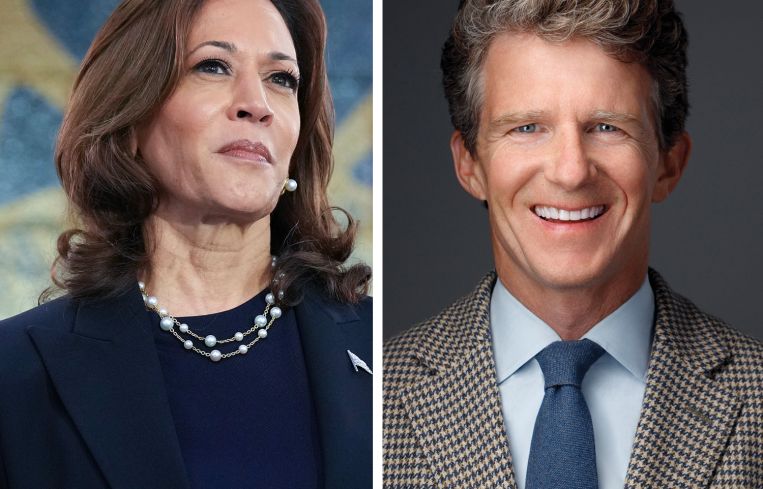

Walker & Dunlop CEO Willy Walker on Biden, Harris and U.S. Housing Policy

The Walker & Dunlop chairman and CEO blasted rent control and tax incentives, and said he saw no problem with private equity buying up single-family homes

By Brian Pascus August 21, 2024 2:43 pm

reprints

Willy Walker’s got some thoughts on Vice President Kamala Harris’ new housing policy — and even a word or two of advice for the rest of Washington, too.

Walker, the chairman and CEO of one of the nation’s largest brokerage and agency lenders Walker & Dunlop, sat down with a group of reporters Monday to discuss a wide range of commercial real estate subjects, but became particularly animated on the topic of President Joe Biden’s proposed rent controls, and Harris’ plan to build 3 million new single-family homes through tax incentives.

“President Biden’s rent cap proposal was wildly distressing … it has no chance of passing, but it’s awful politics,” said Walker. “Rent controls have never worked, and it’s a supply issue, it’s not a rent control issue.”

Last month, Biden asked Congress to pass legislation capping rent increases on existing units at 5 percent, or risk losing current federal tax breaks; moreover, during an August 16 speech in Raleigh, N.C., Harris emphasized her support for federal legislation that bans landlords from using algorithmic systems to automatically raise rents on tenants.

But in that same North Carolina speech, Harris outlined a plan to build 3 million new housing units during her first term in office, if elected, largely through tax incentives provided to home builders who construct units for first-time buyers.

While noting that he was “very pleased” by Harris’ plan to deliver more supply, Walker said that elected officials in Washington, D.C., fail to understand the local dynamics that are at play when it comes to housing construction, which creates a “disjointed housing policy” that that fosters a “not in my backyard” (NIMBY) pushback from communities reluctant to accept large scale new housing development.

“All the money sits in Washington, but the control over what the land is used for sits at the local level, and so that disconnect of big money sitting in Washington, and local control over land use, has to be somehow worked through,” said Walker. “Otherwise, you’ll get a promulgation of NIMBYism, you’ll never get to the supply numbers you need to, and you’ll keep housing costs unaffordable.”

Instead of simply mandating new housing construction targets and offering tax incentives to spur that development of workforce or affordable housing, Walker suggested that Harris should streamline the entitlement process that creates costly roadblocks at a state and county level during pre-development — and one that ultimately removes the profit motive for developers to build lower-cost, single-family homes at a massive scale, according to Walker.

“The problem is it takes you two years to get land entitlements, and by the time you get through the entitlement process, you’re going to build for the highest margin you possibly can because you’ve been sitting around waiting to build, and that’s now a $500,000 home,” said Walker. “And that’s not affordable for someone making the median income in America today.”

Rather than hand out tax incentives Walker says does nothing to remove red-tape around entitlements, Walker suggested that Harris set up restricted, economic “go-zones” for construction, and allow localities to use any leftover money from the Biden administration’s $1.2 trillion Infrastructure Investment and Jobs Act to fund only affordable multifamily units, or single-family homes in the $350,000 range.

“Home builders don’t need incentives … you streamline it, get it to [them] in three months, and they’ll go build,” said Walker. “They’ll go build in a heartbeat because they got a good margin on that stuff. You restrict it, and now you’re really providing an incentive to get to that 3 million goal.”

Harris’ housing proposal also included her support for Ohio Democratic Senator Sherrod Brown’s Stop Predatory Investing Act, which would end tax breaks for private equity firms and investors that purchase large amounts of single-family homes across U.S. municipalities

Brown’s legislation argued this practice is “predatory” as it lowers supply and drives up prices — his legislation would instead prohibit investors with 50 or more single-family rental homes from deducting interest or depreciation on those properties.

CO reported last year that there are roughly 82 million single-family homes in the U.S. and, over the past year, private institutions have committed $60 billion toward purchasing single-family homes for the purpose of leasing them as rentals.

While empathizing with the importance of a homeownership society, Walker dismissed the concerns around the investment practices of private equity firms like Blackstone and Invitation Homes, among the biggest purchasers of single-family homes in America.

“If there’s no demand for rentals, then they wouldn’t have a business,” he said, noting that the average age of renters in America has dropped dramatically from the high-30s to the mid-20s in recent years. “It’s all an affordability issue — it’s that those people who would typically be out buying a home are now ‘trapped’ being renters. They’d love to own a home, but they can’t own, so they’re either renting a single-family home or caught in rental housing.

“No, I don’t ‘blame’ Invitation Homes for buying up single-family housing stock, and therefore that means that some can’t buy a home, they can only rent a home,” he added. “They’re meeting market demand “

When pressed on the notion that this new society of private equity landlords has inaugurated a new form of feudalism in the 21st century — and turned the American Dream of owning a home into a nightmare — Walker pushed back, citing recent history and previous policies from well-meaning politicians that sought to artificially spur homeownership by dictate.

Walker cited former President George W. Bush’s plan to increase homeownership across the U.S. in the early 2000s, which included a 2002 speech that sought to create “an ownership society.” Not unlike Harris, Bush proposed affordable housing tax incentives, spending federal money to help first-time buyers with down payments, and using agency lenders Fannie Mae and Freddie Mac to finance low-income lending.

“He moved in that big push to get more people owning homes, and the moment that homebuilders heard that they started building homes, and the moment that Countrywide Financial heard that they started making loans, and Fannie and Freddie, they started buying those loans, and what ended up happening for that seven-year stretch before the world nearly came to an end was there was a huge amount of home building, there was a huge amount of home financing, and we moved towards an ownership society,” explained Walker.

“Well, we all know where that ended,” he added, alluding to the Global Financial Crisis of 2008.

Walker insisted that the intention of the policy was sound, as homeownership is where generational wealth is created, especially for minorities in America, but he wondered if Washington should be creating policies that incentive homeownership for first-time buyers.

“So the question would be, should you have another 5 percent of the population being homeowners, and if you want that, how do you go about making that happen?” said Walker.

“And it’s very clear that Vice President Harris wants it focused on people who would be first-time homeowners, and the question there would be, how much of that demographic can afford to be a first-time homeowner?”

Brian Pascus can be reached at bpascus@commercialobserver.com.