Metro Loft’s Office-to-Resi Conversion at 20 Broad Street Faces Default

By Isabelle Durso August 28, 2024 5:47 pm

reprints

A converted office tower in the Financial District faces a potential default, even as the wave of office-to-residential conversions in Lower Manhattan continues to build.

A $250 million commercial mortgage-backed securities loan secured by Metro Loft Management at 20 Broad Street has hit special servicing ahead of its September maturity date, according to a spokesperson from the Kroll Bond Rating Agency (KBRA).

KBRA wrote in a report this week that the loan may be in default next month if the borrower is “unable to repay the loan at its maturity.” Metro Loft “has stated they are unable to pay off the loan,” the KBRA spokesperson told Commercial Observer.

A spokesperson for Metro Loft and lender Athene Annuity and Life Company did not immediately respond to requests for comment.

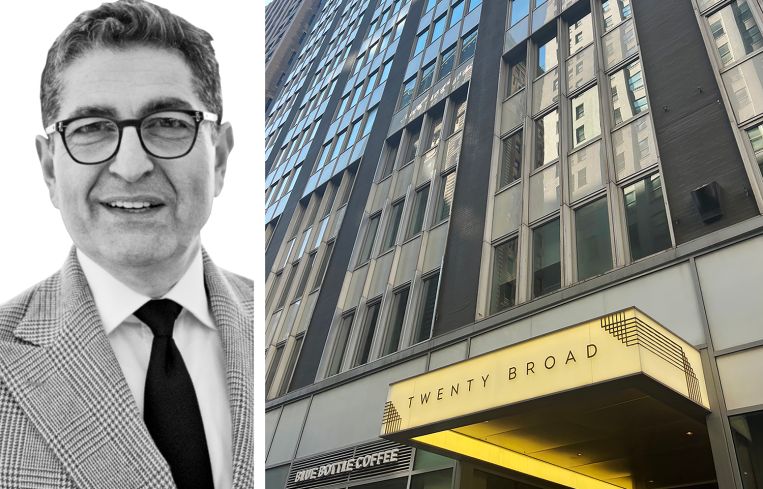

The 29-story, 470,000-square-foot tower, built in 1956, was home to the New York Stock Exchange’s offices before Metro Loft converted it into 533 residential units in 2018, according to Crain’s New York Business, which first reported the potential default.

Despite boasting an occupancy rate of 98 percent in the fall of 2023, KBRA said 20 Broad Street’s finances were “negatively impacted” through the year, causing the building’s net cash flow to fall to $13 million in May — down 11 percent from 2020, Crain’s reported.

Metro Loft’s mortgage, which originated in 2019 and carries a 3.54 percent interest rate, transferred to special servicing after Athene refused its request for a short-term extension on the loan, KBRA said.

Still, Metro Loft has seen significant progress on the office-to-residential conversion front.

CEO Nathan Berman made a name for himself in the sector with more than 26 years of experience doing conversions and has created more than 5 million square feet of residential space out of old office buildings.

In March, Berman announced the largest U.S. conversion to date: the redevelopment of the 33-story, 672,462-square-foot former Pfizer headquarters at 235 East 42nd Street into about 1,500 apartments, as CO previously reported.

Other conversions Berman has overseen are 53 new luxury condos at old book bindery 443 Greenwich Street, 580 apartments at former office tower 180 Water Street, and 331 units at former shipping company headquarters 67 Wall Street.

And the firm has two more major projects underway, including its acquisition of 55 Broad Street last year with Silverstein Properties to turn the 30-story building into apartments, and its conversion of the 1.1 million-square-foot office tower at 25 Water Street.

Isabelle Durso can be reached at idurso@commercialobserver.com.