 13.19 percent. LTV levels dropped from 59.2 percent to 55.4 percent, while cap rates increased from 7.02 percent to 7.16 percent since our July analysis.

In total, 35 properties of the 499 total in our analysis were secured by office assets, comprising a total loan balance of $999.9 million.

The multifamily sector’s average interest rate dropped from 6.7 percent to 6.55 percent, a change of 15 basis points. Debt yields decreased from 10.38 percent to 9.93 percent. LTV levels dropped from 62.5 percent to 53.7 percent, while cap rates declined from 6 percent to 5.77 percent since our July report.

There were 122 properties secured by multifamily properties totaling $1.6 billion in new loan originations.

Retail interest rates dropped from 6.87 percent to 6.58 percent on average in the last three months. However, average cap rates for the retail sector increased from 6.16 percent to 6.45 percent. The average debt yield declined from 12.28 percent to 11.55 percent, while average LTVs went from 57.3 percent to 56.7 percent since the July print.

The retail segment had a total loan balance of $1.4 billion. In total, 60 properties were secured by retail properties.

Mike Haas is the founder and CEO of CRED iQ.