Bronx Multifamily Development Is Booming — But Can Demand Keep Up?

Dozens of buildable sites have been snapped up in this year alone

By Isabelle Durso October 21, 2024 6:00 am

reprints

Something’s cooking in the Bronx.

The borough has seen a sudden burst in market-rate multi-family development and affordable housing construction in recent months — and a lot of it is due to the Bronx’s growing opportunity and affordability, as well as the extension of the 421a tax incentive and its looming successor, 485x.

All signs may be pointing upward for the Bronx, but one question remains: Will people moving to the Bronx stay in the Bronx?

“Infrastructure in the Bronx makes it a very likely candidate for new development,” Bob Knakal, chairman and CEO of BKREA, told Commercial Observer. “There’s a lot to take advantage of there, and that bodes very well for the future of the Bronx. But, like all areas, quality of life is a very important issue.”

A total of 33 development site transactions occurred in the Bronx and totaled $166.4 million during the first half of 2024 — a 50 percent increase in transactions and 86 percent jump in dollar volume compared to the first half of 2023, according to a report from Ariel Property Advisors. In addition, the Bronx development market accounted for 21 percent of all New York City development site transactions during the first half of 2024, second only to Brooklyn, Ariel said.

Moreover, the Bronx beat out Brooklyn for housing completions in the city for the first time in years in 2023, when the Bronx boasted 35 percent of all completions, according to a report from the city’s Department of City Planning.

“The Bronx has great underlying fundamentals, including transportation, culture, food and entertainment and open space, so it’s no surprise that development has taken off in the borough,” said Karen Hu, executive vice president and head of development at Camber Property Group, which is working on a $1 billion development in the neighborhood.

In a March report (the most recent data available), the Real Estate Board of New York found the Bronx accounted for 30 percent of the year’s 30 largest multifamily permit filings.

The average price per buildable square foot in the Bronx during the first half of 2024 reached $110 — a new pricing high for the borough, according to Ariel. The largest trade was Rubin Equities’ $15 million purchase of 286 Rider Avenue in Mott Haven for a planned 105-unit rental complex.

Ariel itself had closings on two development sites in the borough, including the sale of a 75,250-buildable-square-foot project at 36 Bruckner Boulevard in Mott Haven for $9.85 million, Ariel’s Jason Gold told CO. The site is set to bring 99 residential units plus commercial space.

While developers are looking to create both market-rate and affordable units in the Bronx, affordability seems to be their main focus, as that’s why many people move to the borough.

As of October, monthly apartment rents in the Bronx averaged $1,593 for a studio, $1,611 for a one-bedroom, $2,063 for a two-

bedroom, and $2,405 or more for a three-bedroom, according to data from Apartments.com. That’s compared to September’s average monthly rent of $3,084 for a non-doorman studio in Manhattan, according to data from MNS Real Estate. A one-bedroom rental in Manhattan averaged $3,799, while a two-bedroom was $4,859, MNS found.

With apartments going for about half the rents than they are in Manhattan, coupled with close proximity to transportation into that same Manhattan, neighborhoods in the Bronx such as Mott Haven, Fordham Heights, Bedford Park and Morris Heights have seen a recent uptick in leases.

“Mott Haven has really boomed in the last five years,” said Marcia Kaufman, CEO of Bayport Funding, which has provided loans for several Bronx projects. “You can walk across the street and be in Manhattan, take a train or subway down. They also have ferries they brought out of Soundview, which helped that whole area of redevelopment.”

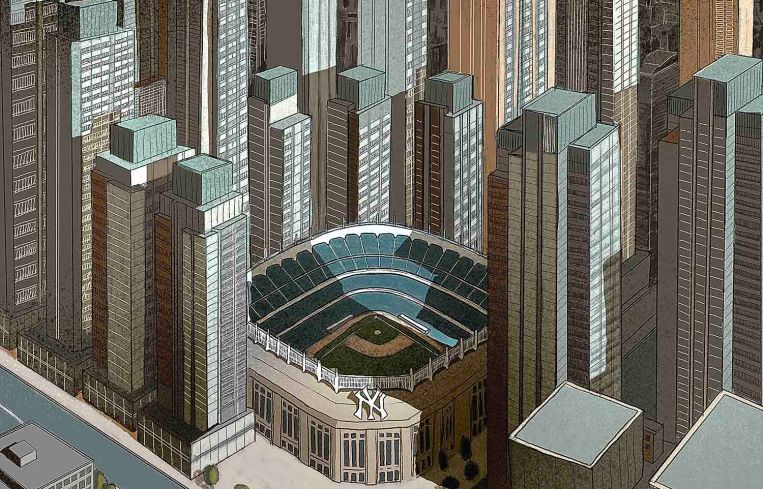

The area’s proximity to attractions such as Yankee Stadium, the Bronx Terminal Market, the New York Botanical Garden, the Bronx Zoo and the Bronx Children’s Museum also makes it a desirable spot to develop.

And developers have noticed that potential. In September, Maddd Equities partnered with Joy Construction and supermarket chain Food Bazaar to purchase a development site at 1959 Jerome Avenue in Morris Heights for $22.6 million, while the Doe Fund bought a newly constructed residential site at 2738 Creston Avenue in Bedford Park for $26 million.

While the Bronx has seen some affordable housing booms in the past, a lot of the recent new construction is thanks to the New York State Real Property Tax Law 485x, a replacement for the expired 421a that the state legislature approved in April. The tax exemption incentivizes developers to build new and affordable multifamily housing units in areas of New York City that need it.

The parameters for 485x, including the volume of affordable housing a developer must include in a project to qualify, are still being worked out. But the promise is there.

“A lot of people are jumping back into the development side now that 485x is underway and people are getting a little more comfortable with it,” Gold said. “We’re seeing a lot of investors step back into the multifamily and affordable market throughout the Bronx.”

And that’s what developers such as Camber Property Group and The Domain Companies are doing.

Camber is in the process of developing Stevenson Square, a $1 billion development that will bring nearly 1,000 affordable apartments, senior housing and publicly accessible community spaces to the Bronx’s Soundview neighborhood, according to Hu.

“The South Bronx and Mott Haven in particular have seen a spate of 70/30 development over the past approximately five years supported by renters seeking the value proposition of outer borough living with only a short commute to Manhattan,” Hu said.

70/30 buildings are a type of affordable housing project in which developers can submit proposals to the city to qualify for a tax abatement and city subsidy if at least 70 percent of the units in their projects are affordable, as CO previously reported.

Meanwhile, Domain is working on its $310 million housing project called Estela, a two-building rental development that has already brought 380 market-rate and 164 affordable units to 445 Gerard Avenue in Mott Haven, according to Matt Schwartz, co-CEO of Domain.

The 600,000-square-foot building — which features both market-rate and affordable units — is already 80 percent leased and features multiple outdoor spaces, as well as a lounge, game rooms, a yoga room and more.

While some have expressed concerns about getting residents to renew their leases in the Bronx, Schwartz said he believes new projects’ affordability will entice people to stay, despite the borough’s occasionally rough reputation.

“We think renewal rates for leasing will stay steady in the Bronx,” Schwartz said. “[It’s clear] the Bronx is resonating and tenants are eager to become a part of its communities.”

And it’s not just new development sites. Investment sales in the Bronx rose 13 percent to $445 million in the first half of 2024 compared to 2023, according to Ariel’s report. In the multifamily market, buildings with at least 75 percent of units rent-stabilized accounted for about 53 percent of dollar volume — the highest since the first half of 2021, Gold said.

Lenders like Popular Bank have loaned major sums of between $50 million and $60 million for projects in the borough, said Greg Miedrzynski, the bank’s director of New York commercial real estate.

In one of its largest deals this year, Popular Bank provided a $51 million construction loan for 247 new residential units at 1351 Jerome Avenue. The bank also gave an $8.8 million loan for 34 units at 84 West 174th Street, and a $9.8 million loan for 51 units at 2187-2189 Ryer Avenue. Bayport Funding, another active lender in the Bronx, recently provided a $6 million construction loan for a 25-unit multifamily development along Aqueduct Avenue in Mount Hope.

“There’s a reason why these developers are looking to build in these areas,” Miedrzynski said. “And the reason is there is some sort of affordability component. When they look at their projects in totality, having lower land prices and land costs help a system and building.”

But there’s also been some developers that have tried and failed in the Bronx.

Nearly four years ago, the Lightstone Group filed permits to build a 43-story mixed-use tower on the Bronx waterfront at 399 and 355 Exterior Street for $59 million, but the project stalled due to delays when the 421a tax abatement expired. It seems nothing has come of it since. (A spokesperson for Lightstone did not respond to a request for comment.)

“Generally, when a developer plans a project and doesn’t go forward with it, one of two things has happened,” Knakal said. “Either their equity changed their mind, or they weren’t able to get the equity, or they decided that the feasibility of the project was not what they originally anticipated.”

And, while the Bronx has a reputation of being an affordable place to live, that could be under threat.

The Association for Neighborhood and Housing Development’s Housing Risk Chart from May 2023 painted a stark picture for the borough, with affordable housing under threat in eight of the Bronx’s 12 community districts.

Community districts 1 through 7 and 12 have seen high numbers of eviction filings, unpaid rent, tenant-initiated housing court cases, and dangerous building conditions, the Bronx Times reported last year. Those districts were among the lowest-income neighborhoods in the city, according to the Bronx Times, citing the association’s data.

It might be the conditions of the area or the financial obstacles that made plans unachievable for developers, though Schwartz suggests a more optimistic reason for why some projects failed: timing.

“It wasn’t until the investments in infrastructure and several key city-sponsored developments got underway that we saw the type of investment we are experiencing today,” Schwartz said. “We’ve seen a critical mass develop, both in terms of housing and amenities, that will support continued and accelerated investment.”

Communities in the Bronx scored a win in August when the New York City Council unanimously voted to approve a plan to rezone a 46-block swath near future Metro-North Railroad stations in Parkchester and Morris Park. The rezoning will allow for the construction of 7,000 new homes.

“The success of this rezoning is a testament to our collaboration, our dedication to the neighborhoods that shaped us, and our love for our home borough of the Bronx,” City Council Majority Leader Amanda Farías, who championed the project, said in a statement at the time.

The rezoning will provide upgrades to the neighborhoods, including investments in parking and open spaces and repairs to local schools, Farías said.

With the rezoning in place and development underway in the wake of the passage of 485x, it seems there’s an answer to the question of whether people will stay in the Bronx. For now, it’s a yes.

“The Bronx is a great borough, and I think it’s going to continue to grow,” Kaufman said. “I think developers should see opportunity there, and it gives affordable housing to a lot of people.”

Isabelle Durso can be reached at idurso@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)